Understanding How to Determine the Amount of Financial Aid You Have Received

Navigating the world of educational assistance can often feel like a daunting task. Many individuals embark on this journey with a mix of excitement and uncertainty, eager to understand their opportunities and options. It’s essential to grasp the various elements involved in securing resources that can help alleviate the costs associated with education.

As you delve deeper into the process, you may encounter a variety of terms and calculations that can leave you feeling overwhelmed. The key lies in breaking down these components into manageable bits, ensuring you clearly comprehend what is available to you. Whether you are exploring grants, scholarships, or work-study possibilities, recognizing the specifics can empower you on your path.

In this exploration, you’ll learn about available tools and strategies to effectively assess the support you may have been awarded. With the right knowledge at your fingertips, you can approach your educational journey with confidence, ultimately allowing you to focus on the experiences that truly matter.

Understanding Your Financial Aid Package

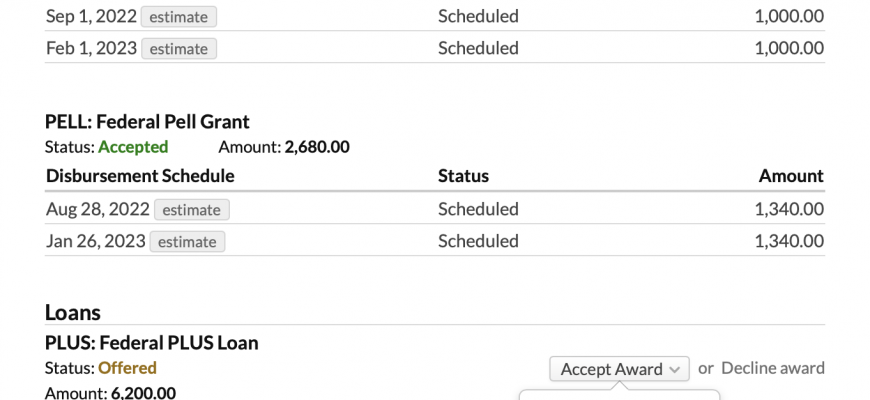

Receiving a financial support package can feel overwhelming at first, but it’s important to take a step back and analyze what’s included. Each offer typically consists of a mix of grants, scholarships, loans, and work-study opportunities that together form a complete picture of your support for educational expenses. By breaking it down, you can see what resources are available to you and how they can help manage costs.

Start by reviewing each component in detail. Grants and scholarships are often the most desirable aspects since they do not require repayment. Next, consider any loans, which usually come with interest rates and terms that are important to understand. Lastly, work-study options may provide you with employment opportunities on campus, allowing you to earn a portion of your expenses while gaining valuable experience.

After you’ve examined the details, it’s beneficial to create a budget that incorporates the support offered. Factor in tuition, fees, housing, and living costs. This way, you’ll have a clearer view of your financial obligations and any potential gaps that might require additional resources. If you have questions or need clarification about certain items in your package, don’t hesitate to reach out to the financial office for guidance.

Key Resources for Aid Information

Finding support for your educational journey can be overwhelming, but there are plenty of trustworthy sources to ease the process. Whether you’re searching for scholarships, grants, or loans, knowing where to look can make all the difference. Let’s explore some essential tools and places to gather the latest updates and details regarding assistance opportunities.

Your school’s financial services office is an excellent starting point. They often provide personalized guidance and have up-to-date information on various programs available to students. Additionally, their staff can help clarify any confusing aspects of the application process.

Official government websites are another reliable avenue. They frequently publish comprehensive information about different funding options, eligibility criteria, and deadlines. Resources such as the Free Application for Federal Student Aid (FAFSA) site also offer helpful tips and important announcements that can aid your search.

Online databases and scholarship search engines can save you time and effort. These platforms compile numerous opportunities tailored to different needs and backgrounds. Utilizing filters can help match you with options that suit your situation perfectly.

Lastly, don’t underestimate the power of community organizations and local foundations. Many offer scholarships or support aimed at residents in specific areas. Engaging with your community can lead to discovering unique resources that you might not find elsewhere.

Steps to Verify Your Eligibility

Understanding your qualifications for assistance can seem daunting, but breaking it down into manageable steps can simplify the process. It’s important to consider various factors that determine your standing and potential support.

1. Review Requirements

Begin by examining the specific criteria set by the organizations offering support. This often includes academic performance, income level, and residency status. Each type of assistance has distinct prerequisites.

2. Gather Necessary Documents

Collect all relevant paperwork that might be required to assess your position. This usually includes tax returns, bank statements, and enrollment confirmation. Having everything in one place can streamline your application.

3. Complete an Application

Fill out the required forms with accurate information. Double-check for any errors, as inaccuracies can delay the review process or impact your eligibility.

4. Contact Support Services

If questions arise, don’t hesitate to reach out for guidance. Many institutions have dedicated departments to assist you with the process and clarify any uncertainties.

5. Track Your Submission

Once you’ve submitted everything, keep an eye on your application status. Many organizations provide online portals where you can view updates regarding your assessment.

By following these simple steps, you’ll be better positioned to understand your qualifications for assistance and receive the support you may need.