Understanding the Factors That Lead to a Decrease in Your Credit Score

It’s no secret that maintaining a solid financial reputation is crucial for navigating the world of loans and mortgages. Everyone strives to keep that reputation in tip-top shape, but what happens when it starts to dip? Several factors can contribute to a less-than-stellar image, and it’s essential to be aware of them.

Some individuals might find themselves baffled when they notice a change in their standing. Life events, spending habits, and payment patterns play a significant role in shaping one’s financial identity. Understanding these dynamics can empower you to take charge and make informed decisions that can positively influence your situation.

In this exploration, we’ll delve into the various elements that can lead to a decrease in your worthiness from a lender’s perspective. By identifying these aspects, you’re one step closer to regaining and maintaining a robust financial standing for the future.

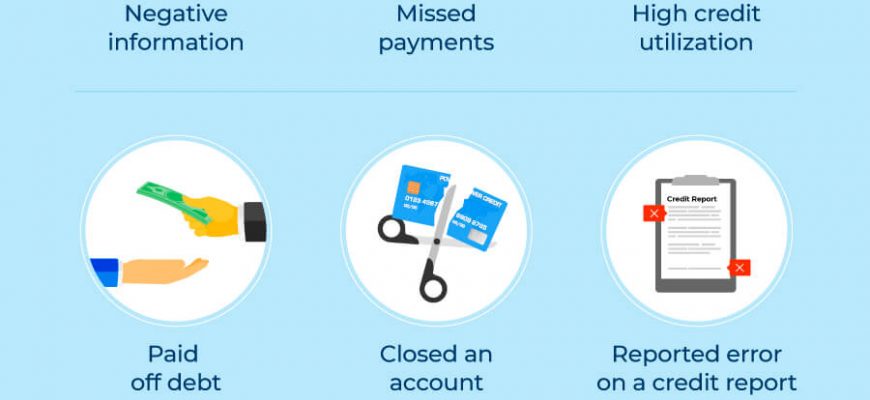

Factors Contributing to Score Decline

There are multiple elements that can negatively impact your financial profile. Understanding these influences is essential for maintaining a healthy standing in the financial landscape. When certain behaviors or situations arise, they can lead to a reduction in your overall rating, affecting future borrowing potential.

Payment history plays a crucial role in this scenario. Missing payments or making late contributions can drastically alter your standing. It indicates to lenders that you may not manage your obligations effectively, which raises concerns about reliability.

Next is the amount of debt you carry. If you have high balances on your revolving accounts, like credit cards, it can signal financial strain. Keeping an eye on your debt-to-limit ratio is important, as exceeding certain thresholds can trigger alarm bells.

Another notable factor is length of credit history. If you close older accounts or fail to establish new ones, it could shorten your record, which lenders often view unfavorably. This is particularly true if you lack a diverse array of accounts over time.

New inquiries into your financial profile can also lead to deterioration. Each time a lender accesses your report for evaluation, it generates a hard inquiry. Too many of these in a short period can create a negative impression, suggesting you may be experiencing financial distress or taking on more debt than you can handle.

Finally, be mindful of public records. Bankruptcy, liens, or judgments can leave a lasting mark and seriously undermine your financial evaluation. Taking proactive measures to avoid such situations is key to preserving a sound rating.

Impact of Late Payments on Credit

Missing payment deadlines can have significant consequences on your financial health. When obligations aren’t met on time, it signals risk to lenders and can lead to a ripple effect that alters your overall financial reputation. This section delves into the nuances of how overdue payments influence financial standing.

Each time a payment is late, it can appear on your financial history, causing potential lenders to hesitate. They often view these delays as a sign of trouble, which can lead to higher interest rates or even a denial of future credit applications. The longer the delay persists, the greater the negative implications, impacting not just your current relationships with lenders, but future opportunities as well.

Furthermore, the severity of the effect hinges on how late the payment is. A payment just a few days overdue may not have as harsh an impact as one that’s weeks or months late. Each passing month amplifies the concern that creditors may have about your ability to manage debts effectively.

Staying on top of payment deadlines is essential. Setting reminders or automating payments can help maintain a positive track record, influencing how lenders perceive your financial stability. The importance of consistency cannot be overstated when navigating the world of finance.

Impact of Elevated Borrowing Ratios on Ratings

Having a high level of outstanding debt relative to available limits can lead to significant consequences for your overall financial health. When you utilize a large portion of your available borrowing power, it can raise red flags for lenders and leave you with a less favorable standing in their eyes. Understanding this concept is essential for anyone looking to maintain a solid reputation in the financial world.

When the balance on your accounts approaches or exceeds the limits set by lenders, it signals to credit agencies that you may be overextending yourself. This perception can lower your attractiveness to potential creditors, leading them to question your ability to manage your financial obligations responsibly. Consequently, a consistent pattern of high usage can seriously diminish your standing.

It’s important to remember that maintaining a low usage ratio is often recommended for optimal standing. Aim to keep your balances well below the limits provided by your lenders. By doing so, you can send a positive message about your financial habits, enhancing your appeal to institutions and creating a path towards improved financial opportunities.