Understanding the Mechanics and Benefits of Credit Lines

Many people find themselves in situations where they need a little extra financial flexibility. Whether it’s for unexpected expenses, planned purchases, or even covering short-term cash flow gaps, having access to funds can make life a lot smoother. This section delves into the essentials of how these financial tools function, shedding light on their features and benefits.

Imagine having a pool of resources that you can tap into whenever necessary. This system allows you to borrow money up to a predetermined limit, giving you the freedom to manage your finances on your terms. Yet, understanding the nuances of this arrangement is key to ensuring that it serves you well.

From interest rates to repayment practices, there are various aspects that come into play when considering these financial options. Grasping how they operate not only helps you make informed decisions but also empowers you to optimize your financial health. Let’s dive into the details to equip you with the knowledge you need.

Understanding the Basics of Credit Lines

When it comes to managing your finances, having access to additional funds can be incredibly beneficial. It’s like having a safety net that allows for flexibility when unexpected expenses arise. Knowing the essentials about these financial tools can empower you to make informed decisions about your spending and savings.

An important aspect to grasp is that these arrangements provide a predetermined amount of money that you can utilize as needed. Unlike traditional loans, which come as a lump sum, this option gives you the liberty to withdraw funds up to a certain limit, and you only pay interest on what you actually use. This feature can be extremely advantageous for those who prefer to maintain control over their expenditures.

Another key point to consider is the repayment structure. Typically, you’ll have the freedom to pay back the borrowed amount over time, which can help ease financial pressure. Additionally, maintaining a good repayment history can lead to higher limits and better terms in the future, reflecting your responsible use of the service.

In summary, familiarizing yourself with the essential qualities of these financial options allows you to harness their potential effectively. Being proactive and well-informed can make a significant difference in your financial well-being.

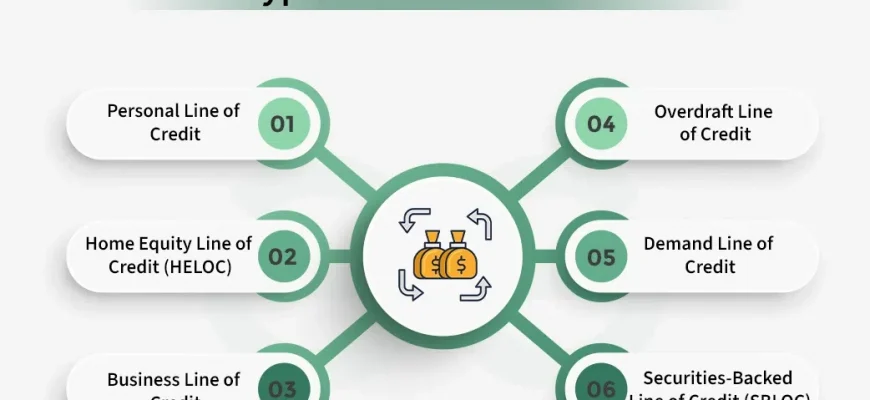

Types of Credit Facilities Available

When it comes to accessing funds, there are various options that cater to different needs and situations. Each type offers unique features, making them suitable for specific purposes. Understanding these options can help individuals and businesses make informed decisions about their finances.

One common choice is the personal arrangement, which allows individuals to borrow money up to a certain limit for personal use. This could be for emergencies, shopping, or even vacations. It’s flexible and offers the freedom to access cash when needed without the hassle of applying for a loan every time.

Another type is a business facility designed specifically for entrepreneurs. This allows companies to manage cash flow gaps, purchase inventory, or invest in growth opportunities. Often, these arrangements come with terms that cater to the fluctuating nature of business finances.

For homeowners, there are options tied to property values. These arrangements allow individuals to tap into their home equity, providing a way to finance major expenses like renovations or education. It’s a popular method for those looking to leverage their asset.

Finally, for those who travel frequently or make purchases in various currencies, some facilities come with perks suited for international transactions. These options may include rewards programs or reduced fees for foreign purchases, making them appealing to frequent travelers.

Benefits and Risks of Utilizing Credit Options

When it comes to managing personal finances, having access to a flexible borrowing option can be both a blessing and a curse. On one hand, it opens up a world of possibilities, allowing individuals to make necessary purchases or cover unexpected expenses. On the other hand, it can lead to poor financial choices if not approached with caution.

One of the main advantages of these financial tools is the convenience they offer. They often come with relatively low interest rates compared to other forms of borrowing, which can make them an appealing option for those looking to finance a purchase or consolidate debt. Additionally, users can draw from these resources as needed, providing a cushion during tough times.

However, with great flexibility comes great responsibility. Over-reliance on these options can lead to accumulating debt quickly, creating a cycle that’s hard to escape. Without careful management, what starts as a helpful resource can turn into a financial burden. It’s crucial to be mindful of the terms and conditions, and to plan repayments to avoid penalties that can add up over time.

In summary, while utilizing such funding alternatives can provide significant benefits, it is essential to weigh these against the potential pitfalls. Knowledge and awareness are key to making informed decisions that lead to long-term financial health.