Understanding the Foundations of Your Credit Score and How It Begins to Impact Your Financial Journey

When navigating the world of finance, many individuals find themselves wondering about the significance of numerical representations that reflect their financial behavior. These ratings play a critical role in determining the access and terms one might have when seeking loans, credit cards, or even housing options. It’s essential to grasp what factors contribute to this numerical assessment and how it can evolve over time.

At its core, this system evaluates various aspects of financial history, including payment habits, amounts owed, and credit longevity. As individuals embark on their financial journeys, they may not realize how their early decisions can shape their future opportunities. Comprehending the origins of this numerical gauge can empower people to make more informed choices and ultimately lead to a healthier financial landscape.

Embracing knowledge about this assessment opens doors for better financial planning. Understanding its foundation sets the stage for building and improving the numerical values that determine one’s financial identity. As you delve deeper, you’ll discover valuable insights that pave the way for stronger economic health and success.

Understanding the Basics of Credit Scores

Delving into the realm of financial well-being, it’s essential to familiarize oneself with the concept of numerical evaluations that reflect one’s borrowing history and reliability. These evaluations play a pivotal role in determining eligibility for loans, credit cards, and other financial services.

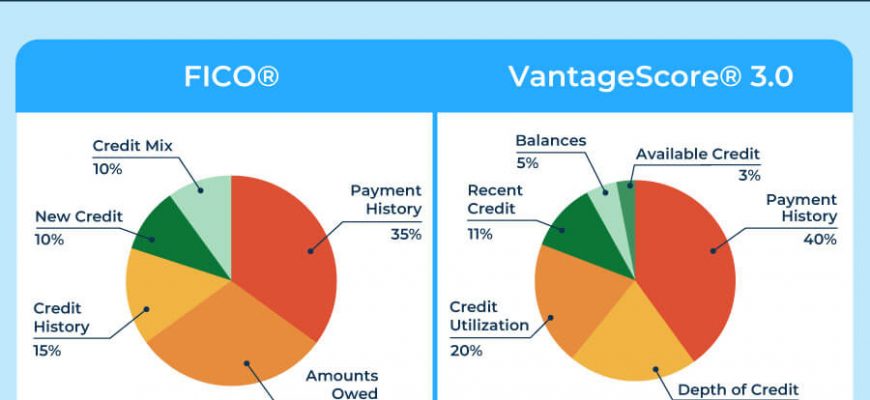

Numbers like these are influenced by various factors, including payment punctuality, outstanding debts, and the length of one’s financial history. Each element contributes to an overall picture, helping lenders assess potential risks associated with granting credit. The more one understands these elements, the better equipped they are to navigate their financial landscape.

Additionally, keeping track of one’s financial journey encourages responsible habits. Simple steps, like paying bills on time and keeping debt levels manageable, can profoundly influence these evaluations over time. Embracing this knowledge empowers individuals to take charge of their financial destinies.

Factors Influencing Your Initial Score

Building a strong financial profile involves various elements that come into play even before you take significant steps. It’s important to recognize that several factors contribute to the foundation of your financial reputation, which can have lasting effects on your future interactions with lenders.

One of the primary influences is the credit history of those close to you, particularly family members. If you are an authorized user on someone else’s account, their payment habits can impact the way your financial reliability is viewed. Additionally, the diversity of your financial activities also plays a crucial role. Having different types of accounts, such as a mix of credit cards and installment loans, can positively shape your standing.

Another key consideration is the length of your financial history. If you have just begun your journey, your background may be limited, affecting how institutions perceive you. On the other hand, previous financial missteps or late payments can leave a mark, as these are significant indicators of risk. Furthermore, the total volume of available credit versus utilized credit will be scrutinized, with a lower utilization generally being more favorable.

Understanding these aspects can serve as a roadmap for improving and maintaining a solid financial reputation. Awareness of how these influences work together equips you to make informed choices moving forward.

Building and Improving Your Credit History

Establishing a solid financial foundation is a journey that many embark on, often filled with choices that can shape future opportunities. Maintaining a positive financial track record is essential for unlocking various benefits, such as lower interest rates on loans and greater access to new financial products. In this section, we’ll explore strategies to cultivate and enhance that essential track record.

One of the most effective ways to begin building that history is by ensuring timely payments on any obligations, whether they are bills, loans, or credit lines. This consistency showcases reliability and demonstrates to lenders that managing finances is taken seriously. Additionally, keeping balances low relative to credit limits can further illustrate sound financial habits.

Another important aspect involves diversifying the types of accounts held. A mix of installment loans, such as car loans or mortgages, alongside revolving credit accounts can provide a fuller picture of credit management skills. It’s also crucial to check for inaccuracies on reports periodically; addressing any discrepancies ensures the information reflects true behaviors.

Lastly, engaging with financial education resources can empower individuals to make informed decisions. Understanding the factors that influence this aspect of personal finance helps in crafting a responsible approach to spending and borrowing. Patience is vital, as building a strong reputation takes time, but the rewards can significantly impact long-term financial wellbeing.