Understanding the Impact of Klarna on Your Credit Score and Financial Health

In today’s fast-paced world of online shopping, many consumers are exploring various options that simplify their purchasing processes. One popular method allows individuals to enjoy their desired products while conveniently delaying full payment. However, the implications of utilizing such services on one’s financial standing can be a matter of concern for some shoppers.

Understanding how these modern payment solutions interact with personal financial profiles isn’t always straightforward. With numerous factors at play, including payment history and borrowing habits, individuals might wonder about the long-term consequences of their choices in this realm. Exploring this topic can provide valuable insights for anyone eager to maintain a healthy financial future.

Being informed is key, especially when it comes to managing one’s fiscal health. By delving into this subject, consumers can gain clarity on what to expect and ensure that their shopping habits align with their overall financial goals.

Understanding Klarna’s Payment Solutions

In today’s fast-paced world, finding flexible payment options can make a big difference in how we manage our finances. Innovative services are emerging, providing consumers with the ability to shop now and pay later, giving them more control over their spending. These platforms not only simplify the purchasing process but also offer various alternatives that can cater to different financial needs.

One of the key features of these payment services is the ability to break down larger purchases into smaller, manageable installments. This approach allows shoppers to make significant purchases without the burden of immediate payment, alleviating some of the pressure often associated with spending. Moreover, this model can enable individuals to maintain a steadier cash flow, as they can plan their payments rather than face a large one-time charge.

Another aspect worth mentioning is the user-friendly interface that comes with many of these tools. With just a few clicks, consumers can choose a payment plan that suits their financial situation. This convenience helps to streamline the shopping experience, allowing individuals to focus on finding the items they love without getting bogged down by complicated payment processes.

Ultimately, these modern payment solutions are designed to enhance the shopping experience while providing a sense of financial empowerment. By offering flexible terms and transparent options, they aim to meet the evolving needs of today’s consumers, ensuring that managing personal finances can be both straightforward and accessible.

Impact of Buy Now, Pay Later on Credit

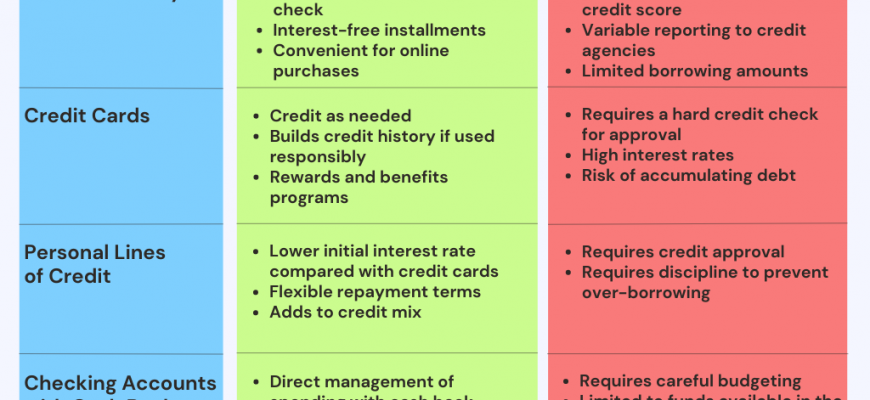

In recent years, the rise of flexible payment options has changed the way people shop. These innovative services allow customers to purchase items immediately while spreading the cost over time. While this can make budgeting easier, it’s important to consider how such arrangements might influence financial profiles and overall borrowing capacity.

Many individuals appreciate the convenience these payment plans offer, but they might not realize that missing payments or managing multiple agreements can lead to potential pitfalls. Lenders often look at various factors when evaluating one’s financial health, and any missteps could have lasting repercussions. Understanding these implications can help consumers make more informed choices in their financial journeys.

Regular, on-time payments can enhance financial reputations, making it easier to access credit when needed. However, if consumers overextend themselves, they may find themselves in a tight spot, which could affect future opportunities. Thus, balancing purchases with payment options is key to maintaining a healthy financial status.

Klarna and Your Credit Report Explained

Understanding the connection between a payment service and your financial profile is essential for anyone exploring flexible buying options. It’s crucial to know how using such platforms can impact your financial health and what lenders might see when they review your information.

When you engage with a service like this, transactions and payment behavior can be recorded, potentially influencing the perception of your financial responsibility. It’s not just about the purchases you make; how you manage repayments can create a lasting impression on potential creditors.

Many users may wonder if utilizing these services leads to marks on their financial history. While some may report account activity to major agencies, others may not, which is a vital point to consider. Being proactive about your payment obligations and staying within your limits can also support a positive reputation.

Ultimately, awareness is key. Keeping track of your obligations and understanding the policies of the platform can help ensure you’re making informed choices that align with your overall financial strategy.