Understanding the Factors That Influence Equity Line of Credit Rates

Navigating the world of financing can often feel like a daunting task. Many individuals find themselves seeking out options that provide access to additional funds while utilizing the value of their properties. This process is not only about securing a loan but also involves understanding the various factors that influence the expenses associated with borrowing. Gaining insight into these elements can empower homeowners to make more informed financial decisions.

One crucial aspect of accessing funds is the expense structure associated with these financial products. It’s essential to recognize that multiple variables come into play, significantly affecting how much one might pay over time. These influences range from the prevailing economic climate to personal financial situations, all intertwining to shape the overall borrowing experience.

For those exploring ways to leverage their assets, it’s beneficial to grasp what drives these associated costs. A clear understanding not only aids in comparing available options but also helps in planning for future financial commitments. In this discussion, we will delve into the pivotal elements that play a role in determining these figures.

Understanding Equity Line of Credit Basics

When it comes to accessing funds, many homeowners have options at their disposal. One of those choices allows individuals to leverage the value stored in their properties. It’s a helpful pathway for those needing flexibility in managing expenses or making improvements around the house. Let’s take a closer look at what this financial tool entails and how it can benefit you.

At its core, this solution provides homeowners with the ability to borrow against the accumulated value of their properties. It’s akin to having a financial reserve that can be tapped into when necessary. This approach is particularly appealing for those who wish to avoid the stringent requirements often associated with traditional loans.

One of the key aspects to understand is that the borrowing capacity is typically dictated by the difference between what is owed on the mortgage and the current market value of the home. This means that as property values appreciate, homeowners can potentially access more funds. This aspect makes it an interesting option for those looking to fund various projects or cover unexpected expenses.

Furthermore, flexibility is a highlight of this financial arrangement. Homeowners can withdraw funds as needed, similar to having a checking account, which allows for smart and strategic financial planning. Nevertheless, it’s crucial to approach this option with a clear understanding of the obligations involved, as borrowing too much can lead to complications.

In summary, utilizing the value accumulated in your home opens up a world of financial possibilities. From home renovations to consolidating debt, this type of borrowing can be a valuable tool when navigating the complexities of personal finance.

Factors Influencing Interest Rate Changes

Understanding what drives fluctuations in borrowing costs can really help you navigate the financial landscape more effectively. A variety of elements play into the adjustments seen in those expenses over time. Let’s break down some of the key influencers that affect these shifts, so you can be better prepared for any surprises along the way.

One major aspect is the central bank’s monetary policy, which can tighten or loosen access to funds based on economic conditions. When the economy is robust, rates generally increase to keep inflation in check. Conversely, during downturns, lower rates may be introduced to spur spending and stimulate growth.

Market competition also plays a significant role. As different institutions vie for customers, they may offer more attractive terms, leading to potential rate decreases. On the flip side, when competition wanes, lenders may raise their costs to boost profits.

Your individual financial profile is another critical factor. Lenders assess everything from credit scores to debt-to-income ratios to determine risk levels. A higher perceived risk often translates into higher charges. Conversely, a strong financial standing usually secures better deals.

Lastly, broader economic indicators, such as inflation and unemployment, provide insight into financial health. Rising inflation often leads to increased costs, while a stable job market typically supports lower expenses. Keeping an eye on these indicators can give you a sense of the future trends.

Comparing Costs with Traditional Loans

When it comes to borrowing money, many individuals find themselves weighing different options. Understanding the financial implications of each choice can lead to better decision-making. In this section, we’ll take a closer look at the expenses associated with various lending methods and how they stack up against each other.

Traditional financing methods often come with fixed terms, while some alternatives may provide more flexibility. Here are some points to consider when evaluating the costs:

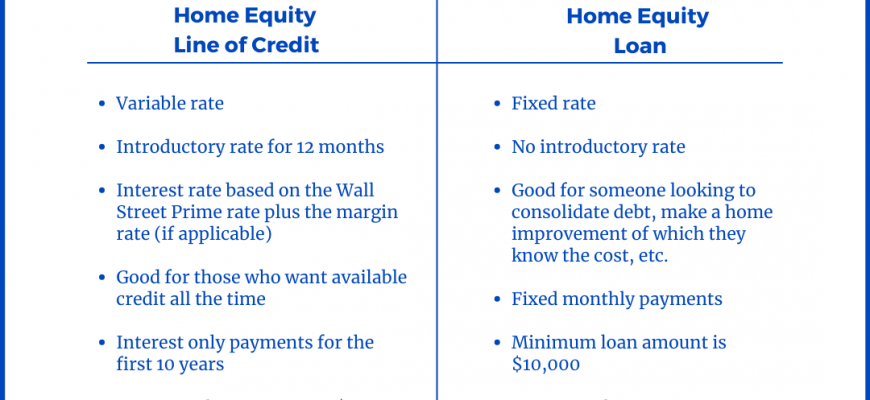

- Interest Rates: Traditional loans usually feature set interest percentages, which can fluctuate based on market conditions. Alternatives may offer variable rates that can change over time, affecting overall repayment amounts.

- Fees: Most lending opportunities come with associated fees. Traditional options often include origination fees, whereas alternative methods may have fewer or different types of charges.

- Repayment Terms: Standard loans typically require a fixed repayment schedule. In contrast, some alternatives provide more adaptable options, allowing for a customized repayment plan based on individual financial situations.

Overall, assessing these factors can help you determine the most cost-effective path for your financial needs. Make sure to carefully analyze each option to find the best fit for your circumstances.