Understanding the Functionality and Benefits of Franking Credits in the Tax System

In the world of investing, navigating the ins and outs of financial mechanisms can sometimes feel like deciphering a complex puzzle. One aspect that often piques interest among investors is the concept of tax offsets provided by certain types of income. These offsets play a crucial role in how individuals approach their investment strategies and ultimately impact their overall tax liabilities.

Imagine receiving a little bonus from your investments that helps reduce the amount of tax you owe. That’s essentially what these offsets offer–a means to lessen the financial burden while still enjoying the benefits of your investment. They can be especially advantageous for those who are keen on maximizing their returns and maintaining a healthy financial outlook.

As we delve deeper into this topic, it’s essential to grasp the mechanics behind these particular financial instruments. By understanding their fundamental principles and how they relate to your income, you can make informed decisions that align with your financial goals. So, let’s explore this intriguing subject further!

Understanding Franking Credits Basics

Let’s dive into a fascinating aspect of the investment landscape that can truly enhance your financial returns. Imagine a system that allows investors to receive a tax bonus on their dividends, making their earnings even sweeter. This concept can significantly benefit individuals when it comes to managing their tax obligations and maximizing their income from shareholdings.

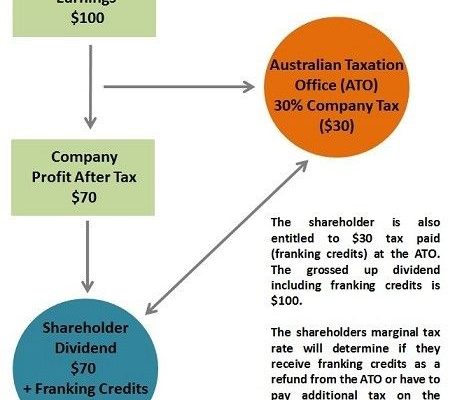

At its core, this system is designed to eliminate the issue of double taxation on earnings distributed by corporations. When companies generate profits, they typically pay corporate taxes. However, when those profits reach shareholders as dividends, it can feel like a second tax bite. The mechanism we’re discussing allows investors to claim back a portion of the taxes already paid, effectively reducing their overall tax burden.

It’s essential to grasp the nuances of this scheme, including eligibility and the specific conditions that apply. Different types of investors might have varying experiences with these benefits, and understanding the particulars can lead to better financial decisions. By familiarizing yourself with this topic, you can navigate the complexities of investing with greater confidence and potentially increase your net returns.

Benefits of the Tax Credit System

The tax credit mechanism offers numerous advantages for investors, creating a more attractive environment for those looking to grow their wealth. By providing a means to retrieve previously paid taxes, this approach effectively lightens the burden for shareholders and fosters investment opportunities.

One of the standout features is the reduction in double taxation. Typically, when companies distribute income, it is taxed at both the corporate and personal levels. This system allows individuals to offset their tax liability, ensuring they are not penalized twice for the same earnings.

Moreover, it enhances the appeal of dividends as a form of income. Investors may feel more inclined to choose stocks that offer payouts because they know they can reclaim a portion of the tax imposed on these earnings. This, in turn, encourages companies to maintain or even increase their distribution policies, ultimately benefiting the market.

Another significant benefit is the encouragement of long-term investment. Individuals are more likely to retain their shares if they know they can benefit from lower tax burdens on dividends. This stability can lead to increased share prices and overall market growth, creating a win-win situation for both investors and companies.

In summary, the tax relief system acts as a powerful incentive, stimulating investment strategies while providing financial benefits. It’s a clear illustration of how thoughtful fiscal policies can contribute positively to the economic landscape, making it an appealing choice for many stakeholders.

Claiming Your Tax Offsets

When you receive dividends from your investments, you might notice a little extra benefit that can significantly impact your tax return. This section will guide you through the process of ensuring you make the most of this advantage, so you can maximize your returns come tax season.

First off, it’s crucial to keep track of all the income you receive from your shares. This includes not only the cash dividends but also any attached benefits. When you get your annual tax statement from the company, it typically details the amount you’re entitled to claim, so hold onto that document.

Next, when preparing your tax return, ensure you include the total value of dividends and their associated offsets. Most tax software will prompt you to enter these figures, making it a straightforward process. If you’re doing it manually, make sure to double-check the instructions from your local tax office to avoid any hiccups.

It’s often wise to consult with a tax professional, especially if it seems a bit overwhelming. They can help navigate the specifics and ensure you’re not missing out on any potential savings. Remember, utilizing these benefits can lead to a significant reduction in your overall tax liability.

Finally, don’t forget to submit your return on time. If you rush the process or miss deadlines, you might lose out on the chance to claim what’s rightfully yours. Keeping organized and understanding the necessary steps can make a world of difference in your financial outcome.