Exploring the Ways to Determine Your Eligibility for Financial Aid

Seeking assistance for education can feel overwhelming, especially when deciphering the complexities of support programs available to you. It’s essential to unravel the various elements that contribute to receiving help, as well as the criteria that impact eligibility. By exploring these aspects, you can gain clarity on what to expect and how to prepare effectively.

When navigating this landscape, it’s beneficial to consider the multitude of resources and assessments available. Think about the documentation needed and the different factors that can influence the outcome. It’s all about finding the right approach and understanding your personal situation, which can lead to better decisions and outcomes.

Engaging with professionals who specialize in this area can provide valuable insights that empower you to take informed steps forward. Remember, this journey isn’t just about numbers; it’s about laying a foundation for future educational endeavors. So, brace yourself for the exploration ahead!

Understanding Financial Aid Basics

Grasping the essentials of assistance programs can feel overwhelming at first, but it’s a vital step for anyone looking to ease the burden of educational expenses. These resources can come in various forms, and each type has its unique characteristics and eligibility criteria. Familiarizing yourself with the different categories of support is crucial in making informed decisions.

At the core of these programs, you’ll find grants, scholarships, loans, and work-study opportunities, each offering different benefits. Grants and scholarships provide help that doesn’t need to be repaid, often awarded based on merit or need. On the other hand, loans require repayment with interest, while work-study roles allow students to earn while they learn, balancing education and work commitments.

Understanding the application process is equally important. Filling out specific forms, like the FAFSA, is often the first step in determining the level of support available. It’s essential to gather accurate information about your finances and educational aspirations to present a clear picture of your situation.

Ultimately, getting a handle on these elements will empower you to navigate your options more effectively, ensuring you can take advantage of the resources at your disposal. Taking the time to research and prepare will lead to a smoother experience in achieving your educational goals.

Key Factors Influencing Financial Aid Eligibility

When exploring assistance options, several elements play a crucial role in determining the level of support one might receive. These factors can vary greatly from person to person, and understanding them can help in making the most informed decisions.

Firstly, the income level of the applicant and their family can greatly shape the possibilities available. Generally, lower income can lead to more opportunities for support, while higher earnings might reduce eligibility. Additionally, the number of dependents a family has often influences this aspect, as more dependents typically mean greater financial need.

Another significant consideration is the cost associated with the institution one chooses. Different colleges have varying expense structures, and that often affects the type of assistance one might be eligible for. Public schools, private universities, and community colleges each have unique financial profiles that can influence assistance packages.

Academic performance also comes into play. Many programs require a certain grade point average or standardized test scores, making it essential to maintain strong performance in studies. Moreover, extracurricular activities and community involvement can enhance one’s overall profile, potentially leading to additional opportunities.

Lastly, citizenship status is a key component. Eligibility for many funding sources is often limited to citizens or permanent residents, so understanding the specific criteria is vital. Navigating these various elements can significantly impact one’s journey toward securing the necessary resources for education.

Steps to Calculate Your Aid Potential

Determining the support you may receive is an important process that can significantly influence your educational journey. By understanding various factors that contribute to this evaluation, you can take charge of your financial planning. Let’s break down the essential steps to get a clearer picture of potential assistance.

Gather Necessary Documentation: Start by collecting relevant documents such as tax returns, income statements, and asset information. This will provide a solid foundation for assessing your current situation and identifying opportunities for support.

Explore Different Resources: Various platforms and tools exist to help estimate the assistance available. Utilizing calculators from educational institutions or government websites can yield quick insights tailored to your scenario.

Understand Eligibility Criteria: Each type of support comes with its specific requirements. Familiarizing yourself with these conditions will empower you to assess your own qualifications more accurately and determine where you may stand.

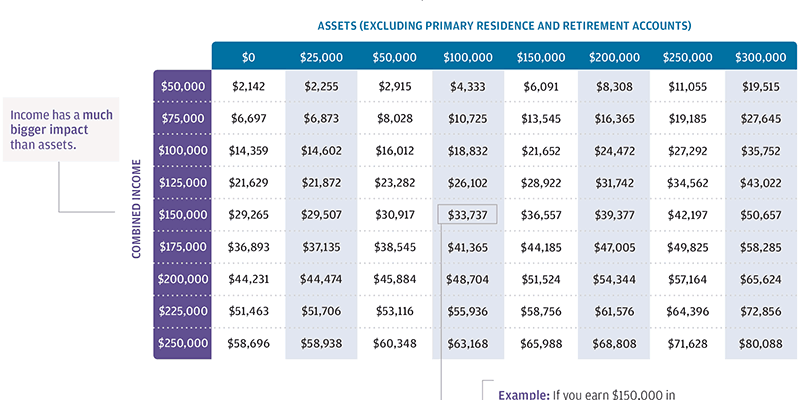

Assess Personal Contributions: Consider your own financial resources. Any savings, investments, or income can impact the amount of support available. The balance of your contributions plays a critical role in the overall calculation.

Consult with Advisors: Don’t hesitate to reach out to school counselors or financial experts. They can offer personalized guidance and clarify any uncertainties you may have about the process, helping you to make informed decisions.

Following these steps can demystify the process and give you greater control over your educational expenses. By staying organized and informed, you’ll be better equipped to navigate the financial landscape ahead of you.