Understanding the Mechanisms Behind Financial Aid in Medical School and Its Impact on Future Physicians

Embarking on a journey in the realm of healthcare education presents both exciting opportunities and daunting challenges. As aspiring professionals navigate their way through rigorous training, many find themselves pondering the nuances of funding options available to them. Grasping the dynamic landscape of financial resources is essential for those looking to thrive in this competitive field.

In the world of healthcare training, there are various avenues designed to ease the financial burdens that students often face. It’s not merely about loans or scholarships; there’s a spectrum of assistance that comes from different sources. Understanding these diverse opportunities can significantly impact an individual’s ability to focus on their studies without the constant stress of monetary concerns.

So, what should one be aware of when exploring these resources? By delving into the specifics, future healthcare professionals can empower themselves with the knowledge needed to make informed decisions. This exploration provides clarity and enhances the overall educational experience, ensuring a smoother path toward fulfilling career aspirations.

Understanding Types of Financial Assistance

Navigating the world of educational resources can be quite the adventure, especially when it comes to pursuing a professional career in health. There are various avenues available to help alleviate the burden of costs, each with its unique advantages and nuances. Let’s explore the different options that aspiring healthcare practitioners can consider to support their journeys.

Grants are one of the most attractive forms of support. These are essentially gifts that don’t need to be repaid, making them ideal for students seeking to minimize debt. Typically awarded based on need or specific backgrounds, grants can significantly ease the financial load.

Scholarships are another fantastic option. Like grants, they don’t require repayment, but they often come with eligibility criteria based on merit, such as academic achievements, community service, or specific interests in healthcare fields. Finding scholarships that align with your goals can lead to substantial savings.

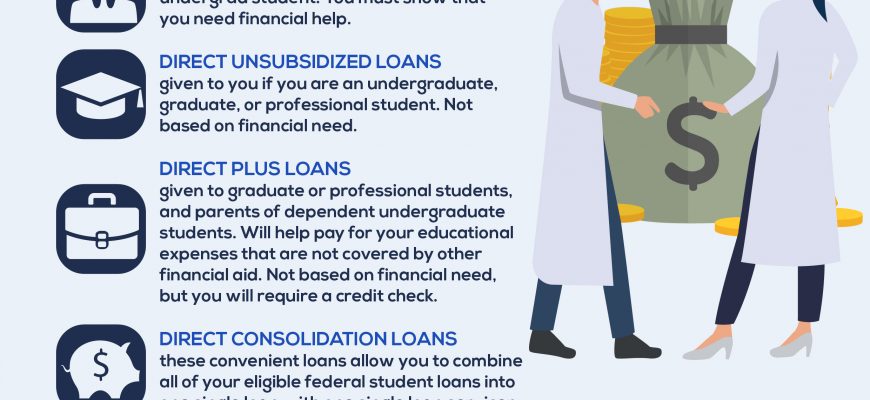

Loans are a more traditional path for funding education but come with a commitment to pay back the borrowed amount over time, typically with interest. Different types of loans exist, including federal and private options, each with varying terms and conditions. Understanding the intricacies of these loans is crucial for making informed decisions.

Work-study is an opportunity for those looking to earn while they learn. Students in work-study programs can take up part-time jobs, often related to their field, to help cover expenses. This not only aids financially but also adds valuable experience to their resumes.

Finally, there are assistantships and fellowships, which can provide a stipend or tuition reduction in exchange for teaching or research responsibilities. These positions often offer the chance to engage closely with faculty and gain insights into the field, making them a win-win situation.

Overall, understanding these various forms of assistance enables future health professionals to select the best options tailored to their circumstances, leading to a well-supported educational experience.

Application Process for Medical School Funds

Securing resources for your studies in the field of medicine can feel overwhelming at times. Understanding the journey of obtaining the necessary support is crucial for aspiring healthcare professionals. This section will guide you through the steps to successfully navigate the application route for assistance tailored to your educational needs.

First, familiarize yourself with the various types of support available. Institutions often provide grants, scholarships, and loans to help students. Researching these options will give you a clear picture of what’s out there. It’s essential to check the eligibility criteria for each program, as these can vary significantly.

Next, prepare your materials. Most programs will request documents like transcripts, letters of recommendation, and personal statements. Crafting a solid personal statement is vital, as it reflects your passion and commitment. Use this opportunity to share your journey and aspirations in the medical field.

Once you have all the necessary paperwork in hand, it’s time to submit your applications. Make sure to adhere strictly to deadlines to avoid missing out on potential opportunities. Keeping a checklist can help you stay organized throughout this process.

After submission, be prepared for possible interviews or additional requirements. Some programs may have specific steps to follow post-application, so stay informed and responsive. Following up with institutions can also show your enthusiasm and determination.

Finally, once you receive offers, assess them carefully. Look beyond just the numbers; consider factors like repayment terms or scholarship commitments. Making an informed decision can significantly impact your educational experience and future career.

Repayment Options After Graduation

After completing their studies, many graduates find themselves navigating the various ways to handle their student debts. Understanding the available pathways can make a significant difference in managing payments effectively. It’s all about making informed choices that align with one’s financial situation and career goals.

Here are some common strategies to consider:

- Standard Repayment Plan: This option allows borrowers to pay off their loans in fixed monthly payments over a ten-year period. It’s straightforward and helps in quick payoff.

- Graduated Repayment Plan: Perfect for those expecting their earnings to increase over time. Payments start lower and gradually increase, usually every two years.

- Income-Driven Repayment Plans: These plans adjust monthly payments based on income and family size. They can extend the repayment period to 20 or 25 years, often leading to loan forgiveness after that time.

In addition to these options, you might also explore:

- Loan Forgiveness Programs: Certain public service professions may qualify for forgiveness after a set number of payments.

- Refinancing: For those with improved credit or income, refinancing might lower interest rates and help reduce overall payments.

- Partial Payments: If facing temporary financial difficulties, some lenders may allow reduced payments for a short period.

Ultimately, staying proactive and seeking advice can lead to the best repayment strategy, ensuring that the transition into the professional world is smooth and financially manageable.