Understanding the Mechanics of Financial Aid Packages and How They Support Students

Navigating the landscape of educational support can often feel overwhelming. Students and their families frequently seek ways to alleviate the financial burden that comes with pursuing higher learning. Various types of assistance are available, tailored to meet different needs and circumstances, helping individuals achieve their academic goals without falling into crippling debt.

At the core of these support systems lies a combination of grants, scholarships, and loans, each designed to provide a unique type of help. The fundamental principle is to create opportunities for students who might otherwise find it challenging to manage the costs associated with their studies. Each option comes with its own rules and requirements, which can make the process seem intricate but entirely manageable.

Grasping how these resources are allocated and structured is essential. By understanding the different forms of support and how they relate to individual situations, students can make informed choices about their educational paths. In this exploration, we will break down the various components of these financial initiatives, shedding light on how they come together to support aspiring learners.

Understanding Financial Aid Components

When you’re navigating the journey of securing assistance for your educational journey, it’s essential to grasp the various elements that make up this support system. Each component plays a unique role in shaping the overall support you receive, allowing you to focus more on your studies than on the financial burden.

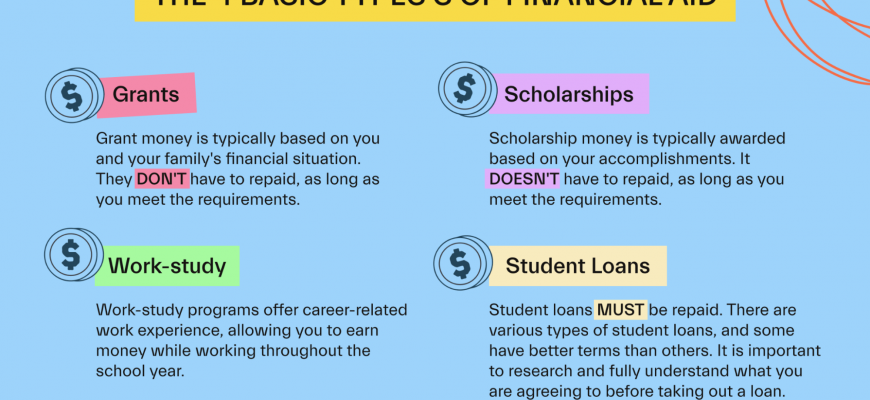

At the core, there are grants and scholarships, which are essentially free funds that don’t require repayment. These often stem from governmental bodies, educational institutions, or private organizations, aiming to alleviate some financial pressure. Then you have the loans, which can be a bit trickier. While they provide essential resources upfront, they do need to be paid back, usually with interest, so it’s vital to understand the terms before diving in.

Additionally, there are work-study programs that offer an opportunity to gain work experience while earning money to contribute to educational expenses. This not only helps with finances but also allows you to build your resume. Understanding how all these pieces fit together can help you make informed decisions that will pave the way for a successful academic experience.

Types of Financial Assistance Available

When considering education funding options, there are various forms of support to explore that can ease the burden of expenses. Understanding these different categories is crucial for making informed choices and maximizing available resources. Each option offers unique benefits and requirements, allowing students to tailor their approach based on personal needs and circumstances.

Grants represent one of the primary forms of monetary assistance, often provided by government entities or institutions. These funds typically do not require repayment, making them an attractive option for many. Scholarships, on the other hand, are awarded based on merit, need, or other criteria, and can significantly reduce educational costs for deserving candidates.

Loans are another popular avenue, allowing students to borrow money with the expectation of future repayment. While they can cover a wide range of expenses, it’s essential to consider the terms and interest rates associated with these loans, as they can impact long-term financial health.

Work-study programs offer a unique twist by allowing students to earn money while pursuing their studies. These opportunities not only provide financial relief but also enhance practical skills and work experience, which can be invaluable after graduation.

Many institutions also offer specific resources or assistance tailored to particular groups, such as veterans, minorities, or students with disabilities. These specialized programs are designed to promote inclusivity and support varied backgrounds.

In summary, navigating the landscape of funding options can be a game-changer for students. By exploring all available resources, you can create a comprehensive strategy that aligns with both your educational goals and financial situation.

Evaluating Your Assistance Effectively

Understanding the support offered to you for your education can seem like a daunting task. It’s crucial to thoroughly analyze what’s being provided, ensuring you grasp both the immediate benefits and the long-term implications. You want to make informed decisions that align with your financial goals while also paving the way for academic success.

Start by breaking down the various components. Look closely at the grants and scholarships; these are typically free funds you won’t have to pay back. Then, consider any loans offered, paying particular attention to their terms. Understanding interest rates and repayment options will prepare you for future obligations. Additionally, investigate work-study options and whether they fit within your schedule and financial needs.

Calculate your total expected costs for the upcoming year, including tuition, books, and living expenses. Once you have a clear picture, compare it to the total assistance you’re receiving. This will help you gauge if you’ll have enough to cover your expenses without incurring excessive debt. If there’s a gap, explore other resources or solutions that can help bridge it.

Finally, reflect on the overall value of the offer. Consider not only the monetary aspect but also how it contributes to your educational experience and future career opportunities. A well-rounded evaluation will empower you to make choices that align well with your personal and financial aspirations.