Ways to Access Your Credit Score for Free Without Any Cost

In today’s world, awareness of one’s financial condition is crucial. Many people are eager to grasp where they stand in terms of their economic reputation. This knowledge can open doors, whether you’re planning to apply for a loan, rent an apartment, or even secure a better insurance rate. There’s a surprisingly simple process to uncover this vital information without having to spend a dime.

Accessing this data doesn’t have to be a complicated ordeal. With a few simple steps, you can obtain the insights you need to make informed decisions about your financial future. It’s all about knowing the right resources that allow you to stay well-informed without any unnecessary costs.

This journey of discovery can empower you, enabling you to take control of your financial situation. Whether you’re preparing for a significant purchase or just looking to maintain a good standing, understanding your financial profile is essential to navigating your economic life more effectively.

Understanding Ratings and Their Importance

When it comes to managing personal finances, many elements play a crucial role in determining one’s ability to make important purchases or secure loans. Among these elements, a numerical representation often takes center stage. This number not only reflects an individual’s past financial behaviors but also has significant implications for future opportunities.

These numerical evaluations influence various aspects of life, from securing a home to obtaining insurance policies. Lenders and institutions rely heavily on this information to gauge the risk involved in extending credit. A favorable rating can lead to lower interest rates, making it easier to manage repayments, while a less favorable one may result in higher costs and limited options.

Understanding the nuances surrounding these assessments is vital. It’s essential to grasp how various factors contribute to the overall figure, allowing individuals to take control of their financial journey. By being informed, one can make smarter decisions and ultimately pave the way for a more secure financial future.

Free Resources to Access Your Credit Score

Everyone wants to stay on top of their financial health, and understanding your standing in the world of lenders is a crucial part of that. Luckily, there are various platforms and tools available that allow you to discover this vital information without spending a dime. These resources provide insights that can help you make informed decisions regarding your financial future.

One popular option is online platforms that specialize in financial well-being. Many of them offer complimentary reports that summarize your financial background, highlighting important details. Using these services can give you a transparent view tailored to your specific situation.

Additionally, some financial institutions provide useful tools directly through their websites or apps. By signing up, you may gain access to valuable insights that help you monitor your financial journey regularly. It’s a great way to keep tabs on any changes that might occur over time.

Furthermore, government-sponsored initiatives exist that aim to educate consumers about their financial standing. These programs often include resources for obtaining comprehensive overviews at no cost. Taking advantage of such initiatives can aid in building a solid foundation for your financial future.

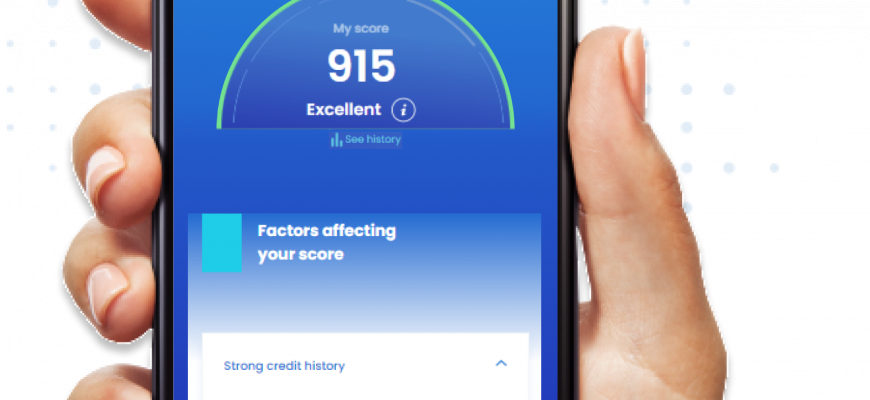

Finally, don’t forget about mobile applications designed with user convenience in mind. Many of these apps not only allow you to view essential details but also provide helpful tips and advice on improving your overall financial health. With just a few taps on your smartphone, you can empower yourself with knowledge.

Steps to Monitor Your Financial Health Regularly

Keeping an eye on your financial well-being is essential for maintaining a stable economic life. By regularly assessing your financial health, you can identify any unexpected changes and take necessary actions to improve your overall situation. This proactivity can lead to better decisions regarding loans, mortgages, and other financial commitments.

Start by selecting reputable services that offer regular updates on your financial profile. Many platforms allow you to access information without any cost, making it easier to stay informed. Make sure to choose a source that provides thorough insights into your history.

Create a consistent schedule for reviewing your information. Setting aside time each month or quarter allows you to track any fluctuations effectively. Consistency is key here; the more regularly you examine your data, the easier it becomes to spot patterns and address any issues.

Pay attention to various factors, such as payment history, overall utilization, and any new accounts opened in your name. Each element tells a part of the story, revealing how well you are managing your finances. Armed with this knowledge, you can adjust behaviors as needed and enhance your financial status.

Finally, remember to challenge any inaccuracies you find. Mistakes can happen, and they can impact your standing. Most platforms will guide you through the process of disputing errors, ensuring your profile remains a true reflection of your reliability. Maintaining accuracy in your information is crucial for making informed financial choices.