Understanding the Gx Credit Score and Its Impact on Credit Card Options

When it comes to managing your finances, one crucial aspect often overlooked is the assessment of your financial reliability. This rating plays a pivotal role in determining how lenders perceive you and can open up a world of financial opportunities. Whether you’re looking to make a significant purchase or simply need a backup option for emergencies, understanding this concept can empower you to make informed decisions.

In today’s marketplace, various tools and offerings are designed to cater to those with varying levels of financial evaluations. The Gx offering, for instance, is tailored to reward individuals based on their established financial behavior. It’s more than just a number; it’s a reflection of your ability to manage funds responsibly, which can grant you access to favorable terms and lower interest rates.

As you delve deeper into the specifics of Gx offerings, you’ll find that they come with a range of perks that go beyond mere financial transactions. From enticing bonuses to exclusive rewards, understanding how to leverage this rating can significantly enhance your purchasing power and overall financial strategy. Embracing this knowledge is the first step towards making your finances work more effectively for you.

Understanding Gx Rating Systems

When it comes to managing personal finances, there’s a key aspect that often goes overlooked but can significantly impact one’s opportunities. This part of your financial profile serves as a reflection of how you handle obligations, revealing a lot about your financial behavior and reliability. Grasping the intricacies of these ratings can empower individuals to make informed decisions regarding loans, mortgages, and various financial agreements.

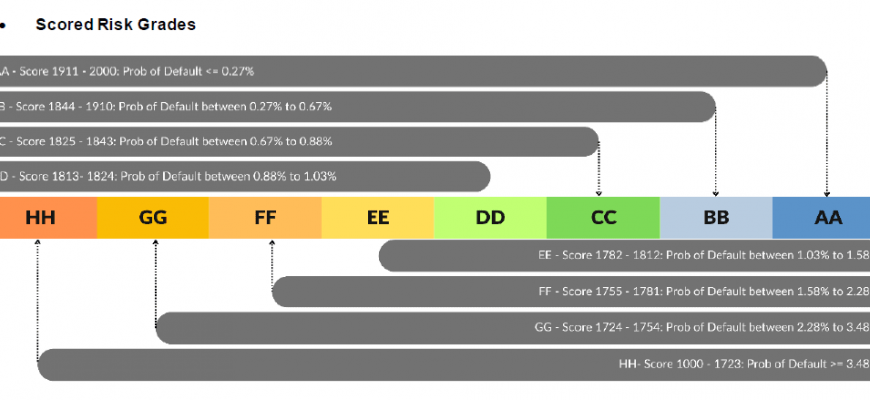

The Gx rating system is utilized by many institutions to evaluate the risk associated with lending to an individual. It encompasses various factors, including payment history, amounts owed, and the duration of credit relationships. Understanding these components not only helps you comprehend what might influence your rating but also guides you in taking appropriate steps to enhance it.

For those seeking to improve their financial standing, familiarizing oneself with the criteria that affect these ratings is crucial. By maintaining good habits, such as timely payments and managing balances, individuals can work towards achieving a healthier financial profile. This proactive approach can lead to better financial opportunities in the future.

In essence, having a firm grasp of the Gx rating systems can be a powerful tool in navigating the financial landscape. Whether you’re applying for a new loan or seeking favorable terms on existing obligations, understanding how these systems work will always serve you well.

The Benefits of Gx Cards

When it comes to managing your finances, Gx options offer a plethora of advantages that can really enhance your experience. These tools are designed to give you more control over your spending and help you achieve your financial goals, providing a convenient way to access funds and enjoy various perks.

One of the standout features of Gx options is the ability to earn rewards on your purchases. Whether you love dining out, traveling, or shopping for the latest gadgets, you can rack up points or cashback that makes each transaction even more rewarding. Imagine turning your everyday expenses into exciting opportunities for future adventures or indulgences.

Another significant benefit is the flexibility that comes with these financial offerings. Many options allow for a grace period, meaning you can make purchases now and pay for them later without incurring immediate interest. This can be a lifesaver for managing unexpected expenses or larger purchases that require some time to settle.

Additionally, Gx tools often come with enhanced security features. With advanced technology, you can feel confident that your transactions are safe from fraud. Many providers offer alerts and monitoring services to give you peace of mind while you make purchases.

Lastly, using Gx solutions can help build a solid financial reputation. By managing your payments responsibly, you’ll be on your way to establishing a positive standing with lenders, which may open doors to better opportunities in the future. All in all, these options not only simplify everyday transactions but also pave the way for a more rewarding financial journey.

Improving Your Credit Score Strategies

Boosting your financial reputation can seem like a daunting task, but with the right approach, it can be an achievable goal. Establishing and maintaining a strong standing requires a proactive attitude and a willingness to learn. Let’s explore some effective techniques that can help elevate your standing in the eyes of lenders and institutions.

First and foremost, timely payments are crucial. Consistently settling your bills on or before their due dates demonstrates responsibility and reliability, qualities that lenders greatly appreciate. Consider setting up automatic payments or reminders to avoid any slip-ups.

Another key factor is your utilization ratio. Keeping your balances low relative to your available limits shows that you are not over-relying on borrowed funds. Aim to use no more than 30% of your available credit to keep your profile healthy.

Monitoring your financial history is essential for spotting any inaccuracies. Regularly review your reports for errors that could negatively impact your image. Disputing any inaccuracies promptly can safeguard your reputation and potentially improve it.

Diversifying your types of accounts can also have a positive effect. A mix of revolving and installment loans can showcase your ability to manage different forms of debt. However, only take on what you can handle responsibly to avoid overwhelming yourself.

Lastly, avoid opening new accounts frequently. While it may be tempting to apply for multiple accounts to increase your limits, each application may result in a hard inquiry, which can adversely affect your standing. Focus instead on nurturing your existing accounts.