Understanding the Functionality of Credit Limits and Their Impact on Personal Finance

When it comes to managing your finances, it’s essential to grasp the concept that defines how much you can spend before hitting a threshold set by lenders. This notion not only influences your purchasing power but also impacts your overall financial health. It’s like having a safety net: it gives you the freedom to make necessary purchases while ensuring you don’t overspend.

Many people find themselves navigating through these financial parameters, often guided by various factors that determine their spending capacity. These factors can include your history of repayment, income level, and even your general relationship with financial institutions. Each of these elements plays a role in establishing what you can access in terms of borrowed resources.

Being aware of these boundaries helps in making informed decisions about expenditures and planning future budgets. It’s not just about having access to funds; it’s about understanding the implications of using them wisely. Balancing your desires with fiscal responsibility can ultimately lead to a more stable and prosperous financial future.

Understanding Credit Limits Explained

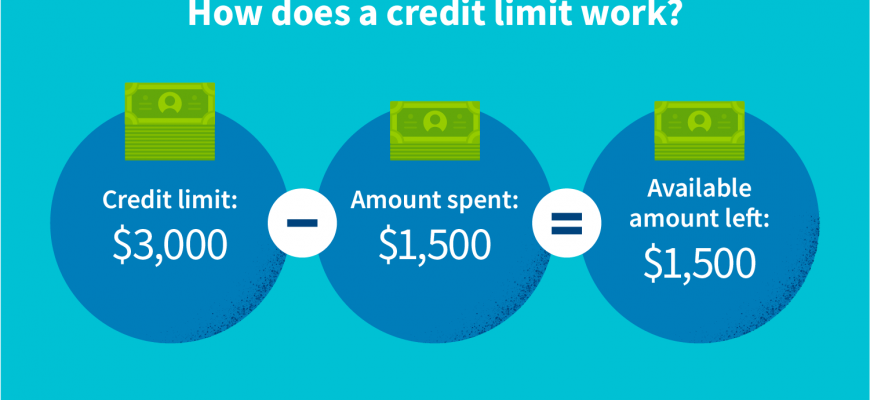

When it comes to managing finances, there’s a concept that plays a pivotal role in shaping one’s purchasing power. It essentially reflects the maximum amount available for transactions, impacting how individuals approach their spending habits and financial planning. Let’s dive into what this means for your financial journey.

These predefined thresholds are often determined by several factors, including income, credit history, and payment behavior. This figure acts as a guideline, ensuring responsible usage while also offering flexibility in times of need. Having this framework in place can influence a person’s ability to navigate expenses, whether they are everyday purchases or larger investments.

Staying within these boundaries can lead to a healthier financial standing, as it encourages individuals to think critically about their expenditures. Moreover, exceeding this threshold may result in penalties or additional charges, which is why keeping track is crucial. By understanding the nuances surrounding these monetary constraints, individuals can cultivate a more organized and successful financial approach.

Overall, grasping how these figures influence financial activities can empower someone to make informed choices, ultimately leading to improved financial well-being.

Factors Influencing Your Credit Limit

Your available borrowing capacity is shaped by several key elements that lenders consider when determining your potential. These factors reflect your financial behavior, reliability, and overall risk profile, ultimately impacting the amount they’re willing to extend to you.

One major aspect is your payment history. Consistently meeting your obligations on time signals to lenders that you are responsible with your finances. The more positive your track record, the higher the chances of receiving favorable terms.

Additionally, your income plays a crucial role. A stable and sufficient revenue stream reassures lenders about your ability to repay any borrowed amounts. Higher earnings often lead to greater access to funds, as they perceive you as less of a risk.

Your overall credit profile is also taken into account. This includes factors such as the total debt you already possess and the duration of your credit history. A balanced approach to managing existing financial commitments can enhance your standing.

Lastly, the type of account being requested can influence the decision. Different products come with varying levels of exposure, and lenders adjust their offers accordingly. Understanding these elements can help you navigate your financial journey effectively.

Impacts of Exceeding Your Limit

Going beyond your established spending threshold can lead to a series of challenges that affect your financial standing. While it may seem tempting to make that larger purchase, the consequences can be far-reaching, impacting not just your immediate finances but also your overall financial health.

One of the first things you might notice is a dip in your creditworthiness. When you exceed your authorized spending, it can signal to lenders that you are struggling with managing your expenses. This can lead to lower scores and ultimately narrower options for borrowing in the future.

Additionally, many financial institutions impose hefty fees whenever you go over your set boundary. These charges can add up quickly, creating a cycle of debt that’s hard to escape. Over time, these unexpected costs can add unnecessary strain on your budget.

Moreover, overspending can lead to restricted access to available funds. Many people find themselves in a tight spot when they unexpectedly run out of resources for essential expenses. This makes it crucial to stay within your thresholds to maintain financial stability.

Overshooting your allocation also can create stress and anxiety. Constantly worrying about finances or facing potential penalties can take a toll on your mental well-being. It’s important to consider both the immediate and long-term effects of exceeding your boundaries to help maintain a healthy financial lifestyle.