An In-Depth Exploration of KPMG’s Financial Statements and Their Implications

Many of us have heard about the importance of analyzing a company’s performance through various reports. These documents serve as a window into an organization’s health and can reveal critical insights into its operations, profitability, and overall standing in the market. By diving into these numerical narratives, we uncover the story behind the figures and gain a clearer understanding of what’s really happening within a business.

In this discussion, we’ll explore how these reports are crafted and what they tell us about companies’ strategies and fiscal strategies. From balance sheets to projections, each piece contributes to a larger picture, helping investors and stakeholders alike make informed decisions. It’s like piecing together a puzzle where each section offers clues about the company’s trajectory and future performance.

Moreover, the effectiveness of these documents often hinges on transparency and clarity. A well-prepared report not only complies with regulations but also enhances trust between the company and its audience. Understanding the nuances involved in creating these documents can significantly empower individuals and businesses, guiding them on their financial journeys.

Understanding KPMG Financial Reports

Diving into the world of corporate documentation can sometimes feel overwhelming, but it’s essential for grasping the big picture of a company’s health. The information shared by leading auditing firms provides insight into various aspects of an organization’s operations, performance, and overall standing in its industry. With the right approach, anyone can make sense of these details and draw meaningful conclusions.

The documents prepared by prominent consulting groups often include various sections that highlight important metrics and key indicators. These components are designed to provide stakeholders with a transparent view of financial activities, allowing them to assess trends and make informed decisions. Whether you are an investor, a business owner, or simply curious, understanding this content can help you navigate the complexities of commerce more effectively.

It’s crucial to identify the core sections within these documents, as they offer essential insights into revenue generation, expenditures, and profitability. By closely examining the various components, one can uncover valuable narratives that reveal how well a company is performing in its market environment. This not only aids in evaluating past performances but also helps in forecasting future success.

Furthermore, understanding the terminology and metrics used in these reports can greatly enhance your analytical skills. By familiarizing yourself with terms like “assets,” “liabilities,” and “equity,” you will be better equipped to dissect the information presented. This knowledge forms a solid foundation for making strategic decisions, whether you’re assessing potential investments or analyzing market competition.

Key Components of KPMG Statements

When it comes to understanding corporate reports, there are fundamental elements that can provide deep insights into an organization’s performance. Each section is designed to convey essential information, helping stakeholders make informed decisions. It’s like piecing together a puzzle where each part holds significant meaning and contributes to the overall picture.

One crucial aspect often highlighted is the overview of operations, which outlines the main activities and achievements of the entity. This section provides context and sets the stage for a deeper understanding of the financial dynamics at play.

Another important element is the analysis of revenue and expenditures, which reveals how funds are generated and spent. This breakdown allows for a closer examination of financial health and sustainability, shedding light on the organization’s efficiency and profitability.

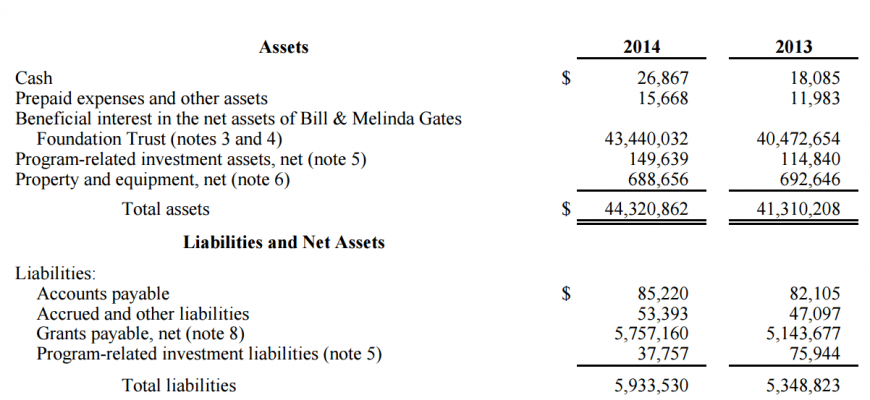

Additionally, the exploration of assets and liabilities provides a snapshot of what an organization owns versus what it owes. This balance is vital for assessing overall stability and risk management strategies employed by the management.

Lastly, insights into management’s discussion and analysis serve as a narrative guide, walking readers through the numbers and explaining the reasoning behind financial strategies. This commentary enriches the raw data, offering valuable context and future outlooks.

Analyzing Trends in Financial Performance

Understanding the shifts in a company’s results over time can provide invaluable insights into its operational health and market position. By examining various indicators, stakeholders can identify patterns that reveal growth, stability, or potential issues that may need addressing. This exploration is essential for making informed strategic choices and projecting future directions.

In this context, one of the key aspects to focus on is the evolution of key metrics. For instance, observing revenues and expenses over several periods can highlight whether a business is gaining traction or encountering obstacles. Similarly, scrutinizing profitability ratios helps gauge how effectively the organization is managing its resources. These metrics often tell a story that numbers alone might not unveil.

Another important factor is comparing these indicators against industry benchmarks. This comparison offers perspective on how a company measures up within its sector. Are the trends it is experiencing in line with general market movements, or do they signal outliers that require further investigation? Such evaluations are crucial for contextualizing performance within a broader landscape.

Lastly, it’s worth noting that contextual influences, such as economic shifts or regulatory changes, can significantly impact results. Recognizing these external variables enables a more comprehensive understanding of trends and helps anticipate future challenges or opportunities. By synthesizing all these elements, companies can create a nuanced picture of their trajectory and refine their strategies accordingly.