Exploring the Essential Criteria for Qualification in Student Financial Aid Programs

Embarking on the journey of higher education often comes with a hefty price tag, making it essential to explore available support options. Navigating the maze of assistance can be both overwhelming and rewarding. Understanding the criteria and necessary steps can pave the way for numerous opportunities, allowing dreams to flourish without the burden of excessive costs.

Various factors influence eligibility, ranging from personal circumstances to academic achievements. Potential recipients should be prepared to gather essential documents and information to assess their standing. It’s all about ensuring that individuals meet the necessary benchmarks, while also highlighting their unique backgrounds and aspirations.

Ultimately, the pursuit of funding is about more than just numbers; it’s a chance to invest in one’s future. The path may require research and diligence, but the end goal of easing educational expenses is surely worth every effort. With the right approach, the doors to financial support can swing wide open, paving the way for a brighter tomorrow.

Understanding Financial Aid Eligibility Criteria

Navigating the landscape of support options can be quite a journey. Various factors come into play when determining access to assistance designed to help with educational expenses. Grasping these elements is essential in order to make informed decisions about securing the necessary resources for academic endeavors.

Income levels often serve as one of the primary benchmarks in this process. Families with lower earnings typically have greater opportunities to receive help. Additionally, the number of dependents in a household can influence outcomes significantly, affecting the overall financial picture.

Residency status may also play a crucial role. Certain types of support are reserved for individuals who maintain specific residency qualifications. Moreover, academic performance and enrollment status can determine eligibility, emphasizing the importance of maintaining a strong scholastic record and attending classes on a full-time basis.

It is beneficial to consider any special circumstances as well. Factors like being a veteran, having a disability, or being a single parent can open doors to additional resources. Thus, understanding individual situations can pave the way for opportunities that might otherwise go unnoticed.

Ultimately, awareness of these criteria is key to unlocking potential support avenues. Diligent research and preparation can lead to enhanced accessibility to the necessary funds aimed at fostering educational success.

Steps to Apply for Assistance

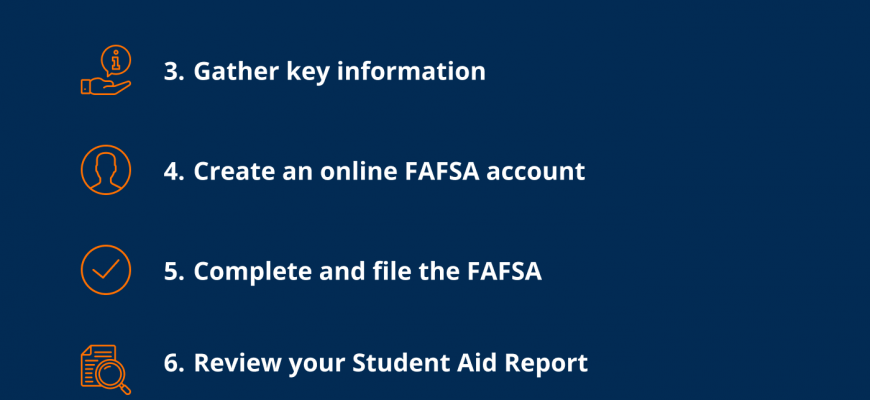

Embarking on the journey towards obtaining financial support for education involves several important actions. Each step lays the groundwork to ensure that necessary resources are accessible for those who need them. Here’s a straightforward guide to navigate the process effectively and smoothly.

First, gathering essential documents is crucial. This includes personal identification, income statements, and any pertinent financial records. Having everything organized helps streamline the application process significantly.

Next, completing the relevant application forms is imperative. Many educational institutions utilize standardized forms that capture detailed information regarding one’s financial situation. It’s vital to provide accurate and honest data to avoid complications later.

After submitting the applications, it’s advisable to keep an eye on deadlines and follow up with the responsible financial offices. Staying proactive ensures that all submitted information is being processed and that no queries remain unaddressed.

Finally, understanding the various types of assistance available is beneficial. Scholarships, grants, and loans come with distinct eligibility criteria and terms. Exploring these options can empower individuals to make informed decisions regarding their educational funding.

Common Types of Financial Support Available

When it comes to funding education, a variety of options exist to assist learners in covering expenses. These resources can come in multiple forms, each offering unique benefits and requirements. Understanding these different types can greatly enhance an individual’s ability to manage education costs effectively.

Scholarships stand out as a popular choice, often awarded based on merit or specific criteria such as academic achievements, talents, or backgrounds. These are typically funds that do not need to be paid back, making them an attractive option for many seeking support.

Grants represent another avenue, usually provided by governments or institutions. Similar to scholarships, grants often depend on particular circumstances, often related to financial need. Receiving a grant can alleviate a significant portion of educational expenses without the burden of repayment.

Loans might come into play for those in need of additional funding. Unlike scholarships or grants, these require repayment post-graduation, often with interest. However, they can serve as a necessary resource to cover gaps that other forms of assistance might not fully address.

Part-time employment opportunities also present a viable solution. Flexible work arrangements allow individuals to earn income while pursuing their studies. Many institutions offer on-campus jobs, creating an environment where work and education can coexist harmoniously.

Understanding these various forms of support can empower learners to navigate their financial landscapes more successfully, ensuring they have the means to pursue their educational goals without undue stress.