Understanding the Mechanisms of Financial Aid Disbursement to Students

Imagine a scenario where pursuing higher education seems within reach for everyone, not just a privileged few. The support systems in place can significantly alleviate the burden of tuition and related costs, setting the stage for a brighter future. These resources often come in various forms, helping students navigate the complex world of expenses associated with academic endeavors.

When it comes to receiving these essential resources, there are distinct processes that determine how these allocations find their way to recipients. Each financial support program has its own unique structure, which can include grants or loans, all designed to assist learners in managing their educational investments. Understanding this landscape is crucial in maximizing these opportunities and ensuring that every bit of assistance is effectively utilized.

As recipients delve deeper into the details of their available resources, they’ll discover the different routes through which assistance is delivered. From direct deposits to tuition reductions, the ways in which funds are disbursed can vary widely. Grasping these nuances enables students to make informed decisions that can enhance their overall academic journey.

Understanding Financial Aid Disbursement

When it comes to receiving assistance for educational expenses, many wonder about the process behind the distribution of those funds. It’s essential to grasp how money is allocated and when it becomes available to students. This crucial step ensures that learners have the resources needed to cover tuition fees, books, and living costs.

Typically, these resources are released in specific intervals throughout the academic year. Students can expect to see the funds credited to their accounts based on a predetermined schedule set by the institution. This timeline can vary widely, so staying informed is key.

In most situations, institutions first apply the resources directly to tuition costs, ensuring that the most significant expenses are addressed. Any remaining balance may then be distributed to the student, providing additional support for other educational needs. Understanding this process can help you better plan your finances for the semester.

Types of Support Payments Available

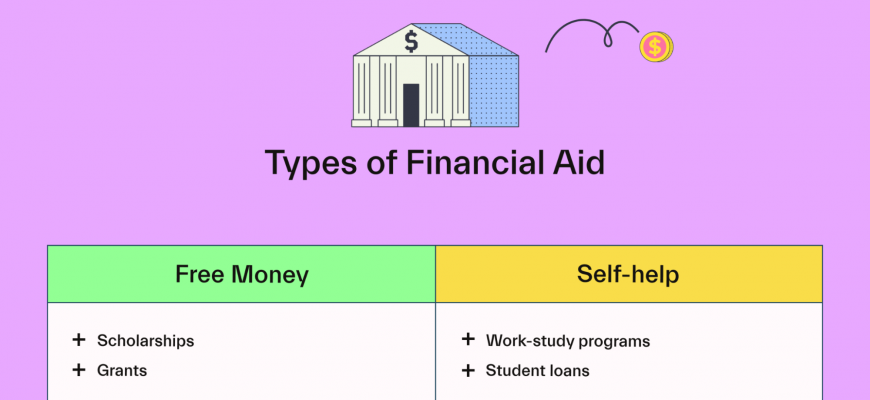

When it comes to funding your education, there are various methods to receive support that can help lighten the financial load. Understanding the different options can make a significant difference in how you manage your resources throughout your academic journey.

One common form of assistance comes in the shape of grants. These are typically provided based on need and do not require repayment, making them an attractive option for many students. Another possibility includes scholarships, which are often awarded based on merit, achievements, or specific criteria, allowing recipients to focus on their studies without worrying about repayment.

Additionally, there are loan options available that may come with lower interest rates or deferment periods while you’re in school. These loans are expected to be repaid after graduation, but they can ease immediate financial concerns. Work-study programs also present an interesting avenue, combining part-time employment with educational funding, allowing students to earn money while gaining valuable experience.

Lastly, some may explore tuition reimbursement options from employers, which can significantly help those already in the workforce. By analyzing all these avenues, students can create a well-rounded strategy to support their educational pursuits.

Eligibility Criteria for Receiving Assistance

When it comes to obtaining support for your educational journey, certain qualifications must be met. These requirements play a crucial role in determining whether individuals can access the resources they need to succeed. A clear understanding of these factors can greatly enhance your chances of securing the help you’re looking for.

First and foremost, applicants typically need to demonstrate financial necessity. This often involves submitting detailed information regarding your income, expenses, and other financial obligations. Organizations aim to ensure that those who need support the most are prioritized.

Additionally, academic performance frequently influences eligibility. Many programs look for candidates with a minimum grade point average or standardized test scores, making it essential to stay focused on your studies. Your commitment to your education reflects your potential for success.

Furthermore, residency status may also come into play. Some assistance programs are specifically tailored for residents of particular states or regions. Understanding the geographical limitations is vital when preparing your application.

Lastly, there are often deadlines that must be adhered to in order to be considered for support. Keeping track of these important dates is essential; missing them could mean losing out on valuable opportunities. Staying organized and proactive will serve you well in this process.

In essence, grasping these eligibility criteria is the first step toward unlocking the support you may need for your academic aspirations. By aligning your circumstances with these requirements, you can navigate the application process more effectively.