Understanding the Functionality and Impact of the Student Aid Index

When it comes to pursuing higher education, many individuals find themselves navigating a complex landscape of financial resources and assistance options. You might be wondering how institutions evaluate applicants’ eligibility for monetary support. It’s not simply a matter of filling out forms; there’s a systematic approach in place that considers various personal and financial details.

Essentially, this process aims to offer a clearer picture of an individual’s financial circumstances. Through a series of calculations and analyses, it helps determine the level of support one can expect. This evaluation isn’t just a bureaucratic hurdle–it’s a fundamental part of making higher education accessible to all, particularly for those who might face financial challenges.

As we delve deeper into this subject, we’ll explore the key components involved in this assessment system. From income metrics to resource allocation, understanding these elements can empower you to make informed decisions about your educational journey. So, let’s unravel the intricacies together and shed light on this vital aspect of navigating your academic ambitions.

Understanding the Basics of Student Aid Index

When seeking financial support for higher education, navigating the landscape can seem daunting. It’s essential to grasp the foundational concepts that underpin how resources are allocated to help learners afford their academic journeys. This section aims to clarify these essential elements, highlighting their significance in the overall equation of funding education.

At its core, the concept revolves around evaluating financial need to determine eligibility for different forms of assistance. Various factors come into play, including family income, assets, and other financial obligations. By analyzing these aspects, a clearer picture emerges regarding how much help an individual may qualify for.

Moreover, understanding these basics involves recognizing the different types of funding available, from grants and scholarships to loans. Each type carries its own requirements and implications for future financial obligations, making it critical for prospective students to familiarize themselves with all aspects of support available.

Ultimately, grasping the fundamental workings of funding resources can empower individuals to make informed decisions, ensuring they pursue opportunities that best fit their needs and aspirations. This knowledge can be a valuable tool in navigating the often complex world of financing education.

Factors Influencing Financial Assistance Determination

When it comes to evaluating the kinds of support available for education, several key elements play a critical role in shaping the outcome. Understanding these variables can provide valuable insights into why specific amounts are allocated to individuals. Let’s explore some of the most significant aspects that influence financial assistance decisions.

- Family Income: One of the primary elements considered is the household’s overall earnings. The lower the income, the more likely an applicant may qualify for increased support.

- Assets: Besides income, the total value of savings, investments, and property also matters. High asset levels can impact eligibility negatively.

- Family Size: The number of dependents in a household can bring complexity to the evaluation. A larger family might indicate greater need.

- Number of Students in College: If multiple family members are pursuing higher education simultaneously, assistance may increase to accommodate this financial burden.

- Type of Institution: The choice between public and private colleges can influence the level of assistance available, as costs vary significantly.

These factors, among others, interplay to create a comprehensive picture of an applicant’s financial situation. It’s essential to grasp how each one contributes to the final determination, as it significantly affects educational opportunities.

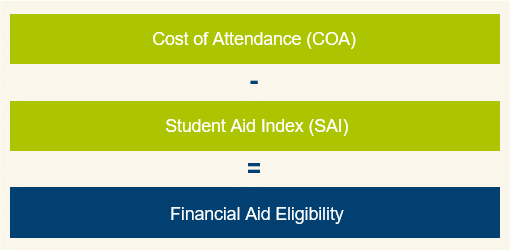

Calculating Your Financial Assistance Eligibility Effectively

Understanding the evaluation process for your financial support eligibility can seem daunting at first, but it really boils down to a few essential steps. Getting a clear grasp of the criteria and how they relate to your personal circumstances is key to optimizing the support you may receive. By being informed and strategic, you can navigate this system with greater confidence.

Start by gathering all relevant financial information. This includes income details, assets, and any other economic factors that might influence your assessment. The more organized you are, the smoother the process will be for you.

Next, familiarize yourself with the specific formulas often used to determine your potential eligibility. Different programs may have distinct requirements, so knowing the nuances can make a significant difference. Take the time to read through any guidelines provided by funding sources–they can offer valuable insights into what is prioritized in the evaluation.

As you calculate, consider seeking assistance or resources that can help clarify your situation. There are many tools and advisors available who specialize in financial resources for education. Don’t hesitate to reach out for support; collaboration often yields the best results.

Finally, keep revisiting and updating your information regularly. Changes in your financial status or in regulations can influence your eligibility. Staying proactive about your situation ensures you are always prepared for any new opportunities that might arise.