Understanding the Factors That Can Cause Your Credit Score to Decrease

Many individuals often find themselves puzzled about the factors leading to a dip in their financial rating. It’s a topic that generates numerous questions, especially since a strong rating can open doors to better loan terms and interest rates. Recognizing the specific elements that influence this popular assessment is crucial for maintaining a healthy financial profile.

Life circumstances, such as unexpected expenses or changes in employment, can significantly impact one’s overall standing. Moreover, the manner in which financial obligations are managed plays a pivotal role in shaping perceptions held by lenders. Whether it’s late payments or high usage of available limits, these actions can lead to a less favorable evaluation.

Keeping a pulse on trends in personal finance management is vital. Understanding how certain behaviors, like applying for new lines of credit or consolidating debt, can create fluctuations can empower individuals. By being aware of these influences, it’s possible to take proactive steps and safeguard that vital financial aura.

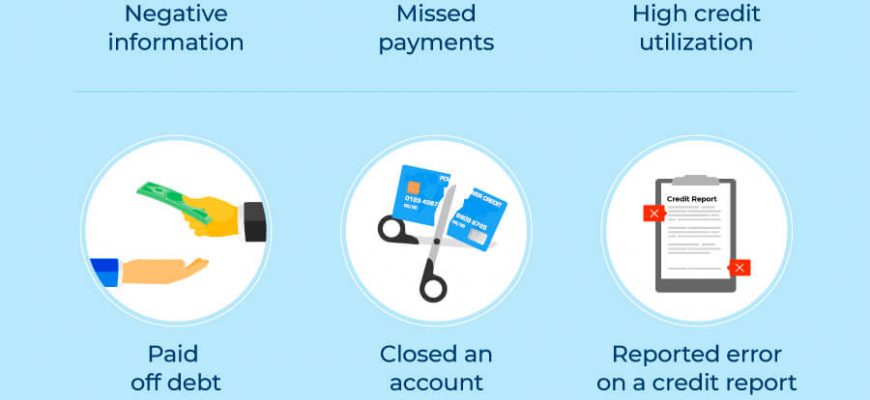

Common Factors Leading to Score Decline

Every financial journey has its bumps along the way, and certain actions or situations can impact your standing with lending institutions. Understanding these influential elements can help you navigate your finances more wisely, ensuring that your reputation remains intact.

One major contributor is payment history. Late or missing payments can create a red flag for lenders. Regularly overdue accounts easily send the wrong message about your financial reliability.

High balances on your revolving accounts can also be detrimental. When you utilize a significant portion of your available credit, it can signal that you might be overextended, which makes lenders uneasy.

Frequent applications for new lines of credit can have an unintended effect too. Each time a lender checks your background, it can appear as though you’re seeking to borrow more than you can manage. This might raise concerns about your overall financial stability.

Another area of concern is the length of your credit history. A shorter record can limit your attractiveness to lenders, as it’s harder for them to assess your financial habits over time.

Lastly, a lack of diversity in your accounts can play a role. A mix of different types of credit can show that you can manage various commitments responsibly, which can be a significant plus in the eyes of financial institutions.

The Impact of Missed Payments

Missing payments can have a significant effect on your financial well-being. When obligations are delayed or overlooked, it can lead to serious consequences in the overall landscape of your financial history. Many people underestimate how just one late payment can alter perceptions of their reliability as borrowers.

Timeliness is key when it comes to repayments. Lenders often view a pattern of missed due dates as a signal that an individual may struggle to manage their finances. This not only raises red flags but can also lead to increased interest rates or even denial of future credit applications.

Moreover, the extent of the impact depends on various factors such as how late the payment is and how often it occurs. A one-time slip might not seem catastrophic, but repeated lapses can create lasting damage. Keeping track of due dates and setting reminders can make a world of difference in maintaining a solid financial footing.

In essence, staying punctual with payments is crucial. It helps preserve a favorable impression with lenders and can ultimately lead to more favorable terms and opportunities in the future.

Credit Utilization: Understanding Its Role

When it comes to financial health, managing how much of your available borrowing power you use is crucial. This specific aspect plays a significant role in shaping your overall financial profile. Keeping an eye on this factor can lead to better opportunities and improved conditions when seeking other forms of financing.

Credit utilization refers to the percentage of available funds you’re currently using. It essentially reflects your spending behavior. If you’re using a large portion of your limit, it can raise red flags for lenders. They often view this as a potential risk, indicating that you might be overly reliant on borrowed funds, which could lead to difficulties in repayment.

Maintaining a balance is key. Ideally, it’s wise to keep this ratio below 30%. That demonstrates to potential lenders that you’re managing your funds responsibly and are less likely to default on payments. Monitoring your borrowing habits and adjusting them as necessary plays an important role in safeguarding your financial future.