Understanding the Mechanics of How Interest on Credit Cards Functions and Impacts Your Finances

When it’s time to make a purchase or cover an unexpected expense, many individuals turn to a financial tool that allows them to pay now and tackle the bill later. This popular option offers convenience and flexibility, making it easier to manage expenses and make desired purchases without having the full amount upfront.

But there’s more to this type of funding arrangement than meets the eye. It involves a series of agreements and conditions that determine how much you’ll ultimately owe, especially if you don’t pay off the balance right away. Familiarizing yourself with these elements is crucial for making informed decisions and avoiding unnecessary fees.

In this exploration, we’ll break down the fundamental concepts behind this system. From understanding how balances accrue over time to recognizing the importance of timely payments, we’ll equip you with the knowledge to navigate this financial landscape effectively. Prepare to demystify the intricacies of this borrowing method and gain insights that can help you use it to your advantage.

Understanding Credit Card Interest Rates

When it comes to managing a plastic payment tool, one of the key components to grasp is the cost associated with borrowing funds. This expense can vary significantly and often plays a crucial role in overall financial management. Having a solid understanding of these charges is essential for anyone using such financial instruments.

Typically, the amount you owe will determine the fees you incur over time. Various factors come into play, including the balance you carry and the terms set by your provider. Knowing how these factors affect your repayments is vital for avoiding unexpected surprises.

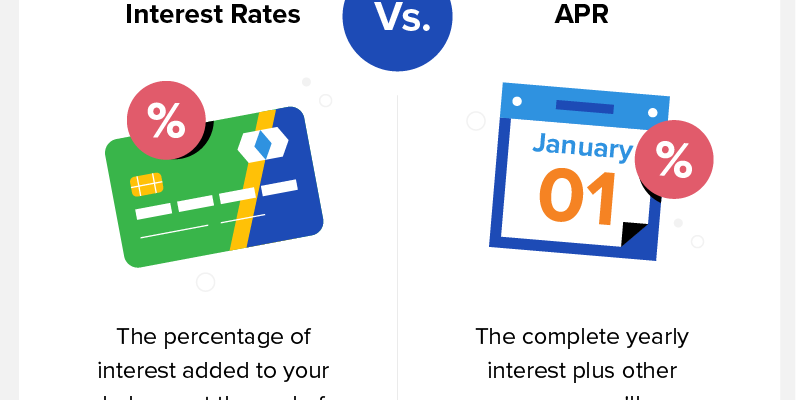

Annual percentage rate (APR) is a key term here, representing the total yearly cost of borrowing. It gives a clearer picture of what to expect in terms of expenses. Keep in mind that promotional rates may also appear enticing but could lead to higher costs later if not managed wisely.

Additionally, late payments or exceeding your limit can lead to penalties that significantly inflate your expenses. Staying informed about these fees can help maintain a healthier financial situation and prevent unwanted stress.

In summary, understanding the nuances of borrowing costs associated with your financial instrument can empower you to make better choices. Taking the time to learn about efficacious management can lead to a more prosperous financial future!

Impact of Interest on Credit Balances

Understanding the influence of added charges on outstanding amounts can significantly change how one manages finances. When balances rise, the costs can accumulate, leading to a heavier burden over time.

These added fees can create a ripple effect on purchasing power and monthly budgeting. Here are some effects to consider:

- Increased Total Amount Owed: Carrying a balance means more than just the original sum; additional charges can multiply what you owe.

- Minimum Payments: Making only the smallest payment extends the payment period and results in higher overall costs.

- Financial Flexibility: Elevated balances can restrict other spending options, impacting lifestyle choices.

- Credit Score Influence: High outstanding amounts can negatively affect your credit score, making future borrowing more expensive.

Being mindful of these implications can encourage responsible borrowing and prudent financial planning. Regularly tracking expenditures and finding ways to reduce balances can lead to healthier financial habits.

Strategies to Minimize Financing Costs

Managing expenses effectively can significantly reduce the burden of additional charges on borrowed funds. By adopting a few smart approaches, individuals can navigate through the complexities of financial obligations without feeling overwhelmed. It’s all about being strategic and informed.

One practical tactic is to pay off the outstanding balance as soon as possible. Making payments sooner rather than later can lower the overall amount owed and help avoid costly fees. Additionally, consider making more than the minimum payment; this can expedite the repayment process and help clear debts faster.

Another useful approach is to keep an eye out for promotional offers. Many institutions provide enticing deals such as introductory zero percent rates for a limited time. Taking advantage of these opportunities can save a substantial amount over time. Just be mindful of the terms to ensure you don’t fall into traps after the promotional period ends.

Utilizing budgeting tools can also aid in tracking expenses and identifying areas to cut back. By developing a clear financial plan, one can allocate funds more efficiently and prioritize repayments, ultimately reducing the overall financial burden.

Lastly, don’t hesitate to reach out for assistance. Consulting with financial advisors or exploring consolidation options can lead to better rates and more manageable payments. Remember, staying informed and proactive is key to minimizing extra costs associated with borrowing funds.

Wow;this video is absolutely stunning! The beauty in this clip is breathtaking.