Understanding the Functionality of Credit Versio and Its Impact on Financial Management

Have you ever wondered how certain financial tools manage to simplify the complexities of managing monetary affairs? In a world where personal finance can often feel overwhelming, innovative systems have emerged to ease the burden. These platforms aim to provide clarity, organization, and an overall better experience for users looking to navigate their financial landscape.

At the core of these advanced solutions lies a fascinating interplay of technology and user-centric design. Each component is carefully crafted to enhance efficiency, allowing individuals to track, manage, and analyze their fiscal responsibilities without the usual stress. By harnessing the power of data and modern algorithms, these tools strive to empower users, making informed financial choices more accessible than ever.

As we delve deeper into this arena, it becomes clearer that the underlying processes are not just about numbers, but about creating an ecosystem where financial well-being is prioritized. The focus shifts from mere tracking to a broader understanding of how various aspects of finance interact, ultimately paving the way for smarter decision-making.

Understanding Credit Versio’s Functionality

In the realm of financial management, there exists a system designed to streamline the process of understanding and improving one’s financial health. This innovative tool aims to empower users by simplifying the complexities associated with credit assessments and fiscal decisions. The core function revolves around providing insightful data and actionable strategies, helping individuals navigate their financial landscapes more effectively.

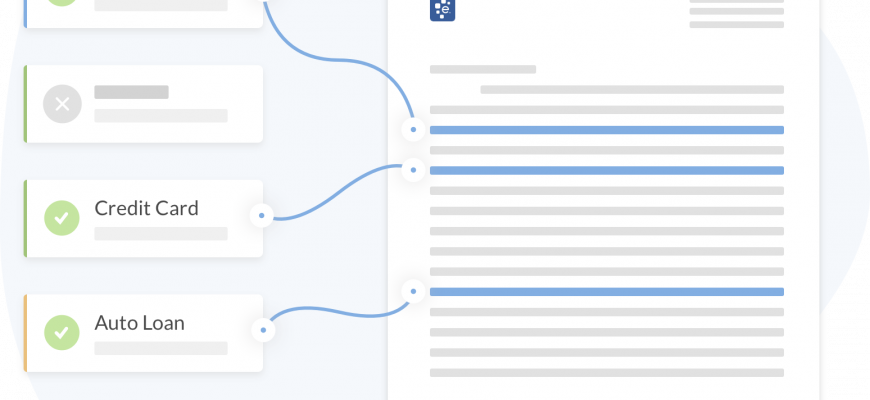

Essentially, this platform serves as a guide, enabling individuals to gain clarity on their credit profiles. Users can expect to access comprehensive reports that break down various aspects of their financial standing. This includes identifying possible areas for improvement and recognizing the implications of their financial choices.

Moreover, the interface is designed to be intuitive, allowing users to swiftly analyze pertinent information without feeling overwhelmed. Tailored recommendations are made available, equipping individuals with the knowledge they need to enhance their creditworthiness over time. The emphasis here is on proactive engagement with one’s financial situation, fostering better habits and informed decisions.

By utilizing these resources, users can embark on a journey towards financial empowerment. This ultimately leads to a clearer understanding of their current status and the steps necessary to achieve their goals. It’s about cultivating a mindset that prioritizes health in personal finance and recognizes the importance of informed actions.

Benefits of Using Credit Versio

Utilizing innovative financial tools can transform the way individuals and businesses manage their financial health. Embracing such solutions not only enhances efficiency but also simplifies complex tasks that might otherwise consume valuable time and resources.

One significant advantage is the ease of access to essential information. With streamlined processes, users can quickly gather insights that inform better decisions. Accuracy is another key benefit; automated calculations reduce the likelihood of human error, providing confidence in the financial data presented.

Additionally, the user-friendly interface allows for seamless navigation, making it accessible for individuals with varying levels of expertise. The ability to integrate various financial accounts fosters a comprehensive view of one’s finances, allowing for more strategic planning. Time savings cannot be overlooked either–automated reports and analytics free up hours that can be spent on more productive activities.

Lastly, utilizing such a solution can enhance overall financial literacy. With the resources provided, users can learn about financial management best practices, leading to smarter fiscal choices in the long run. Whether for personal use or business growth, these tools can play a crucial role in achieving financial goals.

Getting Started with Credit Management Tool

Embarking on a journey to enhance your financial standing can feel overwhelming, but it doesn’t have to be. This section aims to guide you through the initial steps to effectively utilize a remarkable tool designed to simplify your credit improvement process.

First and foremost, familiarize yourself with the platform. Setting up an account is usually straightforward. Just visit the official site, provide some necessary information, and you’re on your way. Once your profile is created, take a moment to explore the dashboard. It’s user-friendly and packed with features tailored to assist you in achieving your financial goals.

Next, seek to understand the resources available. Often, these platforms offer informative materials and tutorials that can be invaluable. Spending time reviewing these guides can provide insights into the functionalities and methodologies that can aid you in your journey.

Monitoring your financial history is crucial. Connect any relevant accounts to gain a clear view of your credit situation. Many tools allow you to track changes and provide personalized advice based on your unique circumstances.

Stay proactive; engage with the provided recommendations. Regularly checking updates and implementing suggestions can lead to significant progress. Remember, patience is key; improvement takes time but can ultimately lead you to better financial health.

Lastly, do not hesitate to seek support. Many platforms have customer service representatives or community forums where you can ask questions and share experiences. Building connections with others on a similar path can make the journey not only more manageable but also more enjoyable.