Understanding the Functioning of Car Loans Offered by Credit Unions

Getting behind the wheel of a new ride can often feel like a daunting experience, especially when it comes to financing options. There are various paths to explore, each with its own set of rules and benefits. Today, we’ll dive into one particular avenue that many people overlook, yet it offers unique advantages for borrowers seeking reasonable terms and personalized service.

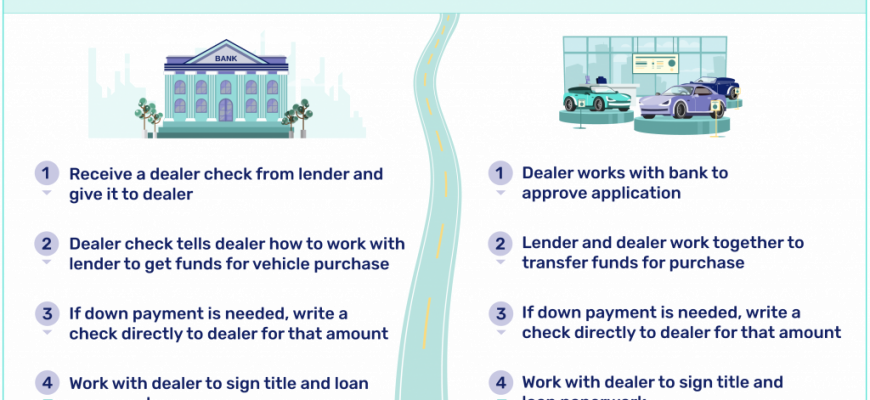

Member-focused organizations provide an alternative to traditional banks, often prioritizing the needs of their users over profit margins. This friendly yet professional environment can make for a smoother experience overall. We’ll explore the mechanics of obtaining funds for your vehicle purchase, highlighting the steps involved and what you might expect along the way.

Particularly, these institutions often present attractive interest rates and flexible repayment options, which can ease the financial burden of acquiring a new set of wheels. Understanding the ins and outs of this process is essential, as it enables you to make informed decisions that align with your financial goals.

Understanding Financing Options

When you’re looking to secure funds for a vehicle, exploring various options available from member-focused financial institutions can be quite beneficial. These choices often come with unique advantages tailored to the needs of individuals, making them an appealing alternative to traditional lenders. By diving into the specifics, you can make informed decisions that align with your financial goals.

One key aspect to consider is the competitive interest rates frequently offered, which can significantly reduce the overall cost of borrowing. Additionally, flexible repayment terms are often available, allowing borrowers to choose a plan that fits comfortably within their budget. Personalized service from staff who genuinely care about your needs can further enhance the experience, providing peace of mind as you navigate the financing process.

Another point worth noting is the potential for streamlined application procedures. Many individuals find the requirements to be less stringent compared to other lending sources, which can make securing funding smoother and quicker. This approach not only helps expedite your purchase but also fosters a sense of community engagement.

Ultimately, understanding your financing choices can empower you to make a choice that suits your lifestyle. Taking the time to explore these member-oriented solutions might just lead you to financial options that make your vehicle ownership journey even more rewarding.

The Benefits of Choosing a Credit Institution

If you’re in the market for financial solutions, considering a member-focused alternative can be a game changer. These organizations often emphasize personalized service, community involvement, and competitive offerings that can make your borrowing experience more enjoyable and affordable.

Lower Interest Rates: One of the standout advantages is often more attractive interest rates compared to traditional banking systems. Since they operate as non-profit entities, they can pass savings directly onto their members, making loans more budget-friendly.

Personalized Service: Another perk is the individualized attention you receive. When you walk through the doors, you’re not just another number. Staff members typically take the time to understand your unique situation and help tailor financial products to suit your needs.

Community Focus: These financial establishments are deeply rooted in the communities they serve. They often invest in local initiatives and support charitable causes, allowing you to feel good about where your money is going.

Flexible Terms: You’ll find that terms can be more adaptable. Member-driven organizations are often willing to work with you to create a repayment plan that fits your lifestyle and budget, so you won’t feel overwhelmed.

Choosing a member-oriented institution can offer a blend of benefits you might not find elsewhere, giving you peace of mind while navigating your financial journey.

Steps to Apply for an Auto Financing Option

Entering the world of auto financing can be straightforward if you follow a few essential steps. It’s all about being prepared and knowing what to expect during the application process. This journey typically starts with understanding your needs and capabilities.

1. Assess Your Budget

Before diving into any agreements, it’s crucial to evaluate your finances. Determine how much you can comfortably spend each month without straining your budget. This includes considering other expenses that might arise.

2. Research Options

Once you know your budget, it’s time to explore different opportunities available to you. Investigate various institutions and their offers to find competitive rates and favorable terms that suit your needs.

3. Gather Necessary Documents

Prepare all essential paperwork for your application. Typical documents include proof of income, identification, and residence verification. Having everything organized will streamline the process.

4. Submit Your Application

Next, you’ll fill out the application. This can often be done online, making it convenient. Be honest with the provided information, as inaccuracies can delay your approval.

5. Await Approval

After submission, there might be a waiting period while your request is processed. Use this time to research potential vehicles and finalize your choices, so you’re ready to go once you’re approved.

6. Review Terms Carefully

If approved, carefully review the terms of the agreement. Ensure you understand all aspects, including interest rates and repayment schedules, before signing anything. It’s essential to fully grasp what you’re committing to.

7. Finalize the Deal

After you’re satisfied with the terms, it’s time to finalize everything. Once signed, you’ll receive the necessary funds or financing directly to purchase your vehicle.

Following these steps can greatly simplify your journey towards securing the right financing solution for your next vehicle!