Understanding the Types of Financial Aid Available and How to Determine What You Qualify For

Navigating the terrain of assistance can often feel overwhelming. Students and their families may find themselves questioning the resources available to alleviate the financial burden of education. There’s a myriad of options out there, tailored to different circumstances and needs, but pinpointing which ones apply to you can seem like a daunting task.

Understanding the various possibilities for support requires a closer look at your individual situation. Each person’s journey is unique, influenced by factors such as background, academic achievements, and personal challenges. You don’t have to unravel this complicated puzzle alone; there are tools and resources at your disposal to help illuminate the best paths forward.

Exploring avenues for support involves a bit of research and some self-reflection. By evaluating your eligibility and aligning your goals with the offerings available, you can move closer to securing the right resources that will aid you in achieving your educational aspirations. Let’s dive into the essentials that can assist you in this quest for financial resources!

Understanding Different Types of Financial Support

When it comes to covering educational expenses, there are various options available that can help lighten the load. Each type serves a unique purpose and can cater to different needs, making it essential to familiarize oneself with what’s out there. From grants to loans, it’s all about finding the right mix to suit your personal situation.

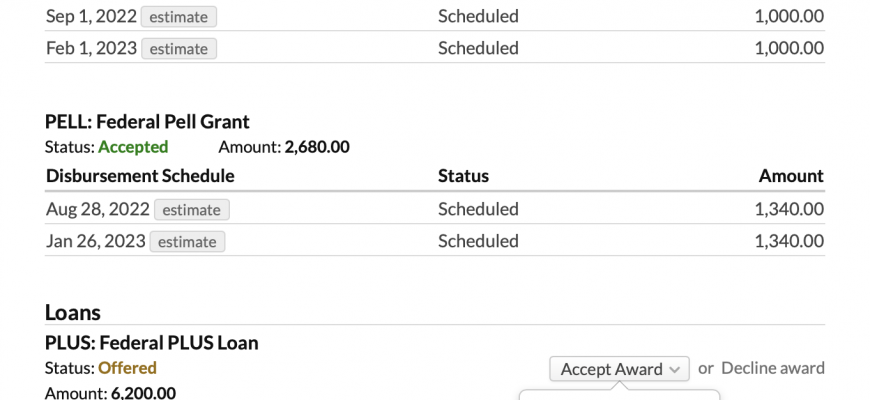

Grants are often considered the most favorable kind of assistance since they typically don’t require repayment. They can be based on merit or need, allowing many students to access resources they might not have otherwise. On the other hand, scholarships also fall into this category–they’re awarded based on specific criteria, such as academic achievements or extracurricular involvement.

For those seeking additional support, loans are another avenue to explore. Unlike grants and scholarships, these funds must be paid back, often with interest. Understanding the different loan types, including federal and private options, is crucial to making informed decisions about future obligations.

Finally, work-study programs provide a chance to earn while learning. Engaging in part-time employment on campus can not only help cover costs but also offers valuable experience that can bolster your resume after graduation. Each of these avenues presents unique opportunities, so it’s worth taking the time to investigate them all thoroughly.

Steps to Determine Your Eligibility

Understanding your options for support can feel a bit like navigating a maze, but breaking it down into steps can make it much simpler. The aim here is to clarify how to assess whether you qualify for various resources and assistance programs available to you, based on specific criteria.

First, start by gathering all necessary documents related to your income, family size, and any other relevant financial information. This data serves as the backbone for any assessment. Next, consider visiting websites that provide information on programs tailored to your situation. Many institutions have calculators or quizzes designed to help you unpack and evaluate your circumstances.

Another important step involves contacting your institution’s support office or similar entities. They often have professionals who can guide you through the complexities and answer any queries you might have. Additionally, sharing your details with peers or family who have gone through similar experiences can provide valuable insight.

Lastly, keep track of deadlines. Many opportunities have specific timeframes for application, and being organized can greatly enhance your chances of receiving the support you need. Remember, staying informed and proactive is key to identifying the resources that match your needs.

Resources for Finding Financial Assistance

When it comes to uncovering support for your educational journey, there are plenty of avenues to explore. A variety of platforms and institutions offer valuable information that can help lighten the burden of costs. Tapping into these resources can make a significant difference in your ability to fund your studies.

Government websites often serve as a primary source for information on available programs. Sites like Benefits.gov and your local state education departments provide comprehensive details regarding different options tailored to various needs.

Another great option is community organizations. Many nonprofits are dedicated to assisting students and may offer scholarships or grants. Connecting with local charities or advocacy groups can uncover opportunities that might not be widely advertised.

Your educational institution is also a key player in this process. Most colleges and universities have dedicated offices that specialize in helping students find support. They can guide you through different programs, scholarships, and even private funding options.

Networking with peers can also reveal hidden gems. Joining online forums or local study groups allows you to share experiences and knowledge about sources of support. Fellow students can offer insights based on what they’ve discovered or applied for themselves.

Finally, don’t overlook social media. There are numerous groups and pages dedicated to sharing opportunities and tips. Following educational influencers or institutions can connect you with timely information and resources tailored to your needs.