Understanding the Requirements for Qualifying for Financial Aid in Colorado

Understanding the landscape of assistance programs available to individuals can be quite a journey. Whether a student pursuing higher education or someone looking to enhance their skills, various options exist to ease the burden of costs. It’s essential to explore pathways that make education and training more accessible to everyone.

Many individuals often wonder about the necessary steps to unlock these resources. Factors come into play, including personal background, household income, and specific documentation requirements. Each program typically has its own set of guidelines that applicants must adhere to in order to receive the desired support.

Gathering relevant information is vital in this process. By diving into the specifics, one can discover potential opportunities that align with personal circumstances. Understanding what is expected can lead to a smoother application process and, ultimately, a more successful experience in obtaining the assistance needed to thrive.

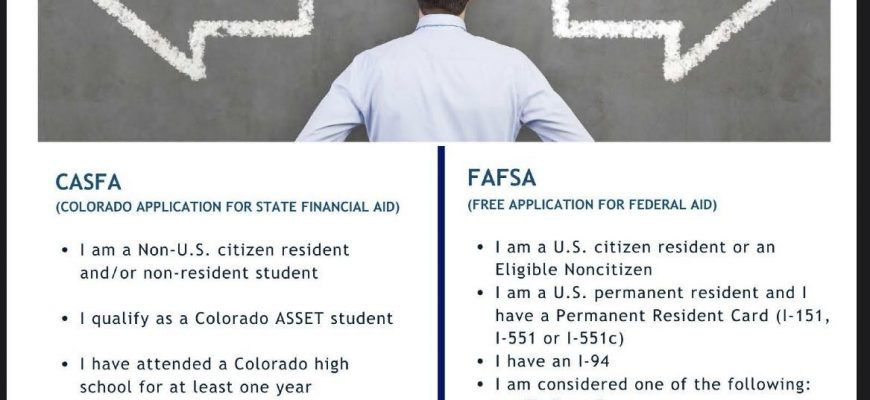

Understanding Financial Aid Eligibility Criteria

When it comes to accessing assistance for education-related expenses, it’s essential to grasp the different factors that determine one’s readiness to receive support. This process can feel overwhelming, but by breaking it down, individuals can better navigate the requirements and find the resources available to them. A combination of academic performance, financial circumstances, and personal background all play a crucial role in this journey.

The evaluation usually involves assessing financial needs, taking into account the income and assets of both students and their families. Academic success is also part of the equation, as many programs set minimum grade requirements to ensure recipients can thrive in their studies. Additionally, specific demographic criteria, such as residency, may influence eligibility, as some programs are tailored for local residents.

Moreover, different types of assistance programs exist, each with unique stipulations. Scholarships, grants, and loans all have their own requirements, ensuring that various needs can be met. Understanding these differences can empower individuals to make informed choices about which options may be most suitable for their situations.

In summary, being aware of the criteria that influence access to educational support can facilitate a smoother process for those seeking help. Knowledge is key, as it allows potential applicants to proactively align their applications with the standards set by various programs and increase their chances of receiving the necessary resources for their academic pursuits.

Steps to Apply for Assistance in Colorado

Embarking on the journey to secure support can be a straightforward process if approached systematically. This section outlines essential steps to navigate the application process effectively.

-

Gather necessary documentation. Be prepared to compile a variety of materials, such as:

- Tax returns from the previous year

- Proof of income

- Social Security numbers for all household members

- Details about any assets or investments

-

Complete the required forms. Make sure to fill out the appropriate application forms, typically available online. Pay special attention to:

- Accurate entries

- Submission deadlines

- Any additional information that may be requested

-

Submit your applications. Ensure all documents are submitted by the established deadlines to avoid any delays. Keep track of:

- Confirmation emails or receipts

- Follow-up requests for further information

-

Monitor the status of your application. Periodically check in on the progress and be ready to respond to any inquiries from the reviewing body. This can include:

- Updating information if circumstances change

- Providing additional documentation as needed

-

Review awards and accept offers. Once informed of any benefits, carefully evaluate the options. Consider aspects such as:

- Any conditions tied to the assistance

- Ongoing obligations or requirements

These steps provide a comprehensive roadmap towards obtaining the necessary resources, paving the way for achieving educational and career aspirations.

Types of Financial Support Available

When it comes to funding options for education, there are a variety of resources that can make a difference. Students can tap into different forms of support, each designed to alleviate the burden of educational expenses. Understanding these options is key to navigating the financial landscape of higher learning.

One widely recognized category includes grants, which are often awarded based on need and do not require repayment. Scholarships, on the other hand, are typically merit-based and can reward students for achievements or talents. Additionally, low-interest loans provide another avenue, allowing individuals to borrow money with the expectation of paying it back over time.

Moreover, work-study programs offer a unique solution by enabling students to earn money while attending classes, creating a win-win scenario. Regional and institutional programs further enhance the variety, often tailored to the specific needs and circumstances of students within the area.

It’s essential to explore all these avenues to find the right mix of support that can help lighten the load of academic expenses. Each option plays a crucial role in making education more accessible and attainable.