A Comprehensive Guide on Freezing Your Credit to Protect Your Financial Security

In today’s world, protecting your personal information has become more crucial than ever. With identity theft on the rise, many individuals are looking for effective strategies to safeguard their financial well-being. The good news is that there are methods available to help you maintain control over your financial identity and prevent unauthorized access to your accounts.

One of the most effective ways to enhance your financial security involves taking proactive measures to restrict activities associated with your financial profile. By implementing certain procedures, you can effectively block potential threats and enjoy peace of mind knowing that your sensitive information is better protected against fraudsters.

This article delves into the steps you can take to safeguard your financial landscape from unauthorized parties, ensuring that your hard-earned assets remain secure. With just a little effort, you can navigate the necessary actions and establish a more secure future for yourself and your finances.

Understanding Credit Freezing Essentials

In today’s financial landscape, safeguarding personal information is more critical than ever. One effective approach to enhance your security involves limiting access to your financial profile, making it more challenging for unauthorized individuals to open accounts in your name.

First off, this process acts as a barrier against identity theft, ensuring that only you can authorize new transactions. It’s essential to recognize that while this tactic offers solid protection, it doesn’t eliminate your existing accounts or impact your creditworthiness directly.

Your next step should involve familiarizing yourself with the specific procedures. Different agencies have their guidelines, and understanding these nuances will streamline your experience. Being prepared means you can respond swiftly should the need arise.

Ultimately, taking these precautions can significantly bolster your financial security, allowing you to maintain peace of mind in an increasingly digital world. Engaging with this practice empowers you to take control of your financial destiny.

Steps to Initiate a Credit Freeze

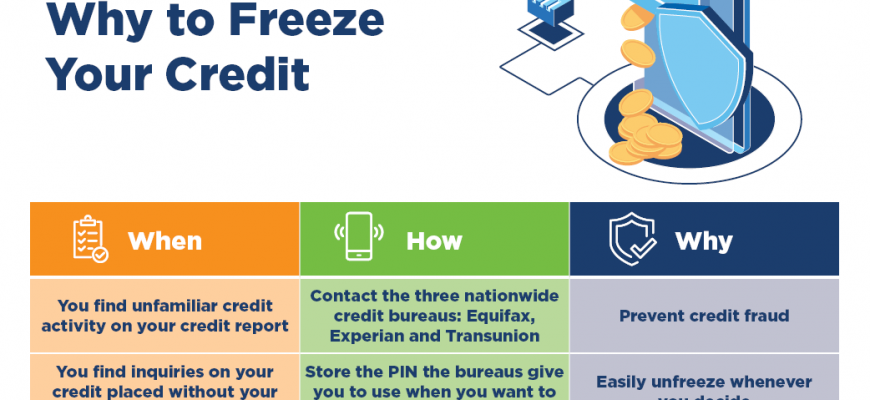

Taking steps to restrict access to your financial information is a smart move in today’s world. It’s crucial to know the process involved in safeguarding your personal details from unauthorized use. Let’s walk through the essential actions you need to take, making this task straightforward and manageable.

First off, gather all important details about your identification, including your Social Security number, any relevant financial accounts, and personal information like your address and date of birth. Having everything on hand will simplify the process and make it more efficient.

Next, reach out to the major reporting agencies–typically, there are three that you need to contact. Each one may have its own procedure, so it’s wise to check their individual websites for specific instructions. You might need to complete a form or provide additional identification to proceed.

Once you’ve submitted your request, make sure to keep track of any confirmation numbers or codes you receive. This step is key, as it allows you to manage the status of your request and ensures everything is in order. You should also be aware that you’ll receive notifications once the action has been successfully implemented.

Finally, if you ever decide to reverse this action, the steps are equally straightforward. Just follow the same channels and provide the necessary verification to lift the restrictions. Being proactive ensures your financial security without much hassle.

Benefits of Securing Your Financial Identity

Taking steps to protect your financial identity brings numerous advantages that can enhance your overall peace of mind. By implementing security measures, you can significantly reduce the risk of unauthorized access to your personal information, ensuring that your financial future remains intact.

One major benefit is the heightened sense of security. When your financial details are well-guarded, you can rest easier knowing that it’s much more challenging for potential fraudsters to use your information unlawfully. This added layer of protection often leads to lower stress levels, allowing you to focus more on your daily life rather than worrying about potential identity theft.

Additionally, many individuals find that securing their financial identity can lead to smoother transactions in the long run. With proper safeguards in place, your legitimate financial activities become less likely to be flagged as suspicious, streamlining approvals for loans, credit applications, and other financial services.

Lastly, implementing these protective measures often empowers individuals to take control of their financial wellbeing. By actively managing who has access to your information, you gain confidence in your ability to make sound financial decisions and safeguard your assets against potential threats.

What an incredible presence! She’s absolutely breathtaking and so graceful. This video captures her charm perfectly.