| Compare | First free* | Max amount | Min amount | Max term |

|---|---|---|---|---|

| Yes | 1200 € Contratar | 50 € | 5-62 day |

| Compare | Processing time | Max amount | ARP(%)* | Min amount | Age limit | Max term | Schedule |

|---|---|---|---|---|---|---|---|

| 10 min. | € 300 Get | 10 % | € 3000 | 18-75 | 1-3 years | 08.00 - 20:00 10:00 - 20:00 |

Understanding the Functionality and Purpose of Credit Notes in Business Transactions

When it comes to managing transactions between buyers and sellers, certain situations may arise that necessitate adjustments after a sale has been finalized. These adjustments often serve as essential tools for correcting mistakes or addressing changes in order quantities. Understanding the mechanics behind these adjustments can significantly enhance both your personal and business financial management.

In the world of commerce, it’s not uncommon for discrepancies to occur. Sometimes, a customer may return a product, or there could be an error in the billing process. In these cases, businesses employ specific documents to reflect these changes. The beauty of these documents lies in their ability to maintain clarity and fairness in the financial process, ensuring that all parties involved are adequately compensated or credited for their transactions.

Getting acquainted with the fundamental principles surrounding these financial instruments can empower you to navigate the complexities of commercial dealings with confidence. By grasping how these adjustments function, you can better manage purchases and returns, which ultimately leads to a smoother and more transparent transaction experience.

Understanding the Concept of Credit Notes

When navigating the world of transactions, you’ll often encounter a mechanism that helps keep things fair and balanced between buyers and sellers. Think of it as a tool designed to provide a level of reassurance for all parties involved. It’s all about ensuring that value can be adjusted and accounted for, especially in cases where exchanges don’t go as perfectly planned.

This unique instrument comes into play when there are adjustments needed after a purchase. Perhaps a mistake was made, or a product didn’t meet expectations. In such instances, this method can offer a way to rectify the situation without the need for cash refunds. It allows businesses to maintain their records accurately while offering clients an easy path to resolving issues, fostering a sense of trust and reliability in the buying process.

In essence, this approach streamlines communication between parties, making it clear what changes need to be applied. Whether it involves a return, reduction, or any other modification, this tool serves as a formal acknowledgement of the adjustment, helping to keep financial statements aligned and ensuring that everyone walks away satisfied.

Key Differences Between Credit Documents and Invoices

When it comes to business transactions, understanding the distinction between various financial documents is essential for both buyers and sellers. While they may seem similar at first glance, these two types of paperwork serve different purposes in the world of commerce. Let’s dive into what sets them apart and why it matters.

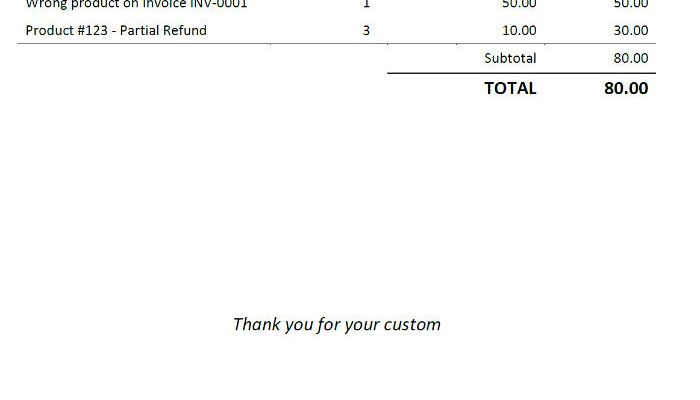

First off, one document typically indicates a sale or a service rendered, detailing the amount owed by the purchaser. On the other hand, the other kind serves as a way to acknowledge a return, discount, or adjustment on a previous transaction. This fundamental difference shapes how each document is utilized in accounting and financial records.

In terms of structure, the transactional document often includes line items, prices, and other necessary details indicating the total amount due. Conversely, the alternative document will usually provide a negative amount or credit value, outlining how much should be deducted from future purchases instead of a payment owed.

Furthermore, the implications for cash flow are also quite different. The one that signifies a sale impacts cash inflow, whereas the counterpart affects future obligations by reducing how much is owed to the business. Understanding this distinction helps in managing finances more effectively.

In summary, knowing the specific roles of these two types of documents can simplify financial management and enhance communication between parties involved in the transaction. Recognizing their unique functions will undoubtedly lead to smoother business operations.

Maximizing Efficiency with Credit Memos

Utilizing a credit document can significantly streamline your financial processes and enhance customer satisfaction. Recognizing their potential allows businesses to manage transactions more effectively while also maintaining strong relationships with clients. By leveraging these tools wisely, organizations can promote transparency and accountability, leading to a smoother operational flow.

First and foremost, ensure clarity when issuing these documents. Clearly state the reason for the creation, whether it’s for a return, overpayment, or service adjustment. Transparency minimizes confusion and sets the stage for a trustworthy interaction with your clientele.

Additionally, always keep proper records. Document each transaction meticulously, as this step provides a clear audit trail. This not only aids in maintaining accurate financial statements but also makes it easier to address any discrepancies if they arise in the future.

Another key aspect is timely communication. Promptly informing customers about the issuance of this document and its implications fosters goodwill. It shows that you value their business and are committed to resolving any issues swiftly.

Finally, integrate these documents into your accounting system. Seamlessly incorporating them into your overall financial strategy ensures that all parties involved have access to the necessary information, facilitating a smoother reconciliation process at the month’s end.

Her charm and beauty are absolutely magnetic! This is beyond impressive—she is a true queen;owning every second of this clip.