Understanding the Mechanisms Behind Credit Karma’s Functionality

When it comes to managing finances, many individuals seek innovative solutions to monitor their financial health. There’s a fascinating service that allows users to track their credit scores and gain insights into their financial standing with ease. This platform strives to demystify many aspects of financial literacy, empowering users to make informed decisions.

Imagine having a resource that not only provides a glimpse into your borrowing potential but also offers personalized advice tailored to your situation. This service aggregates information from various sources, bringing clarity to your financial world. By utilizing advanced algorithms, it presents suggestions that can enhance your financial journey.

As you navigate through your fiscal landscape, this tool encourages you to maintain a proactive approach. Whether you’re aiming to secure a loan or simply wish for a better understanding of your financial habits, users find value in the insights provided. By fostering awareness, it plays a crucial role in helping individuals achieve their financial goals.

Understanding Credit Karma’s Services

In today’s financial landscape, individuals often seek tools to navigate their monetary health. This platform offers resources that empower users to take charge of their financial profiles. By providing insightful guidance, it aims to demystify the complexities of personal finance.

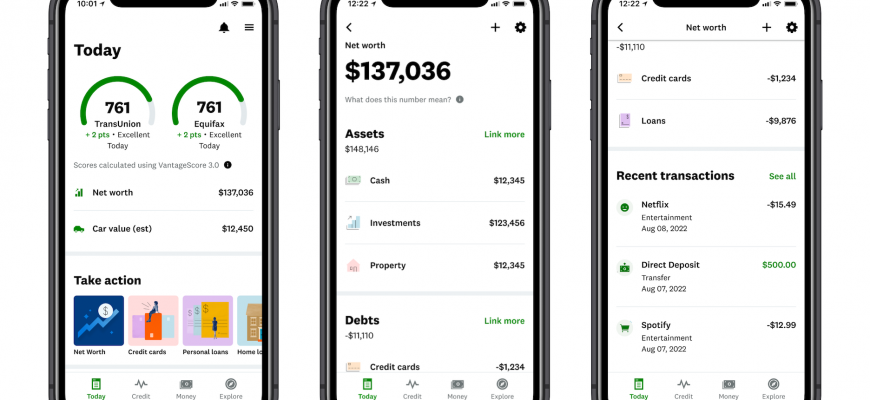

One of the standout features is the access to free credit scores and reports. This enables users to monitor their progress regularly and understand what influences their financial standing. The service breaks down the factors impacting scores, helping people make informed decisions.

Additionally, tailored recommendations for financial products are available. These suggestions are based on individual circumstances, enhancing the likelihood of securing favorable terms. This is particularly useful when searching for loans or credit options that align with specific needs.

Budgeting tools and resources further enhance the experience, assisting users in managing their finances effectively. With these features, individuals can create a clearer picture of their spending habits and set achievable financial goals.

Ultimately, the aim is to equip users with the knowledge and resources necessary to improve their financial situation, promoting a healthier relationship with money over time.

Understanding Score Calculations

When it comes to your financial reputation, there are various factors that come into play, influencing the numbers that reflect your reliability as a borrower. These figures serve as a snapshot of how well you’ve managed your finances over time. The calculation involves several key components that together create a complete picture of your creditworthiness.

Primarily, payment history plays a critical role. Lenders want to see if you’ve been punctual with your payments. A track record of on-time payments boosts your standing significantly, while missed or late payments can have the opposite effect.

The amount you owe is another essential element. This part evaluates your outstanding balances in relation to your total available credit. Keeping your balances low relative to your limits can indicate a responsible approach to managing debt.

Length of credit history also matters. A longer history with varied types of accounts shows lenders your experience in handling credit. Newer accounts might seem risky, as they don’t provide enough information about your behavior over time.

Types of credit accounts contribute as well. A mix of revolving credit, like credit cards, and installment loans, such as mortgages or auto loans, paints a broader picture and demonstrates your ability to manage various obligations.

Lastly, new inquiries can affect your score. When you apply for new loans or credit, it triggers a check that can slightly lower your score temporarily. This is a reflection of how many new debts you’re trying to take on at once.

In summary, the calculation behind these figures is multifaceted, taking into account payment behavior, outstanding balances, history length, account diversity, and new applications. Understanding these components can empower you to take control of your financial journey.

Utilizing Monitoring Features Effectively

Staying informed about your financial status is crucial in today’s fast-paced world. By making the most of tracking tools available, individuals can keep a close eye on their financial health. These functionalities allow users to receive timely updates, spot potential issues, and maintain a vigilant approach toward their economic well-being.

First and foremost, regularly checking your financial reports can reveal important insights. Notifications about changes in your scores or unexpected activities can empower you to take action before problems escalate. Setting up alerts ensures you’re not caught off guard by any alterations in your fiscal landscape.

Moreover, utilizing educational resources provided with your monitoring tools can significantly enhance your understanding of financial principles. Understanding the factors that influence your scores can help you make informed choices. This knowledge aids in building a solid financial future and avoiding pitfalls.

Lastly, reviewing your financial situation periodically is vital. By consistently analyzing your reports, you can identify patterns and trends in your financial behavior. This proactive stance enables you to implement necessary adjustments to achieve your financial objectives effectively.