Exploring the Financial Performance Metrics of POA

The ability of an organization to thrive and grow often hinges on how well it manages its resources and implements strategies. In today’s competitive landscape, understanding the underlying metrics and trends can be a game-changer. This section dives into the various aspects that signal a company’s health and sustainability, helping leaders make informed decisions.

Whether you’re a seasoned expert or just starting your journey, grasping these key indicators will equip you with the knowledge necessary to navigate challenges and seize opportunities. You’ll find insights into how to interpret these signals and what they mean for the overall trajectory of a business.

Get ready to uncover the nuances of tracking success and making strategic adjustments. Through this exploration, we aim to shed light on the essential elements that contribute to lasting viability and growth in any endeavor.

Understanding Financial Performance Metrics

Navigating the world of business analysis can often feel overwhelming, especially when it comes to deciphering the various indicators that showcase a company’s economic health. These indicators act as guideposts, helping stakeholders gauge not just how well an organization is doing, but also where improvements can be made. Familiarity with these critical measures can transform your understanding of a company’s operations and strategic direction.

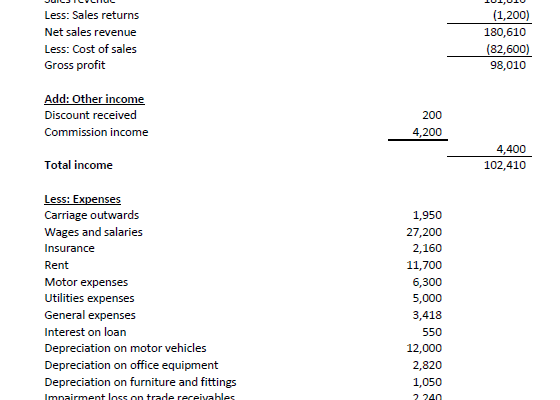

At the heart of this discussion lies the notion of key indicators that reflect operational efficiency, profitability, and overall sustainability. These figures can range from revenue and expenses to more complex ratios that provide insights into asset utilization and capital effectiveness. By interpreting these numerical signals, business leaders and investors can make informed decisions that align with their objectives.

Ultimately, grasping these essential metrics is not just about crunching numbers; it’s about weaving a narrative that illustrates the current state and future potential of a business. Whether you’re assessing quarterly results or plotting long-term strategies, a solid understanding of these vital statistics can make all the difference.

Strategies for Improving Financial Outcomes

When it comes to enhancing business results, there are several approaches that can lead to better results over time. Focusing on key areas such as resource management, revenue generation, and cost control can create a solid foundation for growth and stability. By adopting a proactive stance and being open to new ideas, organizations can position themselves for long-term success.

One effective method involves analyzing existing operations to identify wasteful practices. Streamlining processes not only saves time but also reduces expenses, which positively impacts the bottom line. Regularly reviewing and optimizing workflows ensures that every component of the business runs smoothly and efficiently.

Diversifying income streams is another powerful strategy. Companies that rely on a single product or service may find themselves vulnerable to market fluctuations. By exploring complementary offerings or entering new markets, organizations can cushion themselves against unforeseen challenges while increasing overall profits.

Moreover, investing in employee development can significantly boost morale and productivity. Happy, well-trained staff are often more motivated and engaged, resulting in improved customer service and higher sales figures. Encouraging continuous learning and providing opportunities for growth can lead to a more dynamic and capable workforce.

Finally, leveraging technology can dramatically elevate an organization’s capabilities. Whether through automation tools or data analytics, adopting the latest innovations can enhance efficiency and provide valuable insights. This not only supports better decision-making but also enables quicker responses to changing market conditions.

Analyzing Financial Trends for Decision Making

Understanding numbers and patterns is crucial for guiding choices in any organization. By examining historical data and spotting shifts over time, businesses can make more informed steps towards growth. Assessing these patterns helps in drawing a clearer picture of where a company stands and where it might head next.

Trends can reveal essential insights about consumer behavior, market conditions, and competitive landscape. For example, consistent increases in sales may suggest a growing demand for a product, prompting investment in expansion. Conversely, declining metrics might signal a need to reassess strategies or address underlying issues swiftly.

Utilizing various tools and techniques to track these changes allows for proactive rather than reactive approaches. Visual representations, like charts and graphs, can simplify complex information and make patterns more apparent. When decision-makers have a solid grasp of these aspects, they are better equipped to steer their organizations in the right direction.

Moreover, it’s vital to consider external factors that might impact trends, such as economic shifts, regulatory changes, or emerging technologies. Incorporating these influences into analysis not only enriches understanding but also enhances strategic planning. Keeping an eye on the bigger picture ensures that decisions are grounded in reality rather than assumption.

Ultimately, continuous monitoring and evaluation of trends play a significant role in a company’s adaptability and success. By fostering a culture of data-driven decision-making, organizations can navigate complexities and seize opportunities more effectively.