Understanding the Mechanics Behind Credit Card Payments

Ever wondered what happens in the background when you make a seamless exchange at the store or online? It’s truly fascinating how technology has interconnected various elements to ensure a smooth experience. When you finalize your purchase, a series of complex processes kick in, all aimed at getting that item in your hands while keeping everything secure.

At the heart of this operation lies an intricate network of financial institutions and digital systems. Each player in this drama has a unique role, collaborating to confirm the transaction without you even batting an eye. From the moment you present your method of exchange to the final approval, a world of data is crunched to ensure that everything aligns perfectly.

Understanding this intricate dance not only demystifies the process but also highlights the advances in technology that make modern-day transactions quick and efficient. Whether you’re shopping at your favorite local boutique or ordering that must-have gadget from an online retailer, knowing how these systems function can enhance your appreciation of each purchase.

Understanding the Credit Card Payment Process

When you make a transaction using a plastic money option, a series of actions take place behind the scenes to ensure everything runs smoothly. This intricate process involves multiple parties working together to facilitate the transfer of funds from your account to the merchant’s. Let’s break it down in a straightforward manner.

Initially, your financial institution and the vendor’s service provider come into play. Once you present your plastic for a purchase, the transaction details are sent through a secure network for verification. This is when your bank assesses whether you possess enough balance to complete the purchase.

If approved, the needed amount is reserved, allowing you to finalize your purchase. This quick exchange of information keeps your transaction safe while ensuring that the merchant receives assurance about the impending deposit. Afterward, all parties settle their accounts, completing the entire cycle seamlessly.

In essence, every time you swipe, tap, or input your details online, a rapid yet sophisticated system springs into action, enabling convenient and reliable transactions that we often take for granted.

Key Components of Transactions

When it comes to making a purchase using a plastic piece of financial magic, several essential elements come into play. Each part plays a significant role in ensuring that the process is smooth and secure, allowing consumers to complete their buying experience without a hitch.

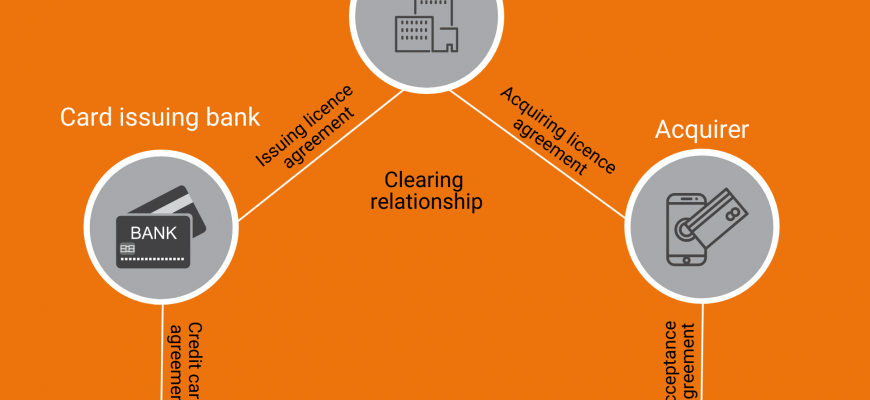

First up, we have the consumer, who initiates the whole process by providing their details for the transaction. Then, there’s the merchant, the business or individual who offers goods or services. This pairing is crucial, as it sets the stage for the exchange. Next, intermediaries like banks and payment processors step in to facilitate communication between the two parties, ensuring that funds are authorized and moved appropriately.

Security measures are paramount in this ecosystem. Encryption technologies protect sensitive information, making sure that it stays safe during transmission. Additionally, verification processes help confirm that the information provided is valid and genuine, further enhancing trust in the transaction.

Lastly, after everything has been approved, the funds change hands, and the transaction is completed. All these components work in harmony to create a seamless experience, demonstrating the complexity and ingenuity behind what may seem like a simple swipe or tap.

Benefits and Risks of Using Credit Cards

When it comes to managing finances, using plastic for transactions can be a double-edged sword. On one hand, there are considerable advantages that make it appealing for everyday purchases, while on the other, potential pitfalls can lead to financial strain if not approached wisely.

One significant advantage is the convenience it offers. Swiping a card is often much quicker than fumbling with cash or checks. Additionally, many people appreciate the rewards programs that provide cashback, points, or travel miles for every dollar spent. Furthermore, having access to a line of credit can help during emergencies, allowing individuals to cover unexpected expenses without immediate financial distress.

However, there are notable dangers that come along with this ease of use. Overspending is a common issue since the tangible feeling of cash does not accompany merely pushing a button. The potential for accumulating debt is heightened, especially when minimum monthly payments become a norm. Additionally, poor management can lead to escalating interest rates and fees, making it harder to regain financial stability.

It’s crucial to weigh these pros and cons thoughtfully. Being informed and responsible in handling such plastic can enhance the experience while minimizing risks associated with mishandling finances.