Understanding the Functionality of Credit Karma Money and Its Benefits for Users

In today’s fast-paced world, keeping track of personal finances can often feel overwhelming. With so many options available, it’s essential to find the right resources that can simplify budgeting and enhance our financial well-being. Various platforms have emerged, offering innovative solutions to streamline financial planning and improve savings strategies.

One such service brings a fresh perspective on managing funds, making everyday transactions easier while providing valuable insights into spending habits. This platform combines useful features that empower users to make informed decisions about their financial futures. By focusing on user-friendly experiences, it aims to bridge the gap between complex financial systems and everyday understanding.

As you delve into this intriguing tool, you’ll find that it not only helps in monitoring expenditures but also encourages smarter financial choices. With a clear focus on transparency and accountability, this service takes a modern approach to traditional money management, ensuring that managing your funds is both effective and accessible.

Understanding Credit Karma Money Features

When it comes to managing your finances, having the right tools at your disposal can make all the difference. This platform offers a variety of functionalities designed to enhance your financial journey. Think of it as having a personal assistant that helps you navigate through your monetary landscape with ease and confidence.

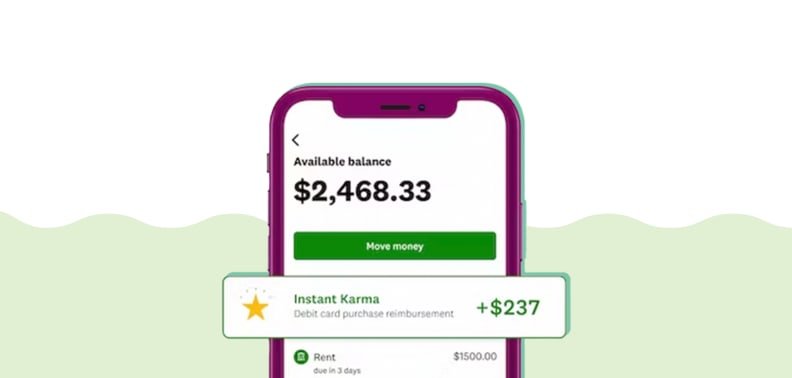

One of the standout attributes is the ability to seamlessly monitor your transactions. This feature promotes better budgeting practices by allowing you to track where your funds are going in real-time. Being aware of your spending habits can empower you to make informed decisions, steering clear of unnecessary expenses.

Furthermore, users can take advantage of a unique offering that provides access to a range of banking services without the usual fees that come with traditional institutions. This not only makes managing your finances more cost-effective but also simplifies the entire process, making it accessible to everyone.

Additionally, you can enjoy a user-friendly interface that encourages engagement and exploration. It’s not just about the features but how they come together to create a comprehensive experience. Everything is designed with the user in mind, ensuring you have all the relevant information at your fingertips whenever you need it.

Ultimately, having these robust features allows individuals to feel more in control of their financial situation. With the right resources, you can turn confusion into clarity and make strides toward achieving your monetary goals.

Benefits of Utilizing Credit Karma’s Financial Tools

Many people are looking for smarter ways to manage their finances and make informed decisions. One of the standout options available in today’s market offers a range of advantages that can enhance your financial well-being. Whether you’re seeking to improve your savings strategy or simply want a better understanding of your financial landscape, this platform provides various tools tailored for users like you.

Convenience is one of the primary perks. You can access essential services in a single place without the hassle of navigating through multiple apps or websites. This all-in-one solution allows for easier tracking of your financial health and progress.

Another significant benefit is zero fees. Many traditional services come with hidden charges, but this option stands apart by providing access to features without costing you a dime. This means you can save more without worrying about unexpected expenses eating into your budget.

The platform also emphasizes transparency. You get clear insights into your financial situation, making it simpler to understand where you stand and what steps to take next. This openness fosters a greater sense of control over your finances.

Furthermore, you gain access to financial education. Numerous resources and tools are available to help you learn about different aspects of managing your finances. This knowledge can empower you to make better decisions moving forward.

Lastly, the interactive nature of the platform enhances user engagement. You’ll find features designed to keep you motivated and informed, encouraging you to stay on top of your financial goals and improve your overall fiscal health.

Getting Started with Financial Management Tools

Taking the plunge into financial resources can be both exciting and overwhelming. Whether you’re looking to manage your funds better or explore new ways to track your financial health, starting with the right tools is essential. The good news is that many platforms offer user-friendly solutions to help you along the way, making it easier to stay on top of your financial goals.

If you’re ready to embark on this journey, the first step is to create an account with a chosen service. This typically involves entering some personal information to ensure a secure setup. Once you’ve established your profile, you’ll gain access to a range of features designed to empower you to understand your financial landscape more clearly.

Taking time to explore the various functionalities is vital. From budgeting features to tracking expenses, these tools can provide insights that allow you to customize your financial strategy. Focusing on setting up alerts and notifications can also be extremely helpful; they keep you informed about your spending habits and upcoming financial commitments.

Seeking out educational resources within the platform can amplify your experience. Whether it’s articles, tips, or FAQs, learning from these materials can deepen your understanding and motivate you to make informed decisions. Connecting with community forums may additionally offer support and advice from others on a similar path.

Don’t forget about continual engagement. Regularly reviewing your financial activities will help you stay aligned with your objectives. As you grow more comfortable utilizing these tools, you’ll likely discover new ways to enhance your financial well-being and overall stability.