Understanding the Mechanisms of Financial Aid Available for Law School Students

Embarking on the journey to becoming a legal professional can be both exciting and daunting. As aspiring attorneys face the rising costs of their education, many wonder about the resources available to them. Fortunately, there are various avenues one can explore to alleviate the financial burden associated with acquiring a degree in the legal field.

In this discussion, we’ll dive into the various options that can provide support to those aiming to achieve their professional dreams. From government programs to private entities, numerous sources exist that can help lessen the financial strain. Grasping the essentials of these offerings can empower students to make informed decisions about their educational pursuits.

Equipped with knowledge about these assistance mechanisms, prospective legal scholars can focus on their studies with greater peace of mind. Understanding these options not only opens doors but also enhances the overall experience of navigating through the complexities of legal education.

Types of Support Available to Law Students

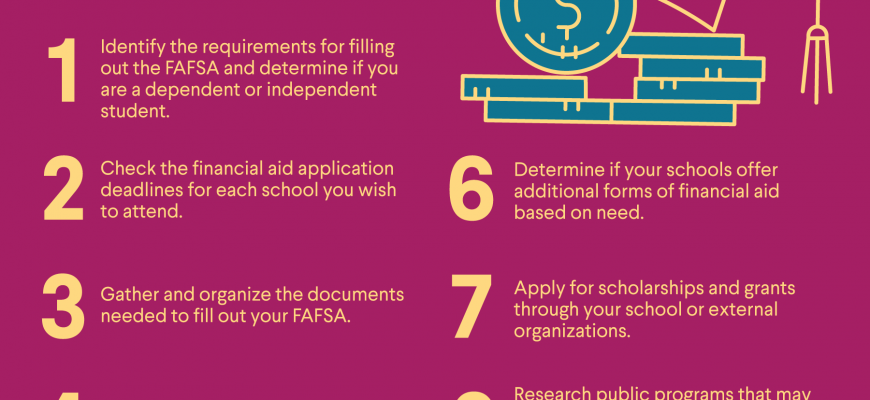

Pursuing a legal education can be quite a financial commitment, but there are various forms of assistance that can help ease the burden. Understanding the different categories of support is crucial for students aiming to navigate their funding options effectively.

First up, there are scholarships, which are often merit-based or need-based. These awards do not require repayment and can significantly reduce tuition costs. Many institutions offer their own scholarships, while external organizations may also provide funding opportunities.

Grants are another appealing option. Similar to scholarships, these funds do not need to be repaid and are typically awarded based on specific criteria. Government and private entities often offer grants aimed at particular demographics or academic achievements.

Then, we have loans. Unlike scholarships or grants, loans must be repaid after graduation, usually with interest. Both federal and private options exist, and it’s wise to explore the terms and conditions carefully to make informed decisions.

Additionally, work-study programs can provide students with part-time employment while attending classes. This allows for practical experience in the field and helps to cover living expenses or tuition fees.

Lastly, some universities provide unique resources, such as fellowships or tuition remission for teaching or research assistance. These programs can offer substantial financial relief while enhancing educational experiences.

Navigating Scholarships and Grants

Pursuing a legal education can be quite an adventure, and finding the right financial resources can make a huge difference. Scholarships and grants are two excellent pathways to explore. They often provide substantial support without the added burden of repayment, which makes them appealing options for many aspiring legal professionals.

Research is your best friend here. Many institutions offer their own awards, so diving into their specific criteria and application processes is crucial. Don’t overlook local organizations, bar associations, and even private foundations, as they frequently provide funding opportunities tailored to future attorneys.

Keep in mind that each scholarship or grant will have its own eligibility requirements and deadlines. Staying organized will help you manage your applications effectively. A well-prepared application, highlighting your achievements and aspirations, increases your chances of securing much-needed resources.

Networking can also play a key role in your journey. Engaging with current students and alumni can reveal opportunities you may not find in a basic search. They can provide tips, insights, and even mentor you through the application process. Building relationships within the legal community can ultimately lead to support that eases your educational journey.

Understanding Student Loans and Repayment

Navigating the world of borrowing money for education can feel overwhelming, but it’s essential to grasp the basics. Loans provide a way to fund your studies, allowing you to focus on mastering your craft without the immediate burden of expenses. Knowing what options are available and how to manage them plays a crucial role in setting yourself up for success.

When you take out a loan, you’re essentially agreeing to receive a sum of money now, with the promise to pay it back later–typically with interest. There are various types of loans you might consider. Some come from private lenders, while others are federal options, often offering more favorable terms. Understanding the differences can help you make informed choices that align with your financial goals.

Once your education wraps up, repayment becomes the key focus. Different plans exist, and selecting one that suits your financial situation is vital. Whether you choose a standard repayment plan or an income-driven option, knowing your responsibilities will guide you on the path to managing debt effectively. Plus, keeping communication open with your lender can provide assistance, should you encounter any difficulties down the road.

Ultimately, taking charge of your loans involves more than just understanding the numbers. It’s about making wise decisions throughout your journey, allowing you to concentrate on your studies while preparing for a financially stable future.