Effective Strategies for Improving Your Credit Score and Repairing Your Credit History

In today’s fast-paced world, many individuals find themselves facing challenges in managing their financial standing. These issues can stem from a variety of factors, including unexpected expenses, job loss, or poor financial decisions. The result often manifests in a less-than-ideal status, impacting one’s ability to secure loans or favorable terms on financial products.

Understanding the steps to enhance this standing is crucial. This journey towards revitalizing one’s financial image involves a strategic approach, where individuals can take control of their economic well-being. From identifying inaccuracies in reports to establishing new, positive financial habits, the process can be empowering and transformative.

Furthermore, it’s essential to recognize that seeking assistance isn’t a sign of weakness. Many opt to explore expert guidance in navigating this complex landscape. With the right tools and knowledge, one can significantly improve their circumstances and pave the way for a brighter financial future.

Understanding Credit Repair Basics

Let’s dive into the essentials of improving your financial standing. Many individuals may face challenges in managing their financial profiles, which can lead to various obstacles in securing loans or other financial products. It’s crucial to grasp the foundational concepts that can lead to a healthier financial future.

The journey to enhancing your financial reputation begins with recognizing the factors that influence your overall assessment. Maintaining a solid financial history is a blend of responsible borrowing, timely payments, and managing existing obligations. Individuals often overlook the importance of regularly monitoring their reports, which can uncover discrepancies or outdated information that may negatively impact their standing.

Approaching this process requires patience and strategy. Prioritizing specific actions, such as paying down existing debts and establishing a consistent payment schedule, can significantly alter your profile over time. It’s also beneficial to seek guidance from professionals who specialize in providing insights and tools to assist you in this endeavor.

Ultimately, understanding these principles can empower you to take control of your financial journey. With dedication and informed decision-making, it’s possible to create a more favorable financial landscape for yourself.

Common Mistakes to Avoid in Credit Restoration

When it comes to enhancing your financial standing, there are several pitfalls that many individuals unknowingly stumble into. Understanding these missteps can save you both time and frustration as you work towards a healthier financial future. Here are some of the most frequent errors to steer clear of.

1. Ignoring Your Report

One of the biggest blunders is neglecting to review your financial history. Regularly checking your report helps you identify inaccuracies that can harm your score. Even a minor mistake can have significant consequences, so make it a habit to stay informed about what’s being reported.

2. Late Payments

Another common error is missing payment deadlines. It might seem minor, but delays can reflect poorly on your score. Setting up automatic payments or reminders can help you stay on top of your obligations and avoid unnecessary damage.

3. Closing Old Accounts

Many believe that closing old accounts will improve their situation, but this is often counterproductive. Length of credit history plays a vital role in scoring systems. Keeping older accounts open, even if they are not in use, can contribute positively to your overall profile.

4. Overusing Credit

Using available funds excessively can signal financial distress. It’s wise to maintain a balance and keep your utilization ratio low. Aim to use no more than 30% of your available credit to maintain a favorable standing.

5. Falling for Scams

Lastly, be wary of offers that sound too good to be true. Many scam artists prey on those looking for assistance, promising quick fixes that can lead to more harm than good. Always do thorough research before engaging with any agency or service.

By avoiding these common missteps, you can take a more effective approach towards improving your financial health and achieving your goals.

Effective Strategies for Improving Your Credit

Boosting your financial reputation can seem daunting, but there are practical approaches that can make a significant difference. By understanding and implementing some smart tactics, you can enhance your standing and create opportunities for better financial decisions in the future.

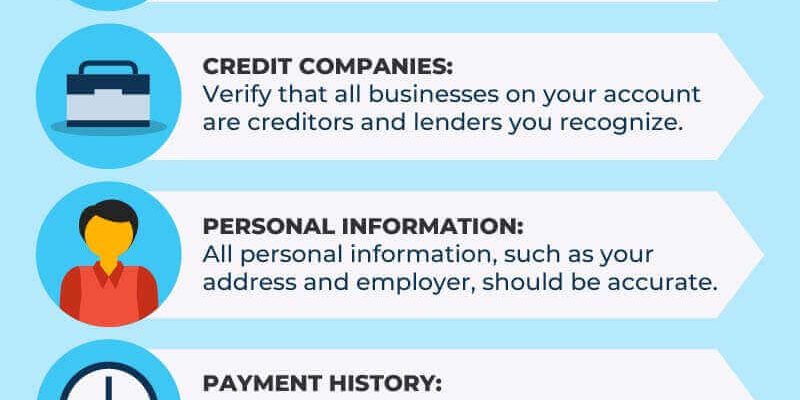

Stay Informed: Regularly checking your financial reports is a crucial step. Mistakes can happen, and being proactive about identifying inaccuracies can save you from unnecessary setbacks. Take the time to review your reports at least once a year.

On-Time Payments: Making your payments promptly is one of the most effective ways to build a solid foundation. Set reminders or automate your transactions to ensure you never miss a due date. This consistency can go a long way in boosting your profile.

Reduce Unused Accounts: If you have multiple accounts that are rarely used, consider closing the ones that don’t serve a purpose. However, be mindful of the impact this may have on your overall utilization ratio.

Limit New Applications: While it might be tempting to apply for new accounts, each inquiry can affect your score. Focus on managing your existing accounts efficiently before seeking new options.

Utilization Ratio: Keeping your balances low relative to your available limits is essential. Aim to maintain a utilization ratio under 30%. This practice can positively influence your overall score.

Educate Yourself: Knowledge is power. Take the time to understand the various factors that influence your standing. This knowledge empowers you to make informed decisions that align with your financial goals.

By implementing these strategies, you can gradually enhance your standing and open doors for future financial flexibility. Remember, persistence and discipline are key to achieving your desired outcomes.