Understanding the Impact of Credit Inquiries on Your Credit Score

Understanding the intricacies of your financial reputation can be quite a journey. Many factors come into play when it comes to determining how trustworthy you appear to lenders. One notable aspect revolves around the investigations performed by lenders when you apply for credit. These actions can create ripples in your financial profile, sometimes leading to more questions than answers.

Often, individuals may not fully grasp how these assessments influence their overall standing in the eyes of financial institutions. It’s essential to recognize that each inquiry can carry weight, ultimately shaping perceptions about your reliability. Therefore, it’s crucial to be aware of the nuances surrounding these evaluations and their implications.

Additionally, knowing when and how these checks occur will empower you to manage your financial image better. Achieving a solid understanding can pave the way for better financial decisions in the future, ensuring you maintain a favorable status in an ever-competitive lending landscape.

Understanding Credit Pulls and Scores

When you engage with financial institutions for loans or credit options, certain processes come into play that can influence your overall financial profile. This segment aims to shed light on these evaluations and their implications for your financial health.

The practice often involves assessing your financial history, which can lead to various outcomes. Each time an inquiry is made into your financial background, it can lead to shifts in the metrics that represent your reliability as a borrower.

There are two main types of inquiries: the ones that occur due to your own applications for new lines of credit and those that happen as part of regular checks by lenders or service providers. Understanding the difference between these two can be key in managing your financial reputation effectively.

Frequent assessments might create a perception of risk, potentially leading to reduced points in your overall evaluation. Meanwhile, less common inquiries generally have minimal impact, suggesting stability in your borrowing behavior.

Keeping tabs on these evaluations is essential for anyone looking to maintain or improve their financial standing. By knowing how different types of checks can influence your overall metrics, you can make informed decisions that work in your favor.

Types of Credit Inquiries Explained

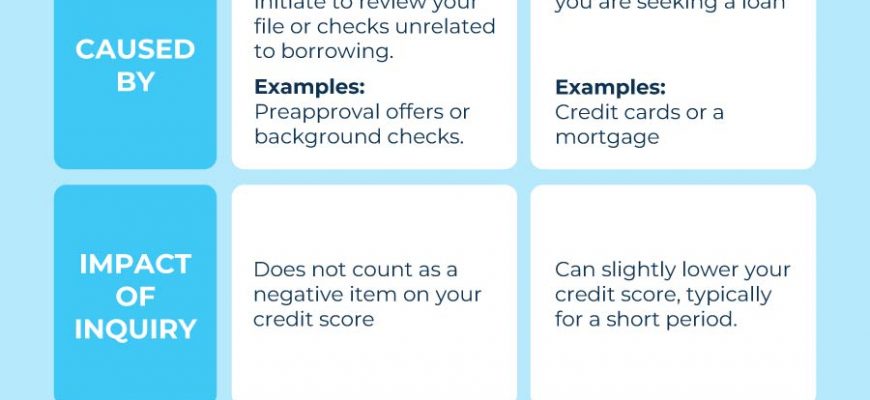

When it comes to understanding how various requests for financial information influence your financial reputation, it’s crucial to recognize that not all inquiries are created equal. In this section, we will break down the distinct categories of these requests and their unique impacts on your profile. Knowing the difference can empower you to make informed choices moving forward.

Hard Inquiries are typically associated with applying for new lines of credit, such as loans or credit cards. When a lender reviews your financial history for approval, it counts as a hard inquiry. This type may have an immediate, albeit small, effect on your overall rating, reflecting the increased risk that comes with seeking additional financial resources. However, don’t panic; they usually diminish in significance over time.

Soft Inquiries, on the other hand, often occur when you check your own financial status or when a company evaluates your profile for pre-approval offers. These do not impose any burden on your rating, allowing you to keep tabs on your financial health without the worry of repercussions. So, whether you’re casually reviewing your own reports or considering offers, soft inquiries remain harmless.

Understanding these distinctions provides a clearer picture of how financial institutions gauge your reliability. By navigating the world of inquiries wisely, you can enhance your financial journey and maintain a solid standing in the eyes of lenders.

Impact of Hard Versus Soft Inquiries

When you’re exploring the world of credit, understanding the nuances between different types of inquiries is essential. Some assessments can have significant repercussions on your financial reputation, while others are relatively harmless. Let’s break down the differences and their implications.

- Hard Inquiries:

- Triggered when a lender assesses your financial history to make a lending decision.

- Typically occurs when you apply for loans, mortgages, or credit cards.

- Can lead to a temporary decline in your financial rating.

- Usually, noticeable for up to a year but linger on reports for up to two years.

- Soft Inquiries:

- Happen when you check your own financial standing or when a company does so for promotional reasons.

- Do not impact your financial reputation at all.

- Often used for background checks or pre-approval processes.

- Can be done without your permission and remain completely invisible to potential lenders.

Being aware of these distinctions can guide your credit-related decisions. Keeping an eye on how many hard inquiries you accrue is wise, especially if you’re planning any large financial moves soon. In contrast, utilizing soft inquiries can offer insights and peace of mind without any negative effects.

Strategies to Minimize Score Damage

When considering new financial opportunities, many become concerned about potential repercussions on their overall standing. While some factors are unavoidable, there are effective techniques to help safeguard your rating from unnecessary hits. By being mindful in your approach, you can pursue your goals without compromising your financial health.

Consolidate Your Applications – Instead of randomly applying for multiple loans or services, try to consolidate your requests. Aim to submit them within a short timeframe. Many scoring systems recognize this tactic and will treat several inquiries as a single request, reducing the overall impact.

Regular Review of Your Reports – Keep an eye on your financial documents. Regular checks can help you spot any inaccuracies or errors. If you notice any discrepancies, take action promptly. A clean report is crucial for maintaining a positive image.

Maintain Existing Accounts – Length of credit history plays a significant role in determining your standing. Instead of closing old accounts, keep them active even if you no longer use them regularly. This contributes positively to the duration factor in your overall assessment.

Limit New Accounts – Adding multiple new accounts within a short period can raise eyebrows. Instead, focus on essential applications and avoid unnecessary ones. Quality over quantity can help in preserving your favorable position.

Build Positive Relationships – Regular and timely payments on existing obligations can significantly counterbalance the effects of new inquiries. Consistency in payments showcases reliability and helps bolster your reputation.

Taking deliberate and informed steps can lead to better outcomes. By adopting a strategic mindset, you can navigate the financial landscape while minimizing any potential drawbacks. Remember, maintaining a healthy financial image requires a blend of caution and informed decision-making.