Understanding the Process of Credit Limit Resets and What It Means for Your Financial Health

Ever wondered about the intriguing world of financial thresholds? It’s fascinating how these parameters play a pivotal role in managing funds effectively. Many people often overlook the nuances that come into play when discussing available balances and spending capabilities.

The dynamics surrounding these financial ceilings can significantly impact personal budgeting. As situations change, so too do the allowances that dictate how much one can utilize. Familiarizing oneself with the mechanics of this system can lead to better financial decisions and a more streamlined approach to spending.

Whether you’re planning a major purchase or just keeping an eye on daily expenses, understanding this aspect can empower you. Grasping the factors that influence these allowances illuminates the path toward responsible management and can even enhance one’s financial literacy.

Understanding Credit Limit Changes

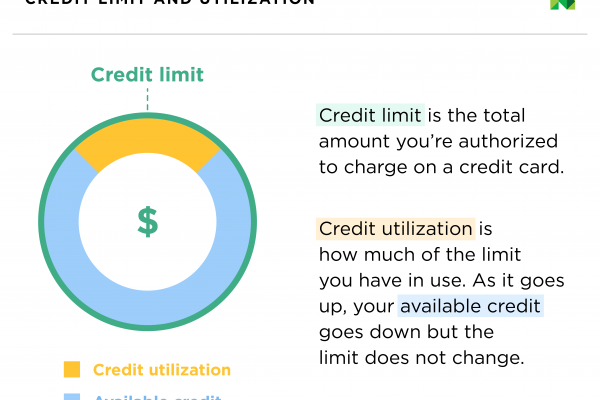

When it comes to borrowing power, many factors come into play that can affect the amounts you have available. These adjustments are not just random; they stem from various influences in your financial landscape. It’s essential to grasp how these shifts happen and what drives them to maintain a healthy relationship with your finances.

Factors such as payment history, income variations, and overall credit behavior are hugely influential. For instance, consistently making timely payments can enhance your standing, while missed payments may trigger a decrease. Additionally, lenders regularly review accounts, adjusting available funds based on their assessment of risk. Thus, monitoring your habits becomes crucial.

Moreover, life changes, such as a job promotion or a shift in financial obligations, can lead to reevaluation from your lender. Increased earnings might encourage them to offer higher amounts, while financial setbacks may prompt a different approach entirely. By staying proactive and informed, you can navigate these modifications smoothly and make the most of your borrowing opportunities.

Factors Influencing Your Credit Limit

Several aspects come into play when determining the amount of available funds on an account. Understanding these elements can help you navigate the financial landscape more effectively. Let’s dive into the key components that play a vital role in shaping the access to borrowed funds.

Income Level: One of the primary influences is the individual’s earning capacity. Higher earnings generally lead to a greater allowance, as lenders perceive a stronger ability to repay borrowed sums.

Payment History: A solid record of timely payments paints a positive picture for lenders. Consistently meeting obligations reflects reliability and can result in an improved available balance over time.

Debt-to-Income Ratio: This ratio compares monthly debts to monthly income. A lower ratio signals better financial health, potentially allowing for an increase in available funds.

Credit History: Length and quality of one’s credit profile are crucial. A lengthy history with responsible usage often correlates to enhanced borrowing options.

Recent Applications: Frequently applying for new accounts can raise red flags for lenders. Multiple inquiries in a short span might suggest financial distress, negatively affecting the assessable amount.

Market Conditions: External factors also play a part. Economic stability or downturns can influence lenders’ willingness to extend funds, affecting access across the board.

By considering these elements, individuals can better understand the nuances of borrowing options and the potential pathways to enhancing their financial profiles.

When and How Limits Are Adjusted

Adjustments to available funds occur regularly, influenced by various factors. Understanding when these changes take place can help you manage your finances more effectively. For many, it’s a matter of keeping track of spending patterns and repayment behavior.

Typically, these modifications happen monthly or quarterly, depending on the policies of the lending institution. A thorough review of your activity outlines whether you are maintaining a responsible approach to borrowing. Consistent payments and low utilization rates usually lead to increased availability, while missed payments can result in a decrease.

Additionally, external factors such as changes in income or economic shifts may prompt lenders to reevaluate assigned amounts. For instance, a rise in salary might lead to a positive revision, reflecting improved financial stability. Conversely, a downturn in the economy could lead to tighter controls.

It’s wise to stay informed about personal finances and pay attention to communications from financial providers. They often notify clients of any changes or opportunities for adjustment, keeping transparency at the forefront.