Determining Your Eligibility for Financial Aid and How to Find Out If You Qualify

Navigating the world of funding options can be a bit overwhelming, especially when it comes to determining your potential access to support. Many individuals seek assistance to further their education or meet essential needs, yet figuring out whether you meet the requirements can feel challenging. It’s essential to grasp the various factors that may come into play as you explore your options.

Various parameters can influence your standing in relation to support resources. From your income and family circumstances to academic achievements and other responsibilities, these elements weave together to create a comprehensive picture of your situation. Ultimately, understanding these criteria can help you take the necessary steps to maximize your benefits.

As you embark on this journey, remember that there are resources available to guide you through the process. Engaging with experts and accessing relevant tools can provide a clearer understanding of the path ahead. A proactive approach will surely serve you well in uncovering all the possibilities that await.

Understanding Eligibility Criteria for Assistance

Determining whether you meet the requirements for support can feel a bit daunting, but it’s essential to break it down into manageable parts. Different types of assistance come with their own set of guidelines, and familiarizing yourself with these specifics can help clarify your situation. By exploring the various factors that influence access to resources, you can better grasp what is expected and what you may need to provide.

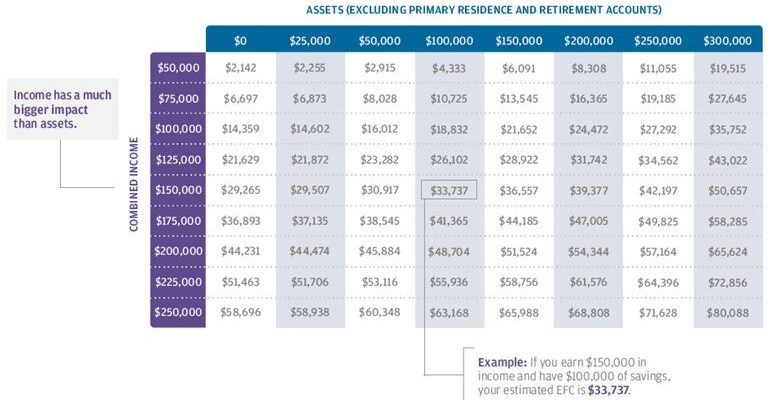

First and foremost, factors such as household income, size, and unique circumstances play a significant role in assessing eligibility. Institutions often take into account your financial background, so gather relevant documentation, as it can give you a clearer picture. Additionally, your enrollment status, whether part-time or full-time, may impact your access to available resources.

It’s also essential to consider academic progress and achievements, as different programs often have criteria related to course completion and overall performance. Engaging with the requirements of specific organizations can unveil further details that could affect your eligibility. Overall, staying informed and proactive will empower you on your journey toward securing the assistance you seek.

Key Documents Needed for Application

When you’re gearing up to seek assistance for your educational pursuits, there are specific pieces of paperwork you’ll need to gather. These documents are essential in presenting your situation accurately and ensuring that you have a solid foundation for your request. Having everything prepared can significantly smooth the process and help you focus on your studies rather than stressing over missing information.

One of the primary items you’ll want to have on hand is your tax returns from the previous year. This shows your financial standing and provides insight into your income. Alongside this, be sure to collect any additional income documentation like W-2 forms or pay stubs. These will help clarify your monetary situation further.

Do not forget to include your identification documents, such as a driver’s license or social security number. This information is crucial for verifying your identity. Additionally, gather proof of enrollment, such as acceptance letters from your chosen institution, as they underline your commitment to pursuing education.

Finally, any documentation regarding assets, such as bank statements or property ownership records, can also be helpful. This paints a fuller picture of your financial landscape. By having all these documents in order, you’ll be setting yourself up for a successful application process.

Common Misconceptions About Financial Support

When it comes to seeking assistance, many people hold onto beliefs that can create confusion or hinder their potential opportunities. It’s easy to fall prey to myths that circulate, especially regarding who can receive help and under what circumstances. Let’s clear the air and tackle some of these misunderstandings to better grasp the world of support options available.

One prevalent idea is that only students with exceptional academic records are eligible for resources. In reality, many types of support exist that consider a range of criteria beyond grades. Another common myth is that wealthy families are automatically disqualified from receiving any kind of support. The truth is that myriad factors influence the decision-making process, and financial status isn’t the sole determinant.

Some people also believe that waiting until the last minute to apply will not affect their chances. In fact, many institutions allocate resources on a first-come, first-served basis, making early applications beneficial. Lastly, the notion that all resources come in the form of loans can discourage potential applicants. There are various grants and scholarships available that do not require repayment, providing an excellent alternative for those seeking assistance.