Understanding the Mechanics of Financial Aid and Its Impact on Students

Navigating the world of higher education can be daunting, especially when it comes to covering the costs associated with tuition and other expenses. For many, the journey towards a degree is significantly shaped by resources that help alleviate the financial burden. These resources come in various forms, enabling countless individuals to pursue their academic goals without the constant worry of their bank balance.

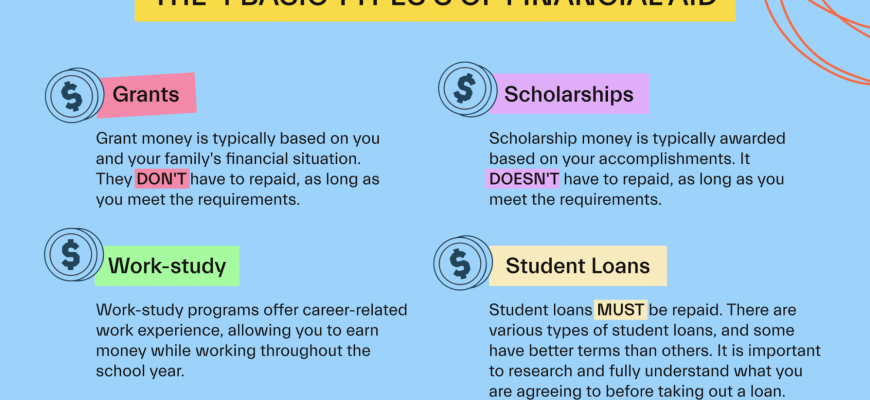

In this discussion, we’ll explore the different types of support available to students, breaking down the complexities involved in obtaining them. From grants and scholarships to loans and work-study opportunities, there are numerous options to consider. Whether you’re a first-time college attendee or a seasoned student returning for further studies, understanding the landscape of monetary assistance can make all the difference.

Our aim is to provide clarity and insight into what these options entail, how to access them, and the implications they have on a student’s future. While the journey may seem overwhelming at first, being informed is the first step towards making empowered financial decisions in your educational venture.

Understanding Types of Financial Support

When it comes to funding your education, there are several ways to secure assistance. Each option offers different resources that can help lighten the financial burden, making it easier to achieve your academic goals. From grants to scholarships, understanding these various forms can be essential to making informed decisions about your education.

First up, we have grants, which are often awarded based on need. These funds do not require repayment, providing a helpful way to cover tuition and other expenses. Next, scholarships come into play. These are typically based on merit, such as academic performance or talent in specific areas, and they also do not need to be paid back.

Then there are work-study programs, which allow you to earn money through part-time employment while attending school. This can be a great way to gain experience and maintain an income. Additionally, loans are available but require repayment after graduation, making them a more serious commitment. Understanding these different resources can empower you to take control of your education financing.

Overall, knowing the diverse avenues for obtaining monetary support can guide you in navigating the complexities of funding a college education. Each type has its nuances, and determining the best combination for your situation can greatly influence your academic journey.

The Application Process Explained

Navigating the path to securing assistance for education can feel overwhelming, but breaking it down into manageable steps can simplify the journey. Understanding what to expect throughout the various stages can ease your mind and help you prepare effectively.

Initially, it’s important to gather all necessary documents and information, including personal identification and financial details. This foundational step sets the stage for a smoother experience as you fill out required forms. Timing plays a critical role here; being aware of deadlines ensures that you won’t miss out on opportunities available to you.

Next, engaging with the necessary applications will allow you to present your situation accurately. Each form will often ask for specific details about your background, family income, and any other pertinent information. It’s essential to be honest and thorough, as this will greatly influence the support you can receive.

Once the submissions are complete, the waiting game begins. During this time, schools and organizations will evaluate the applications and determine eligibility. This review process varies by institution, but staying patient and proactive during this period can significantly benefit you.

Finally, once decisions come in, you’ll receive notifications about the resources available to you. Taking the time to analyze each offer carefully is crucial. This is your chance to weigh different options and decide what ultimately aligns best with your educational goals.

Managing Support Wisely for Education

Making the most of your educational funding is crucial for achieving your academic goals without unnecessary stress. It involves understanding how to allocate resources in a way that not only covers tuition but also supports other essential needs throughout your studies. By planning carefully, you can ensure that every dollar goes further and contributes to a successful learning experience.

First and foremost, a budget is your best friend. Start by listing all expected expenses, from classes to books, housing, and daily necessities. Knowing the total cost can help you determine how much assistance you have and where it’s most needed. It’s easy to overlook smaller costs, but those can quickly add up and strain your finances.

Next, prioritize your spending. While it might be tempting to splurge on the latest gadgets or social outings, focusing first on essentials, like your courses and materials, will pay off in the long run. Consider second-hand textbooks or digital alternatives, which can be more affordable while still offering valuable content. Every little bit saved can be redirected towards other important expenses.

Additionally, keep track of your funding sources. Some programs might require you to maintain a certain GPA or complete specific tasks. Staying organized and aware of deadlines will help you keep your support intact and prevent any surprises down the line. Using tools like spreadsheets or budgeting apps can also simplify this process, making it easier to monitor your finances.

Lastly, seek advice and resources available on campus. Many institutions offer workshops or counseling on managing funds effectively, providing insights that can help you navigate expenses better. By tapping into these resources, you can gain valuable knowledge that enhances your educational journey and prevents financial burdens.