Achieving the Pinnacle of Credit Karma Scores

When it comes to managing your financial health, one of the most crucial aspects is understanding your standing in the eyes of lenders. This rating reflects your ability to handle debt responsibly and can significantly impact your chances of securing favorable loan terms. Many people strive to reach the pinnacle of this evaluation, yet few know the steps necessary to attain such a status.

In this discussion, we will explore the nuances of what it takes to elevate your financial position. By delving into key factors that influence this evaluation, we aim to provide practical tips and insights that can empower you to enhance your financial profile. With the right approach, you can unlock opportunities that lead to better interest rates, approval chances, and even peace of mind.

Join us as we navigate through strategies designed to boost your standing and achieve the best possible results. Whether you’re just starting your journey or looking to refine your existing knowledge, there’s always something new to learn about mastering your financial landscape.

Understanding the Credit Rating System

When it comes to managing personal finances, having a clear grasp of how your financial standing is evaluated can make a world of difference. The evaluation framework offers valuable insights into your borrowing potential and financial health. It breaks down complex factors into easier-to-understand metrics that help you gauge where you stand in the eyes of lenders and creditors.

This evaluation is influenced by various elements, such as your payment history, the amount of debt you owe, the length of your financial history, and the types of accounts you hold. Understanding these components helps you identify areas that may need improvement, allowing you to work towards a better financial reputation.

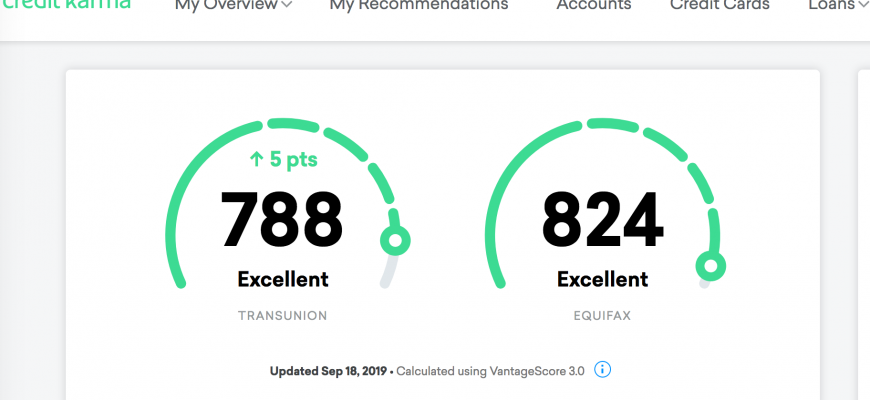

Moreover, this rating is not just a number but a reflection of your financial behavior over time. Regularly checking this figure can help you stay informed about your financial progress and make strategic decisions when it comes to loans, mortgages, or credit cards. By keeping an eye on your rating, you empower yourself to take charge of your finances and potentially unlock better financial opportunities down the road.

Factors Influencing Your Financial Rating

Understanding what impacts your financial rating can make all the difference when it comes to managing your economic health. Various elements play a role in shaping this important number, and being aware of them can help you take control of your financial future. Let’s dive into what really counts and how you can boost your overall standing.

One major factor is your payment history. Regular, on-time payments demonstrate reliability, which lenders love to see. If you’ve fallen behind or missed payments, it can severely affect your reputation. Similarly, the total amount of debt you carry in relation to your available credit lines is crucial. Keeping balances low compared to your limits shows that you’re not overly dependent on borrowed funds.

Duration of your financial history also matters. An established timeline with accounts in good standing provides lenders with confidence about your habits over time. New accounts can temporarily lower your rating because they shortchange your average account age, so it’s wise to avoid rushing into credit applications unless necessary.

The variety of credit you utilize is another piece of the puzzle. A mix of revolving credit, like credit cards, and installment loans, such as mortgages or car loans, can portray a picture of healthy financial behavior. Lastly, frequent credit inquiries, particularly within a short period, may signal to lenders that you’re in financial distress, which could be a red flag.

By focusing on these aspects, you can work towards improving your standing and building a more favorable profile over time. It’s all about making informed decisions and taking consistent actions to enhance your economic reputation.

Steps to Achieve a Top Score

Improving your financial standing is not just a matter of chance; it’s a result of thoughtful planning and consistent effort. If you’re aiming for an exceptional rating that reflects your financial reliability, following a strategic approach will certainly help you get there.

- Understand Your Rating System: Familiarize yourself with how the metric is calculated. Knowing the factors that contribute to your standing will allow you to make informed decisions.

- Pay Bills Promptly: Timely payments are crucial. Set reminders or automate payments to avoid late fees and negative impacts on your standing.

- Reduce Outstanding Debt: Work on paying down existing debts. Prioritize high-interest loans first, as they can weigh down your overall financial health.

- Avoid Excessive Applications: Each time you apply for new lines of credit, an inquiry is made. Too many applications in a short time can signal risk, so be judicious.

- Maintain a Diverse Credit Portfolio: A mix of credit types, such as revolving credit and installment loans, can benefit your overall standing. Be strategic about how you approach new forms of credit.

- Regularly Review Your Reports: Check your reports for errors or inaccuracies. Disputing mistakes can help improve your overall standing.

- Keep Old Accounts Open: The length of your credit history matters. Keeping older accounts active can positively impact your rating.

- Limit Credit Utilization: Aim to use only a small percentage of your available credit. Experts often recommend keeping this below 30% to maintain a healthy profile.

By following these steps consistently, you can pave the way to an outstanding rating that reflects your dedication to financial responsibility. Remember, it’s a journey that requires patience and perseverance!