Effective Strategies for Evaluating and Comparing Financial Aid Award Packages

When embarking on the journey of higher education, many individuals find themselves immersed in a complex world of support offerings. These resources are designed to alleviate the financial burdens associated with tuition and related expenses. However, understanding the nuances of these options can often feel overwhelming, as each institution presents a different combination of assistance.

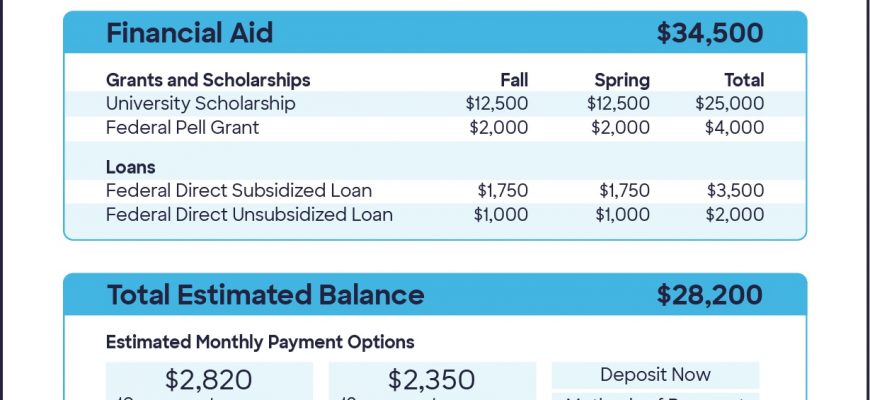

Each opportunity comes with its unique set of terms and conditions, making it essential to evaluate and analyze each offering carefully. From grants and scholarships to loans and work-study positions, distinguishing between these can significantly influence your educational experience and future finances. Knowing what to look for and how to interpret the details makes all the difference in making an informed choice.

By taking a closer look at the elements of each support option, individuals can uncover the true value of what is being presented. This process not only helps in identifying potential costs but also sheds light on the overall financial commitment involved. Ultimately, gathering the right information allows for a more strategic approach to pursuing educational goals.

Understanding Different Types of Aid

Navigating the landscape of assistance options can feel overwhelming at first. But, once you break it down, it’s easier to grasp the distinct forms of support available to students. Each type of support plays a unique role in making education more accessible and can come from various sources, each with its own set of characteristics and requirements.

Grants represent a full-tuition lifeline for many. Typically awarded based on need, these funds don’t require repayment. Scholarships, on the other hand, are often merit-based and can be awarded for academics, athletics, or specific talents, giving recipients an extra incentive to excel.

Loans are a different story. While they provide immediate funds for education, these resources must be repaid over time, often with interest. Understanding the terms and implications of borrowing is crucial before making any commitments.

Work-study opportunities also stand out, offering students a chance to earn money while gaining valuable work experience. This can be a fantastic way to alleviate some costs while still focusing on studies.

Each of these options serves a different purpose and comes with its own expectations. Familiarizing yourself with them can empower you to make informed decisions about your educational journey.

Evaluating Costs and Benefits of Awards

When navigating the world of educational funding options, it’s crucial to weigh the pros and cons of each offer. Every opportunity comes with its own set of expenses and advantages that can significantly affect your overall experience. Understanding these nuances will help you make informed decisions that align with your aspirations and financial situation.

First off, consider the total expenses associated with your education. Look beyond just tuition fees; include living costs, textbooks, and any additional fees that may arise. Some opportunities cover a significant portion of these expenses, which can alleviate the financial burden considerably.

Next, assess the benefits offered by each option. This could range from tuition reductions to stipends for practical experiences. Some programs might include networking opportunities or access to resources that can enhance your learning journey. Identifying these extras is essential, as they could provide enriching experiences that go beyond the classroom.

Ultimately, striking a balance between costs and benefits is key. By carefully analyzing each opportunity, you can find the one that not only meets your financial needs but also supports your long-term academic and career goals. This thoughtful evaluation process will empower you to select the right path for your future.

Key Factors in Aid Comparisons

When it comes to evaluating support options from various institutions, it’s essential to consider several crucial aspects. Each offer can present a different combination of grants, loans, and work-study opportunities that can heavily impact your financial situation. Understanding the nuances of these components helps in making informed decisions as you navigate your educational journey.

First off, take a close look at the grant versus loan ratio. Grants provide funds that do not need to be repaid, making them highly desirable. On the other hand, loans can accumulate interest and lead to future repayments, which could strain your budget. Keeping this balance in mind is fundamental for long-term planning.

Next, examine the total amount provided. It’s important to assess not just the numbers but also what they mean for your day-to-day expenses. Additionally, consider the renewal criteria for recurring support. Some assistance may require maintaining certain academic standards or fulfilling specific service commitments.

Don’t overlook the fine print around terms and conditions, as well. The details regarding repayment schedules, interest rates, and any hidden fees can significantly shape your financial landscape post-graduation. Also, be aware of the timeline for when funds will be disbursed, as this can impact your ability to manage expenses like tuition and housing.

Finally, reflect on the overall fit with your educational goals. A generous package might be tempting, but it’s essential to evaluate it within the context of the institution’s reputation, program quality, and potential career outcomes. The broader picture will help determine the best choice for your future endeavors.