Ways to Improve Your Credit Score and Boost Your Financial Health

Building a robust financial reputation can significantly influence various aspects of your life, from securing loans to getting favorable interest rates. Most of us strive for improvement in this area, as it opens doors to new opportunities and enhances financial freedom. Understanding the factors that contribute to this gradual ascent can help you take actionable steps toward achieving your goals.

Many individuals often wonder what practical measures lead to an increase in their financial trustworthiness. It’s not just about keeping bills paid and accounts in good standing; there are a myriad of elements at play. By focusing on specific habits and understanding how they affect your overall financial picture, you can take control of your journey and elevate your standing effectively.

In this guide, we’ll explore various strategies that can contribute to a healthier financial profile, transforming it over time into something that reflects your commitment to sound financial management. So, whether you’re starting from scratch or looking to enhance an already solid foundation, there’s something valuable here for everyone.

Understanding Credit Score Components

When it comes to your financial health, a particular number plays a crucial role in determining your eligibility for loans, credit cards, and even rental agreements. It’s important to realize that this figure isn’t just a random value; it’s influenced by various factors that reflect your financial behavior over time. Grasping these elements can truly empower you in managing and improving your overall financial profile.

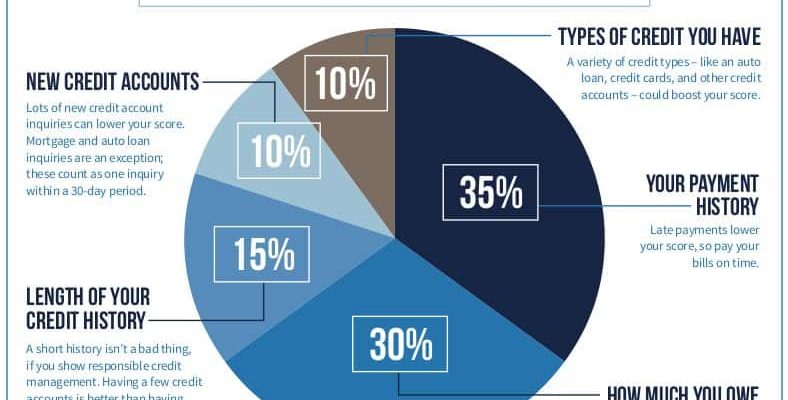

Three primary factors shape this numerical representation: your payment history, amounts owed, and the length of credit history. Each of these components carries its own weight and contributes differently to the overall picture. For instance, consistently making timely payments showcases reliability, while the total amount of debt you carry can signal risk to potential lenders.

Additionally, the types of accounts you hold and the frequency of new inquiries into your financial background also play significant roles. Diverse types of credit can enhance your profile, leading to a more favorable assessment. Meanwhile, applying for too many accounts in a short span might raise red flags, indicating potential financial distress.

Understanding these individual elements not only helps demystify the process but also allows you to take proactive steps. By being mindful of how your actions influence this crucial number, you can strategically improve your financial standing and open up new opportunities for yourself.

Effective Strategies to Improve Your Score

Boosting your financial standing can open doors to better opportunities, whether it’s securing a loan, renting an apartment, or getting a favorable insurance rate. By making some informed choices and adopting certain habits, you can significantly enhance your financial reputation. Let’s explore a few straightforward methods to help you on this journey.

First and foremost, staying on top of your payments is crucial. Consistently making your payments on time demonstrates responsibility and reliability. Set reminders or automate payments if that helps keep you organized. Additionally, managing your debt levels is vital. Aim to keep your utilization ratio–how much of your available credit you’re using–under 30%. This shows lenders that you’re not overly reliant on borrowed funds.

Regularly reviewing your financial history is also a smart practice. Obtain your reports and check for any inaccuracies. If you spot mistakes, dispute them promptly. Cleaning up errors can lead to immediate improvements. Building a mix of different types of credit, like installment loans and revolving credit, can be beneficial too. It shows lenders that you can handle various financial products responsibly.

Finally, consider maintaining older accounts. Length of credit history plays a role in how lenders assess you. If you have an account that you haven’t used in a while but is in good standing, keep it open. It shows a longer relationship with credit providers and can positively influence your overall assessment. With these strategies in hand, you’ll be on your way to enhancing your financial standing in no time.

The Impact of Payment History

When it comes to financial health, one key aspect plays a vital role in shaping overall perceptions. This element reflects reliability and can dramatically influence how lenders view a person’s trustworthiness. Maintaining a positive track record in settling debts not only fosters trust but also opens doors to numerous opportunities in the lending world.

Timely payments are crucial. They serve as the foundation of this relationship, demonstrating a commitment to fulfilling financial obligations. Even if everything else seems in order, a few missed deadlines can quickly undermine credibility and create ripples that affect future prospects.

Consistency is the name of the game. Regularly honoring payment commitments builds a history that speaks volumes about one’s financial habits. Additionally, staying aware of due dates and proactively managing accounts can lead to substantial improvements over time.

Furthermore, while occasional slips can happen, the key lies in recovering swiftly. Making up for a missed payment can help restore faith and mitigate any negative impact. In the long run, cultivating a positive payment history becomes an invaluable asset, paving the way for favorable terms and greater financial freedom.