Exploring the Role of Finance in Supporting and Growing Business Success

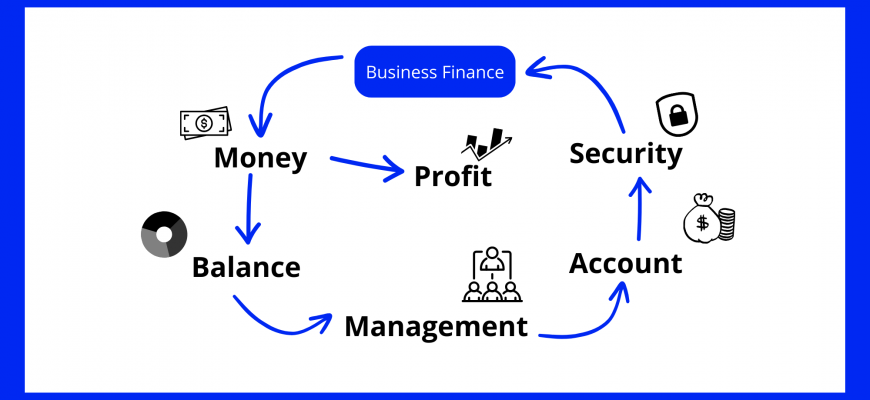

In today’s dynamic marketplace, understanding the intricate connections between monetary resources and organizational success is vital. Every decision made within an organization often hinges on effective allocation and oversight of funds. This relationship goes beyond mere numbers; it shapes strategies, influences operations, and drives innovation.

Sound monetary strategies create a robust framework that empowers an organization to reach its goals. By ensuring there are sufficient assets to support ambitions, it paves the way for sustainable progression. Whether it’s investing in cutting-edge technology, expanding reach into new markets, or enhancing customer experience, the availability and management of capital are central to these initiatives.

Moreover, the ability to analyze and interpret financial data allows leaders to make informed decisions. This insight is not just about keeping the books balanced. It’s about anticipating challenges, seizing opportunities, and steering the organization towards lasting success. In essence, a well-rounded approach to handling resources is what sets thriving entities apart from the rest.

Understanding Financial Resources for Growth

When it comes to expanding a venture, having the right monetary tools at your disposal is crucial. These resources not only serve as a foundation but also provide the necessary momentum to elevate operations and realize ambitious goals. Grasping the different types of capital available can make a significant difference in a company’s trajectory.

At the core, every enterprise requires a mix of assets–be it through savings, investments, loans, or even grants. Each of these options comes with its own perks and considerations. It’s essential to evaluate which combination aligns best with the objectives you wish to achieve. Knowing where and how to acquire these resources can pave the way for more informed decisions and foster sustainable growth.

Diving deeper into this subject reveals the various strategies leaders can adopt to optimize their funding. Building solid relationships with financial institutions, understanding market trends, and being proactive in seeking investment opportunities are just a few paths that can lead to fruitful outcomes. The right approach unlocks potential and opens doors to new possibilities.

In essence, maximizing available resources not only ensures that a venture runs efficiently but also positions it advantageously in a competitive landscape. The key lies in continuous evaluation and adaptation to harness what truly works for long-term success.

Investment Strategies to Enhance Profitability

In today’s competitive landscape, optimizing returns is crucial for growth and sustainability. Smart allocation of resources can significantly boost revenue and ensure long-term success. By exploring various techniques, organizations can uncover new avenues for financial gains.

Diversification stands out as a key approach. By spreading investments across different sectors or asset classes, one can mitigate risks and capitalize on emerging trends. This not only safeguards against market fluctuations but also opens doors to multiple income streams.

Value investing is another powerful tactic. Identifying undervalued assets with solid fundamentals can yield substantial returns over time. Patience is essential here, as the goal is to nurture those investments until they reach their true worth.

Incorporating technological advancements also proves beneficial. Utilizing data analytics and artificial intelligence can provide insights into market behavior, ultimately guiding smarter investment choices. This approach can elevate decision-making and enhance overall profitability.

Active portfolio management remains a cornerstone of effective investment practices. Regularly reviewing and adjusting strategies based on market conditions helps to maintain optimal performance. Staying agile enables quick responses to shifts, ensuring positions remain profitable.

Lastly, consider impact investments. Aligning financial goals with social responsibility attracts like-minded investors and can create a positive brand image. This strategy not only generates profits but also contributes to meaningful change in society.

The Role of Budgeting in Business Success

Creating a well-structured financial plan is essential for achieving long-term goals and maintaining stability. It’s not just about tracking expenses; it’s about making informed decisions that drive growth and effectiveness. A solid budgeting approach enables organizations to allocate resources wisely and monitor performance against objectives.

A budget acts as a roadmap, guiding operations and highlighting areas that need attention. This approach fosters accountability and encourages proactive management. Here are some critical aspects to consider:

- Resource Allocation: Ensuring that funds are directed towards the most impactful areas.

- Performance Measurement: Evaluating success through comparisons with financial targets.

- Financial Discipline: Encouraging responsible spending and minimizing waste.

Moreover, a clear budget can enhance communication within teams. It aligns various departments towards shared goals and sets expectations. Engaging everyone in the budgeting process fosters collaboration and ensures that all voices are considered.

In times of uncertainty, a well-prepared budget can serve as a crucial tool. It allows for adaptability and responsiveness to market changes, ensuring that the organization remains resilient. Ultimately, effective budgeting is not merely an administrative task; it’s a vital component of thriving in competitive environments.