Achieving the Maximum Credit Limit Available

Building a strong financial reputation is essential for anyone looking to navigate the world of personal finance successfully. This reputation influences a variety of opportunities, from obtaining loans to qualifying for better interest rates. Understanding the factors that contribute to this standing can not only empower you but also lead to numerous benefits in the long run.

One of the most significant aspects of achieving a stellar financial profile lies in your ability to demonstrate reliability in managing responsibilities. Lenders and financial institutions favor those who exhibit consistency and promptness in handling their obligations. By focusing on specific strategies, you can enhance your standing and unlock a wealth of possibilities.

In this article, we will explore different methods and best practices that enable individuals to achieve the pinnacle of their financial reputation. Whether you’re just starting your journey or looking to improve your current status, there’s always room for growth and improvement. Let’s dive into the steps that will help elevate your financial standing and set you on the path to success.

Understanding Credit Scores and Their Importance

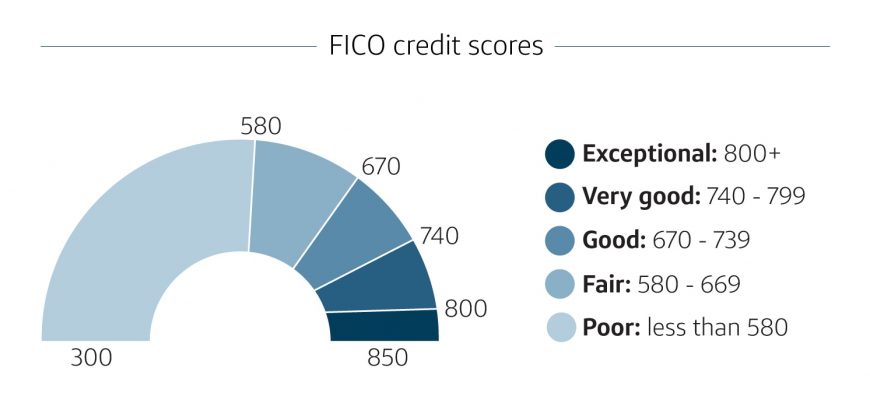

When it comes to managing your financial life, one crucial aspect stands out: the numbers that reflect your borrowing habits. These figures can have a significant influence on various opportunities, from purchasing a home to securing a loan for a new car. Knowing how these metrics work and their implications can help you make informed decisions and enhance your financial well-being.

Your financial reputation isn’t just a simple number; it’s a reflection of your reliability when it comes to repaying borrowed funds. Lenders look at this information to assess the level of risk involved in extending credit to you. A strong score can open doors to lower interest rates, better loan offers, and even renting a place to live. Conversely, a lower rating may lead to higher interest expenses or difficulty in obtaining financing at all.

Navigating the world of these evaluations requires understanding the factors that contribute to your score. Things like payment history, outstanding balances, and the length of your credit history all play vital roles. By being proactive in managing these elements, you can improve your standing and ultimately benefit from greater financial flexibility.

In a nutshell, staying informed about how these ratings impact your financial future is essential. Whether you’re planning a large purchase or simply looking to improve your current situation, taking charge of your financial metrics can lead to exciting opportunities and peace of mind.

Tips for Achieving the Best Credit Rating

When it comes to managing your financial reputation, there are several essential steps you can take to enhance your standing. Building a solid foundation involves being mindful of your financial behaviors and making informed choices that can lead to a more favorable outcome. By adopting certain practices, you can position yourself for better opportunities in the future.

One effective strategy is to consistently pay your bills on time. Late payments can significantly impact your standing, so setting reminders or automating payments can be tremendously helpful. Additionally, maintaining a low balance on your accounts relative to their limits is crucial. Aim to keep your usage below 30% to demonstrate that you are a responsible borrower.

Furthermore, consider checking your financial reports regularly for any inaccuracies. Mistakes can happen, and they may adversely affect your standing. Disputing errors promptly can help ensure that your profile reflects your true financial behavior. Moreover, limiting the number of new accounts you open within a short timeframe is essential, as numerous inquiries can raise red flags for lenders.

Another useful tip is to cultivate a mix of account types. A healthy combination of installment loans and revolving credit can paint a more comprehensive picture of your financial habits. Lastly, it’s wise to keep older accounts active, as a longer credit history generally contributes positively to your overall standing. By implementing these strategies, you can work towards a more favorable evaluation of your financial reliability.

How Financial History Affects Economic Possibilities

Your financial history plays a crucial role in shaping the opportunities available to you. It influences everything from loan approvals to rental applications and even employment prospects. The way individuals manage their finances can open doors or create barriers in various aspects of life, ultimately determining the level of access they have to essential resources.

Additionally, many landlords conduct background checks on prospective tenants, and your financial behavior can impact their decisions. A good standing can make renting a property simpler, while a troubled financial background may mean needing to provide additional guarantees or facing increased deposit requirements.

Moreover, some employers consider applicants’ financial backgrounds as part of their hiring process. This practice stems from the belief that those who demonstrate responsible financial habits are more likely to exhibit reliability and strong decision-making skills in their professional lives.

Overall, maintaining a positive financial reputation is essential for seizing future opportunities. By understanding how your financial practices influence various facets of your life, you can make informed choices that pave the way for brighter economic prospects.