Understanding the Importance and Benefits of a Credit Card Grace Period

When it comes to managing finances, there’s often a lot to consider, especially when dealing with various forms of borrowing. One aspect that many might overlook is the time frame in which payments can be made without incurring extra charges. This little-known opportunity can make a significant difference in how you handle your debts.

In simpler terms, there’s a window during which you can pay off your balance without worrying about additional fees. This feature can provide a sense of relief, making it easier to keep track of expenses and stay within budget. Knowing that you have a cushion can also help you avoid the stress of unexpected costs when managing your bills.

Understanding the ins and outs of this allowance not only empowers you but also encourages smarter financial habits. It’s about becoming more savvy with your money and ensuring that you make the most of every dollar you spend. Hence, diving into the details of this particular benefit can lead to a more secure and informed approach to your financial wellbeing.

Understanding the Concept of Grace Period

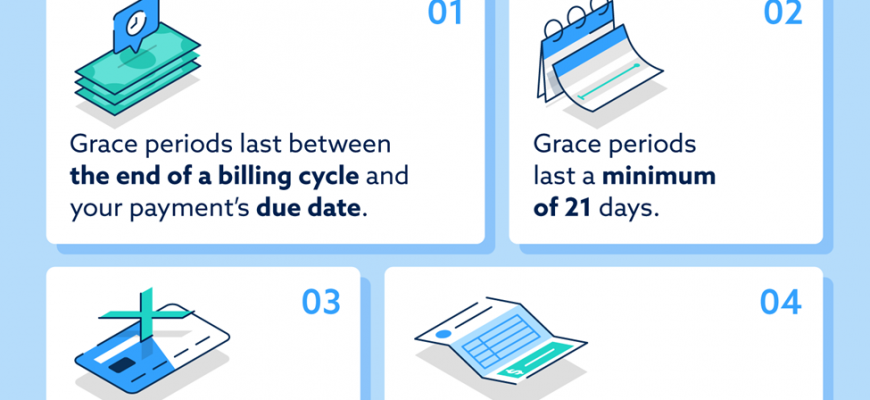

Have you ever wondered about that little window of time given after a transaction when you’re not charged interest? It’s a fascinating practice that many financial institutions use to assist their clients in managing payments more effectively. This approach allows individuals to settle their balances without incurring additional costs, as long as they stay within a certain timeframe.

Essentially, this timeframe serves as a buffer. If payments are made in full before the deadline, you can avoid extra fees entirely. It’s a clever way to encourage responsible borrowing while offering some leeway for those who might need it. Understanding this concept is crucial, as it can significantly impact your financial planning and budgeting strategies.

Many consumers may overlook the importance of this opportunity, but it can play a vital role in building a sound financial foundation. Being aware of how this timeframe works can help you make informed decisions about your spending and repayment. After all, a little knowledge can go a long way when it comes to managing your finances wisely.

How the Delay Affects Your Finances

Understanding the concept of having extra time to pay off your balance can significantly influence your financial decisions. This opportunity allows individuals to manage their expenses without incurring immediate charges, making it a valuable feature for those who may need a little wiggle room in their budget.

When you utilize this timeframe wisely, you can avoid unnecessary interest expenses. By ensuring that payments are made within this allowance, you can keep your overall costs lower. This approach not only helps maintain a healthier financial status but also fosters better budgeting habits over time.

Moreover, being aware of how this feature works can aid in planning larger purchases or expenses. It gives you flexibility, providing a strategic advantage by allowing time to gather funds before the official due date. Thus, you can make informed choices without the pressure of immediate repayment, ensuring your finances remain stable.

In summary, being mindful of this delicately structured timeframe plays a crucial role in managing your overall financial health. It empowers you to navigate your expenses more efficiently and enhance your money management skills.

Maximizing Benefits of Credit Card Grace Period

Understanding how to make the most out of the time between billing cycles can really help you manage your finances better. It’s essential to grasp the nuances that come with the arrangement, as doing so can not only save you money but also improve your overall financial health. Taking advantage of this time means being strategic about when to make purchases and when to pay your balance.

First off, consider timing your expenses wisely. If you know your statement closes on a specific date, try making larger purchases right after that date. This way, you can enjoy extra time to pay off the balance without incurring interest, giving you a cushion to prepare your finances accordingly.

Also, it’s a smart move to pay off higher-interest balances first. If you have multiple outstanding amounts, focus on clearing those that accrue the most interest. This strategy can significantly reduce the total cost of borrowing, especially if you utilize the available duration effectively.

Don’t underestimate the impact of timely payments either. Setting reminders to ensure you pay your dues on or before the due date can help you avoid unnecessary charges. Even if you can’t pay the whole balance, making a partial payment can show responsible behavior, positively impacting your credit score.

Finally, consider utilizing rewards wisely. If your financial tools offer points or cashback for spending, plan your purchases to maximize these benefits. Paying off those expenses before interest begins to accrue will allow you to enjoy the perks while keeping your costs low.