Understanding the Functioning of Credit Bureaus and Their Impact on Financial Health

Have you ever wondered about the systems that evaluate individual financial behavior? These organizations play a critical role in the economy, serving as intermediaries that gather and analyze information related to personal financial transactions. They serve as repositories of data that influence lending decisions and impact the financial well-being of countless individuals.

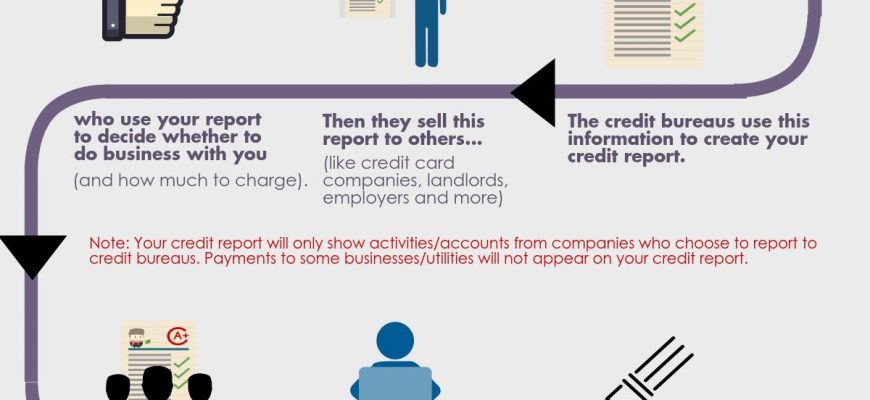

At their core, these entities collect information from various sources, including banks, credit card companies, and other financial institutions. They compile this data into comprehensive reports that reflect an individual’s financial reliability. By doing so, they create a profile that lenders can reference when deciding whether to extend credit or other financial services.

But what exactly happens behind the scenes? It’s more than just collecting numbers; there’s a complex process of assessing risk and determining how reliable an individual is based on their past interactions with credit providers. Understanding this process can empower you as a consumer, enabling you to make informed financial decisions and manage your personal ratings effectively.

Understanding the Role of Credit Bureaus

When we talk about financial life, there’s this important entity that gathers and shares information about people’s borrowing habits. Think of it as a giant library of your financial behaviors, where each individual has a unique record. This data helps different organizations make informed decisions about lending and creditworthiness. Without it, the process of obtaining loans or credit would be a lot more chaotic.

These agencies collect details from various institutions such as banks and lenders, focusing on factors like your payment history, amounts owed, and length of credit history. By analyzing this information, they create a score that reflects how likely you are to repay borrowed funds. It’s almost like an adult report card but for your financial responsibilities! This score influences everything from loan approvals to interest rates.

Additionally, the insights provided by these entities aid consumers in maintaining their financial health. By regularly checking your file, you can spot any inaccuracies or potential identity theft issues early on. Engaging with your information not only empowers you but also encourages responsible financial behavior. It’s all about understanding your position in the wide world of finance and taking control of your economic destiny.

Understanding Score Evaluations

Calculating a financial score involves several key factors that reflect an individual’s borrowing behavior and payment history. This measurement provides insight into a person’s reliability when it comes to handling debts and financial responsibilities.

Primarily, payment history plays a significant role. Timely payments on loans and bills help build a positive track record, while missed or late payments can negatively impact the overall assessment. The remaining balance owed on existing debts also contributes to the evaluation. Keeping outstanding balances low in relation to available credit demonstrates prudent financial management.

Length of credit history is another influential element. A longer track record can enhance one’s standing, showing lenders that the individual has experience managing various types of accounts. Additionally, the mix of different account types, such as revolving and installment accounts, can further refine the score, as variety showcases the ability to handle diverse financial situations.

Lastly, each time someone applies for new borrowing, a credit inquiry is generated, which can slightly affect the score. So, being strategic about seeking new credit opportunities is also key. All these components come together to create a comprehensive view of an individual’s financial behavior, ultimately shaping their overall financial reputation.

The Impact of Credit Reports on Borrowing