Understanding the Mechanics of a Credit Freeze and Its Benefits

In an age where personal data has become a valuable asset, safeguarding it is more important than ever. Many people are seeking ways to protect their financial histories from unauthorized access. This involves taking proactive measures to limit who can see information that could be exploited. It’s all about creating a barrier to enhance your security and peace of mind.

When an individual opts for this protective action, they initiate a process that essentially blocks potential creditors from accessing sensitive information. This is particularly crucial in instances where identity theft is a concern, as it helps to prevent fraud before it occurs. By taking control in this manner, individuals can keep an extra layer of security around their financial profile.

Understanding the ins and outs of this process is vital for anyone looking to maintain their financial well-being. From the initial steps to the implications of activating such a measure, there’s much to explore. Delving into the details reveals how straightforward it can be to secure your financial landscape, ensuring you remain in charge of your information.

Understanding the Basics of Credit Freezes

When it comes to safeguarding your financial identity, it’s important to know the tools at your disposal. One of the most effective measures in this realm is the action of restricting access to your financial profile. This can help create a barrier against potential fraudsters who may attempt to misuse your information.

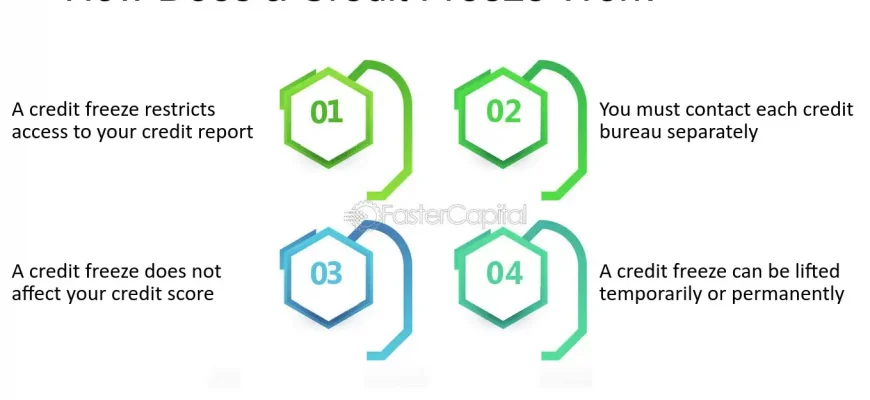

Essentially, implementing this strategy ensures that lenders cannot view your financial history, making it difficult for anyone to open new accounts in your name. This protection is particularly valuable if you’ve experienced a data breach or other privacy concerns. The process is relatively straightforward and can be executed with ease through major reporting agencies.

Beyond the short-term benefits, understanding this mechanism can empower you to take greater control over your finances. It’s one step in a broader approach to ensuring your personal information remains safe, allowing you to breathe a little easier in an often unpredictable digital landscape.

Impacts of Freezing Your Credit

When you choose to restrict access to your financial history, it can bring about several significant effects in your everyday life. This action, often recommended for those concerned about identity theft, isn’t without its trade-offs. While it offers a layer of protection, understanding its implications is essential before making this decision.

One immediate consequence is the difficulty it creates for lenders when you apply for loans or new accounts. Since they cannot access your information, you may face delays, or even rejections, when trying to secure financing. This can be frustrating, especially if you’re in the midst of important transactions like buying a home or a car.

Moreover, the process of lifting these restrictions can be time-consuming. Whenever you decide to make a new financial move, you’ll need to ensure that the necessary permissions are in place, which may involve using PINs or passwords. This additional step can be cumbersome for those who aren’t prepared.

Additionally, it’s worth noting that existing accounts are not affected. You won’t lose access to your current credit lines, but any new credit applications could require extra effort. Understanding these nuances will help you make informed decisions about your financial security.

Steps to Initiate a Credit Freeze

Starting the process to secure your financial identity is simpler than you might think. By taking a few straightforward actions, you can significantly enhance your protection against potential threats. Here’s a clear guide on how to get things rolling and ensure your personal information remains safe.

First, gather all necessary documents to confirm your identity. This typically includes government-issued identification, social security number, and proof of residence. It’s essential to have these handy, as they will be required during the application process.

Next, reach out to the major reporting agencies. You’ll need to contact each one individually since they don’t share information with one another. This means visiting their websites or calling them directly. Each agency has its own procedure, so it’s helpful to follow their instructions closely.

After making contact, you’ll fill out a request form. This can usually be done online, via phone, or through the mail. Ensure that all information provided is accurate to avoid any delays. Once you submit your request, a pin or password will be generated. Keep this information secure, as it’ll be crucial for future changes.

Once your request is processed, you’ll receive confirmation that your information is now secured. Take a moment to review everything to ensure that the process is complete and correct. If you wish, you can also set reminders for future reference in case you need to temporarily lift the restriction.