Understanding the Methods Credit Karma Uses to Determine Your Income Information

Have you ever wondered about the magic behind personalized financial insights you receive? Many platforms claim to possess detailed information about your financial situation, and this raises intriguing questions. It’s fascinating how technology pulls together various data sources to create a picture of your finances, even if you haven’t shared all the specifics directly.

Additionally, this process isn’t just about gathering numbers; it’s about interpreting them to offer you tailored advice. Through advanced algorithms and strategic partnerships, these platforms gather useful data points to better assess your fiscal landscape. While it may seem like a mystery, there’s a logical method behind the scenes that fuels these assessments.

Getting to the bottom of these evaluations can provide clarity and enhance your understanding of your financial health. By exploring the elements that contribute to these insights, you can make more informed decisions moving forward. After all, staying informed is a key factor in managing your financial future effectively.

Understanding Credit Karma’s Income Calculation

When it comes to evaluating financial health, having a clear grasp of earnings is essential. Many users wonder about the methods employed to assess these financial figures. It’s fascinating how technology can pull together various pieces of information to create a comprehensive picture of one’s fiscal situation.

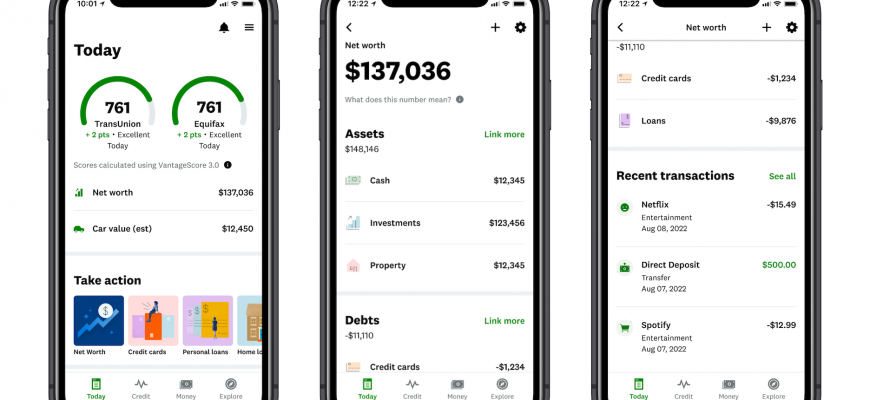

The platform utilizes a blend of user-provided data and external sources to estimate the financial resources of individuals. By analyzing factors such as current employment status, job type, and additional earnings, it builds a reliable overview. This amalgamation helps deliver insights that empower users to make more informed decisions regarding their finances.

Moreover, users can enhance the accuracy of these assessments by directly sharing relevant details. This proactive approach not only sharpens the evaluation but also fosters transparency in the financial journey. Overall, it’s about making sense of numbers and trends to assist individuals in achieving their monetary goals.

Sources of Financial Information Used

When it comes to understanding one’s financial landscape, various resources come into play. These data points help form a clearer picture of an individual’s financial standing and habits. By tapping into different channels, a comprehensive overview is created, enabling informed decisions.

Bank Transactions: Regular banking activity is one of the primary sources of insight. Patterns in deposits and withdrawals reveal much about spending habits and overall financial health. For instance, consistent salary deposits can signal stable earnings.

Employment Records: Details from employers also contribute significantly. Verification of job status and salary information provides a foundation for understanding a person’s earning potential. Many platforms partner with organizations to secure this type of data, ensuring accuracy.

Credit Reports: Credit histories are another crucial component. These documents outline past borrowing and repayment behaviors, offering insight into an individual’s reliability and financial responsibility over time.

Tax Information: Tax returns serve as another vital reference. They reflect a person’s financial activities over a year, often illustrating income levels and deductions that clarify overall fiscal responsibility.

Each source offers a piece of the puzzle, combining to deliver a holistic view of one’s financial picture. By weaving together these various elements, a well-rounded assessment emerges, guiding individuals toward smarter choices.

Ensuring Data Privacy

In today’s digital landscape, safeguarding personal information has become a top priority for many services. Users want to feel secure while sharing sensitive details, and platforms have responded by implementing a range of protective measures. Transparency and reliable protocols play key roles in building trust between the service and its users.

A variety of encryption techniques are employed to protect data from unauthorized access. By encoding information, even if a breach occurs, the stolen data remains unreadable to malicious actors. Additionally, stringent authentication processes help ensure that only verified individuals can access specific accounts, adding another layer of security.

Furthermore, regular audits and assessments help maintain the integrity of data handling practices. These evaluations identify potential vulnerabilities, allowing organizations to adapt and improve their security measures continuously. Communication with users about privacy policies and changes fosters an environment of trust, ensuring everyone is aware of how their data is treated.

Ultimately, a commitment to data protection allows users to engage with services confidently. By prioritizing privacy, platforms can maintain ethical standards and provide a safe environment for all users, ensuring that personal information remains under control and protected.