Determining the Amount of Financial Aid You Are Eligible to Receive

Determining the level of support available for education can feel overwhelming. Many students and their families find themselves navigating a complex landscape of options and qualifications. The process often involves various forms of assessment and important criteria that can influence the outcome.

Gaining insight into the resources accessible for educational pursuits can significantly impact financial planning. It’s crucial to explore the different types of assistance offered, from grants to scholarships, and what factors contribute to their availability. Utilizing available tools and resources can help bring clarity to the process and empower individuals to make informed decisions.

Furthermore, understanding the specific qualifications and requirements necessary for obtaining this assistance can inspire confidence. Engaging with financial aid offices and conducting thorough research are essential steps in demystifying the journey toward securing valuable support for educational goals.

Understanding Financial Aid Types

Diving into the world of educational support options can feel overwhelming. Various forms exist, each with its unique characteristics and purposes, making it essential to grasp what’s available. Knowing the distinctions aids in making informed decisions for educational pathways.

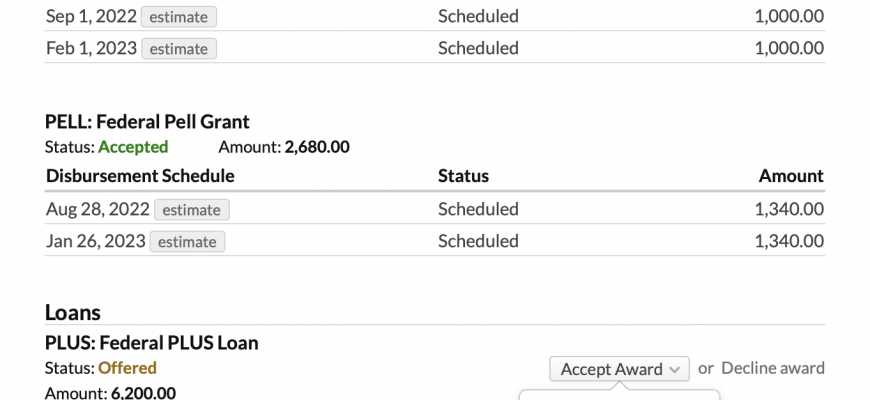

One primary category includes grants, which typically don’t require repayment. These are often awarded based on financial necessity and can significantly ease the burden of tuition costs. Scholarships, on the other hand, reward merit or specific talents and may also come with various eligibility criteria.

Loans represent another option. Unlike grants or scholarships, they demand repayment after graduation, making understanding the terms crucial. Interest rates and repayment schedules differ greatly and can impact future finances.

Work-study programs are a blend of employment and education. Participants can earn money through part-time work while pursuing their studies, helping to cover living expenses or educational materials.

Lastly, institutional aid refers to funding offered directly by colleges or universities. These funds can vary widely between institutions and often reflect a combination of academic performance and financial need. Familiarizing oneself with these types enables better planning for a successful educational experience.

Calculating Your Financial Need

Understanding the amount of support available for educational pursuits can seem overwhelming, but breaking it down into simpler parts makes the process easier. Essentially, it’s all about determining the gap between the resources at one’s disposal and the total expenses associated with higher education. Identifying this difference lays the groundwork for figuring out the assistance that might be on the table.

The initial step typically involves gathering information on family income, assets, and any existing scholarships or grants. Next, it’s important to consider the total cost of attendance, which includes tuition, books, room and board, and other essential expenses. By using various formulas, many institutions can calculate needs based on these figures, ultimately leading to an understanding of where additional support may be required.

Moreover, different factors may influence the outcome, such as the number of dependents, household size, and unique circumstances that could impact one’s financial situation. This comprehensive approach ensures that the calculations paint an accurate picture, reflecting not just financial capabilities but also the overall context of an individual’s life.

In the end, all this information helps clarify where assistance may be sought. The clearer the understanding of expenses versus resources, the better equipped one becomes to evaluate potential options and make informed decisions regarding educational funding.

Sources of Financial Assistance Explained

When it comes to funding education or pursuing various opportunities, a variety of resources exist to help individuals achieve their goals. Understanding these options can make a significant difference in alleviating the burden of expenses. Different types of support are available, each with its own set of qualifications and applications, catering to diverse needs and circumstances.

Grants represent one of the most sought-after forms of support. These funds typically come from government entities, educational institutions, or private organizations and do not require repayment. Scholarships share a similar advantage, often awarded based on merit, financial need, or specific criteria, allowing recipients to reduce their educational costs substantially.

Another avenue to explore includes loans, which, unlike grants and scholarships, must be repaid after a certain period. They can come from government or private sources, with varying interest rates and terms. Understanding the repayment options is essential when considering this route.

Additionally, work-study programs provide a unique opportunity for individuals to earn money while gaining valuable work experience. These programs often allow students to balance their academic responsibilities with part-time employment, easing some of the financial pressures.

Finally, local community organizations, businesses, and foundations frequently offer resources and funding opportunities. Staying engaged in the community and researching these options can unveil hidden gems that may not be widely advertised but provide meaningful support.