Exploring the Pinnacle of Credit Quality Standards in Today’s Financial Landscape

When it comes to managing finances, understanding the nuances of investment security is essential. The realm of financial assurances often presents us with various classifications that indicate how reliable or risky an investment might be. This section delves into the various levels of assurance, highlighting those that stand out for their exceptional stability and dependability.

In the world of finance, not all classifications are created equal. Certain designations represent a unique blend of robustness and trustworthiness, making them highly sought after by both investors and institutions alike. By exploring these premium categories, we gain valuable insights into the factors that contribute to their esteemed status, as well as the benefits they offer in navigating the complex landscape of investments.

Moreover, understanding these superior ratings can significantly guide decision-making processes. Whether you’re an experienced investor or just starting your financial journey, recognizing the significance of these stellar classifications can bolster your confidence and help you make informed choices. Together, let’s embark on this exploration and uncover what sets these outstanding financial assurances apart from the rest.

Understanding Ratings and Their Importance

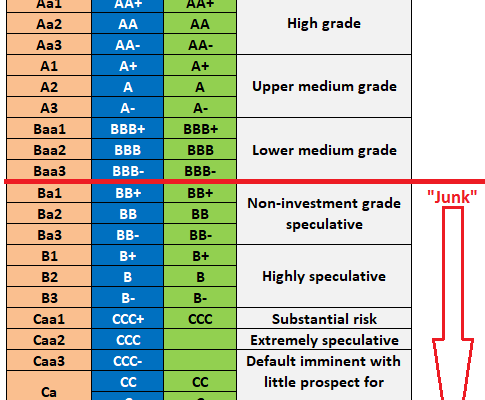

When it comes to financial markets, the significance of evaluations cannot be overstated. These assessments provide investors with valuable insights into the reliability and stability of various entities, ranging from governments to corporations. By determining the likelihood of an organization meeting its obligations, these ratings serve as a guiding light for making informed decisions.

A comprehensive understanding of these assessments is crucial for anyone looking to navigate the complexities of investments. They not only aid in identifying investment opportunities but also help in managing risks. Evaluations are based on various factors, including financial health, market position, and economic conditions, which altogether depict a firm’s potential for success.

Moreover, the implications of these evaluations extend beyond personal investment choices. They play an essential role in shaping the broader economic landscape. A reputable assessment can influence interest rates, borrowing costs, and investor confidence. Everybody involved–from individual investors to large institutions–depends on these insights to effectively allocate resources.

Ultimately, grasping the fundamentals of these evaluations equips individuals and organizations alike with the tools needed to make strategic financial decisions. They form the backbone of secure and informed investing, paving the way for a more stable financial future.

The Impact of Credit Quality on Investments

When it comes to investments, the condition of an entity’s financial trustworthiness plays a crucial role. It influences not just the safety of your returns but also your overall investment strategy. Understanding how this aspect affects various investment types can help you navigate the market with more confidence.

The trustworthiness of bonds, stocks, and other financial instruments is key to assessing potential risks and rewards. Generally, assets with stronger reliability attract more investors, which in turn drives up demand and potentially boosts prices. Conversely, instruments with weaker fiscal standings may carry higher risks, deterring cautious investors looking to preserve their capital.

Another important factor is the effect of this credibility on interest rates. Investments deemed less secure often come with higher yields to compensate for the increased risk. This phenomenon can create a tempting allure for some, but it’s critical to weigh the higher potential returns against the likelihood of default or loss.

Moreover, the reputation of an issuer influences market perception. If an entity faces challenges that affect its trustworthiness, it might lead to a decline in its investment value, impacting those who hold its securities. Staying informed about the fiscal health of issuers can empower investors to make timely decisions based on changing circumstances.

In summary, the reliability of financial instruments shapes the landscape of investment opportunities. By understanding its implications, you can position yourself to make more informed choices and mitigate potential risks in your portfolio.

Strategies for Achieving Top Standards

Setting the bar high when it comes to financial reliability is essential for both individuals and organizations. Reaching the pinnacle of financial integrity not only enhances your reputation but also opens up a world of opportunities. To navigate this journey successfully, adopting a set of effective strategies can make all the difference.

1. Consistent Payment Habits: One of the most pivotal strategies involves maintaining timely payments. This practice demonstrates fiscal responsibility and builds a solid track record over time. Whether it’s bills, loans, or credit lines, punctuality speaks volumes about your financial ethics.

2. Limit Debt Exposure: Another effective approach is managing your debt levels judiciously. Keeping obligations within reasonable limits ensures that you can maintain a healthy balance between income and expenditures. This not only mitigates risks but also promotes better financial health.

3. Monitor Financial Reports: Regularly reviewing your financial statements and scores provides invaluable insights into your standing. Being proactive in identifying any discrepancies or areas for improvement ensures that you stay on top of your game and can make informed decisions.

4. Build a Strong Financial Portfolio: Diversifying your financial assets can bolster your reputation significantly. Engaging in different investment avenues and ensuring a varied portfolio can serve as a cushion against market volatility and enhance your overall standing.

5. Establish Healthy Relationships: Networking and building positive relationships with financial institutions and lenders can serve you well. Strong connections can sometimes lead to better terms and opportunities, paving the way for smoother processes in the future.

By integrating these strategies into your financial practices, you can effectively work towards achieving the pinnacle of reliability and trustworthiness in your financial endeavors. The journey may require effort and dedication, but the rewards are undoubtedly worth it.