Understanding the Mechanisms of Credit Lines in Canada and How They Function

In today’s financial landscape, many individuals seek methods to manage their spending capacity effectively. The ability to tap into a pre-approved pool of resources offers a sense of security and convenience, especially when unexpected expenses arise. This arrangement can be a game-changer for those aiming to maintain a balanced budget while still enjoying some financial freedom.

Imagine a system where you can borrow funds up to a certain limit without going through lengthy approval processes each time. This flexibility can empower individuals to make necessary purchases or handle emergencies without the pressure of immediate repayment. By grasping the ins and outs of this financial tool, one can navigate personal finances with greater confidence and agility.

As we explore this topic further, it’s essential to understand the different elements involved, including the mechanics of accessing available funds, the importance of responsible management, and the potential benefits and risks associated with it. By gaining insight into these factors, anyone can become better equipped to make informed decisions that align with their financial goals.

Understanding Credit Lines in Canada

When it comes to personal finance management, having access to additional resources can be a game changer for many individuals. This form of borrowing allows for flexibility, giving users the ability to tap into funds as needed without going through a lengthy application process each time. It offers a safety net for unexpected expenses or planned purchases, making financial planning a bit easier.

Essentially, this type of financial product allows individuals to access a predetermined amount of money set by their lender. Users can withdraw any amount up to that limit, which can make budgeting and managing cash flows more straightforward. As repayments are made, the available balance replenishes, providing ongoing access as long as the account remains in good standing.

It’s crucial to recognize the importance of smart usage. While it can be incredibly beneficial, irresponsible handling may lead to unwanted debt. Keeping track of spending and making timely repayments ensures that the experience remains positive. Understanding fees and interest rates associated with this financial option is also key for effective management.

In summary, individuals looking for ways to manage their finances more effectively might find this option to be a valuable tool. By approaching it with caution and awareness, they can enjoy the benefits while avoiding common pitfalls.

Benefits of Utilizing a Flexible Borrowing Resource

Managing finances effectively can be a game-changer, and having access to a flexible borrowing resource offers a range of advantages. This tool provides not only financial relief but also an opportunity for strategic planning. By tapping into this resource, individuals can navigate unexpected expenses or invest in future projects with ease.

One of the primary perks of this facility is the ability to borrow funds as needed, helping to maintain control over spending. Unlike traditional loans, where you receive a lump sum, this option allows for incremental access. You only draw what you require, significantly aiding in financial organization.

Another significant advantage is the potential for lower interest rates compared to alternatives like credit cards. By utilizing this resource wisely, you can minimize the cost of borrowing, making it a smart choice for those who wish to save money over time.

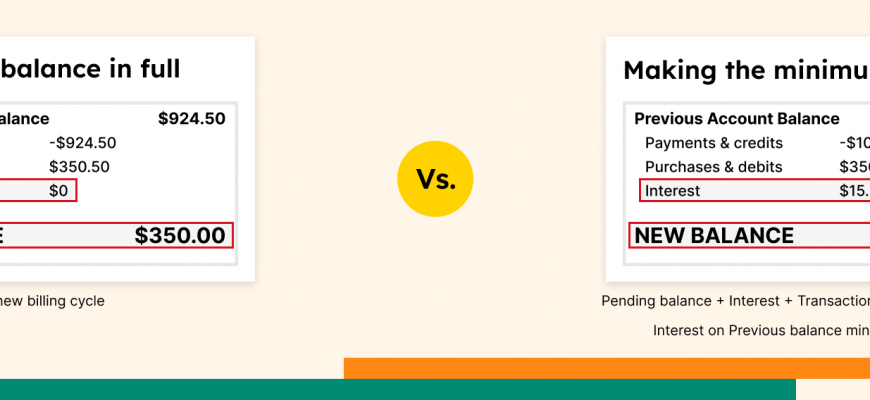

Moreover, flexibility in repayment is a major benefit. You can pay off the amounts you’ve used at your own pace, provided you meet the minimum requirements. This adaptability can be particularly appealing during financially tight months. The opportunity to adjust payment terms helps in maintaining a positive credit profile.

Lastly, this financial tool can enhance your overall creditworthiness. Responsible use and timely repayment can reflect positively on your credit score, opening doors to more favorable borrowing options down the line.

Application Process for Canadian Credit Lines

Getting access to additional financing in Canada is a straightforward journey if you’re aware of the necessary steps. The procedure generally involves several key actions that aim to assess your financial status and creditworthiness. Understanding each stage can help you navigate the process smoothly and increase your chances of approval.

Initially, you’ll need to research various lending institutions and the different types of offers available. Take your time comparing interest rates, fees, and terms to find an option that suits your needs. Once you’ve narrowed down your choices, it’s time to gather the required documentation, which typically includes proof of income, employment details, and identification.

After collecting your paperwork, you’ll submit the application to your chosen lender. This may be done online or in person, depending on the institution’s policies. The lender will review your submission, possibly contacting you for further information or clarification. It’s crucial to respond to any requests quickly to keep the process on track.

Once your application is assessed, you’ll receive a decision. If approved, you’ll be provided with the terms of the agreement, including your borrowing limit and repayment conditions. Make sure you read everything carefully before signing. If the outcome isn’t what you hoped for, don’t be discouraged; sometimes, it’s just a matter of refining your approach or working to improve your financial profile.