Understanding the Interaction Between Financial Aid and Early Decision Admissions Processes

Embarking on the journey to higher education often involves a complex web of choices and responsibilities. For many students, submitting applications ahead of the usual timeline can present both opportunities and challenges. While the excitement of gaining an early commitment from a chosen institution is palpable, questions regarding available support resources can add layers of complexity to this decision-making process.

As young individuals navigate this pivotal phase of their lives, it’s crucial to understand how various programs and resources might influence their educational aspirations. The nuances of securing assistance during this period can greatly impact not just the emotional, but also the financial landscape of a student’s college experience. With considerations ranging from eligibility to funding options, students often find themselves weighing their options carefully.

Grasping the implications of this unique application strategy can help students and their families make informed choices. By delving into the mechanics of resource allocation and how it fits within the framework of an accelerated admission process, one can better navigate the myriad factors at play in higher education.

Understanding Early Decision Financial Aid

Navigating the world of college applications can be tricky, especially when it comes to submitting your commitment ahead of other applicants. This option may create some questions about how support systems are put in place to assist students financially. When you choose this route, it’s essential to know what to expect in terms of monetary assistance and how it aligns with your overall college journey.

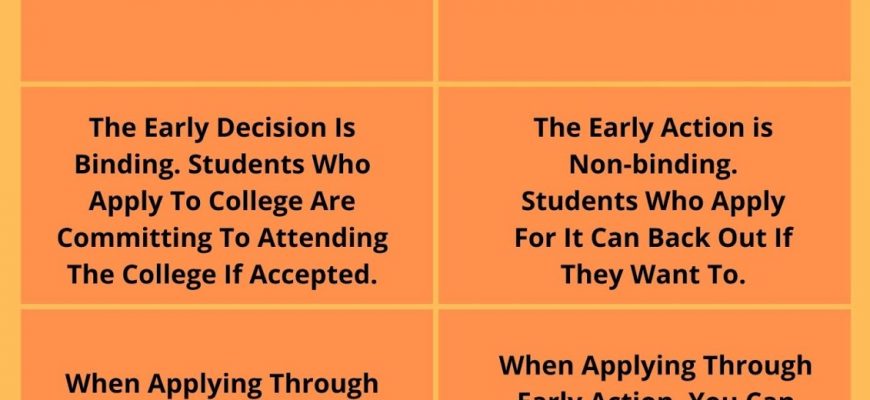

Commitment to a School is often a primary factor in this process. By opting for this path, students agree to enroll if accepted, which can influence the types of grants and scholarships available to them. Many institutions take this into consideration, potentially streamlining their support offers, knowing the prospective student is ready to make a binding commitment. This approach often results in a different package compared to regular admission processes.

Another vital aspect involves timing. The application deadlines for these commitments can be significantly earlier than standard timelines. This aspect may affect the opportunity to explore various funding options, as many resources have determined timelines. Applicants should be proactive and understand how their choices impact overall financing scenarios.

It’s also wise to connect with the financial services department. They can provide clarity about what types of resources might be accessible and how any personal circumstances may play a role. Institutions often have specific policies regarding assistance for students who make early commitments, so staying informed is crucial.

Ultimately, making a decision ahead of others can be rewarding academically while simultaneously presenting unique challenges regarding support. By remaining informed and engaged, students can navigate the complexities of funding effectively.

Implications of Binding Commitments

Choosing to commit to a college early can have significant consequences, impacting not just the admissions process but also potential funding opportunities. When students opt for this route, they are making a strong statement about their preferred institution. This decision often comes with commitments that may limit options down the road.

One of the main aspects to consider involves the financial landscape. Students are signing on the dotted line, indicating they’re ready to enroll if accepted. This choice can create a predicament if monetary support doesn’t align with families’ expectations. In many cases, aid packages might not be fully known at the time of commitment, placing applicants in a tricky situation.

Moreover, it’s essential to think through how accepting a binding offer influences the overall college application journey. There’s a risk of losing opportunities for better financial support at other institutions, as students may be unable to negotiate aid once they’ve locked in their choice. This scenario can leave individuals feeling trapped if they discover more favorable options later on.

In summary, early commitments are not just about securing a spot at a desired college; they encompass a broader picture that includes financial ramifications. Understanding these implications can help students make well-informed choices that align their educational goals with their financial realities.

Types of Support Available for Applicants

When exploring options for assistance, it’s essential to understand the various forms that can help ease the financial burden of higher education. Each type of support can play a pivotal role in shaping an applicant’s experience. Here’s a breakdown of the most common forms you might encounter.

- Grants: These are often awarded based on need and do not require repayment. They can come from federal, state, or institutional sources.

- Scholarships: Typically based on merit, these awarded amounts do not have to be paid back, making them a highly sought-after option for students.

- Work-Study Programs: These provide students with part-time jobs, allowing them to earn money to help pay for educational expenses while gaining valuable experience.

- Loans: While these must be repaid with interest, they can help fill the gap between expenses and available resources. They come from various sources including federal and private lenders.

Each category has its own unique eligibility criteria and application processes, so it’s wise to explore all available options to find what fits best with your individual situation.

- Research and determine your eligibility for grants and scholarships.

- Understand the terms associated with any loans you may consider.

- Look into work-study opportunities that align with your schedule.

By familiarizing yourself with these different types of support, you can make informed decisions that align with your goals and resources.