Understanding Financial Assets Valued at Amortised Cost for Better Investment Decisions

In the realm of finance, there’s a crucial topic that often flies under the radar, yet it plays a significant role in how companies manage their resources. This subject revolves around the method of evaluating certain holdings that are not traded on the market but still hold essential value for an organization. These valuations are critical for understanding a firm’s overall financial health, influencing both strategic planning and investment decisions.

When we talk about the evaluation of specific holdings, we’re diving into a detailed approach that helps businesses gauge their worth over time. This method provides a clear view of how these holdings are expected to generate future benefits. By applying this technique, organizations ensure that their financial statements reflect the true value of these items, making it easier for stakeholders to grasp the company’s position.

Moreover, grasping this concept is vital for anyone interested in finance. It opens up a window into how organizations perceive their long-term holdings and the rationale behind maintaining certain values on their balance sheets. Embracing this understanding will not only enhance your knowledge but will also prepare you for deeper discussions about financial strategy and resource management.

Understanding Amortised Cost Accounting

When navigating the world of accounting, one often encounters methods that help in tracking and reporting the value of various instruments over time. One such approach is a systematic and thoughtful way to represent the financial landscape, focusing on how the value of certain items evolves throughout their lifespan. This technique is essential for providing clarity and consistency in financial records, making it easier to gauge true worth as time passes.

At its core, this methodology emphasizes the gradual decrease in value, reflecting real-world use and economic realities. By employing this strategy, organizations can accurately represent income and expenditures, ensuring that stakeholders have a clear view of the entity’s economic health. This is particularly beneficial for long-term implications, as it allows for a more precise alignment of revenue and related expenses over time.

Understanding this accounting tactic requires a grasp of its underlying principles, including the recognition of initial values and periodic adjustments. The idea is to match income generated with the costs incurred, creating a balanced financial picture. This way, businesses can make informed decisions based on a realistic summary of their resources and obligations.

Ultimately, adopting this accounting approach fosters transparency and reliability in financial documentation, paving the way for sustainable growth and strategic planning. It’s not just about numbers; it’s about telling a story that accurately reflects the journey of an organization through the ebb and flow of economic activity.

Benefits of Classification of Monetary Instruments

When it comes to managing monetary instruments, categorizing them can offer quite a few advantages. It allows organizations to better understand their holdings and the associated risks. By placing similar instruments into specific groups, decision-makers can streamline their strategies and enhance their financial planning processes.

One significant benefit of this classification is clarity. Having a clear view of the various types allows for easier reporting and analysis. Stakeholders can get a straightforward picture of the company’s financial health, leading to more informed investment choices. Additionally, it enhances transparency, which is crucial in fostering trust with investors and regulators.

Another advantage is the ability to manage risk more effectively. Different categories come with varying levels of volatility and credit exposure. By identifying these differences, organizations can tailor their risk management practices to better protect against potential downturns. This not only aids in compliance with regulations but also promotes a more resilient financial strategy.

Furthermore, classification aids in financial forecasting. When instruments are grouped appropriately, predicting future cash flows becomes easier. This can empower companies to allocate resources more efficiently, ensuring they are prepared for both opportunities and challenges that may arise in the market.

Overall, the classification of monetary instruments simplifies complex structures, enhances strategic planning, and contributes to robust financial health. It’s an essential practice for any organization aiming to thrive in today’s dynamic economic environment.

Challenges in Amortised Cost Valuation

When it comes to assessing the value of certain instruments, there are notable hurdles that professionals often face. These complexities can arise from various factors, impacting the accuracy of valuations and leading to potential misinterpretations. Understanding these challenges is crucial for anyone involved in the evaluation process.

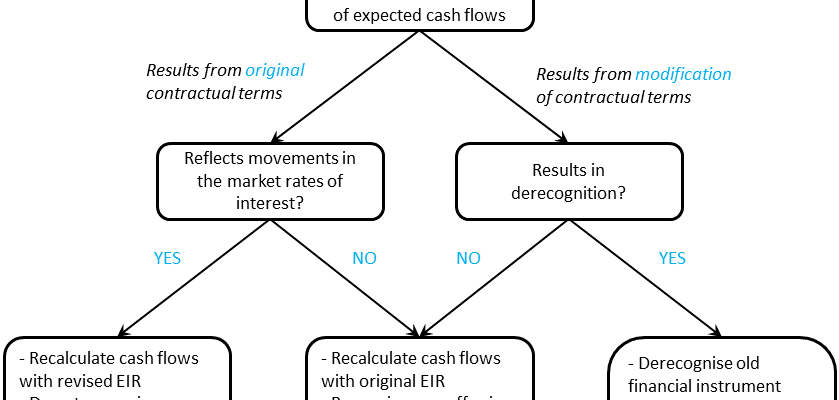

One significant issue relates to the estimation of future cash flows. Predicting how much money will come in over time can be tricky, especially when economic conditions fluctuate or when the underlying assumptions are not grounded in solid analysis. These uncertainties can skew the resulting figures, making it harder to arrive at a reliable figure.

Another factor complicating this process is the selection of appropriate discount rates. The choice of rate can dramatically change the outcome, yet finding a rate that accurately reflects risk while remaining realistic is no small feat. Professionals often grapple with how to balance market conditions, risk perception, and the unique characteristics of the asset.

Additionally, regulatory challenges may come into play. Changes in laws or accounting standards can create confusion or necessitate adjustments in how values are assessed. Staying up-to-date with shifting requirements is essential for ensuring compliance and accuracy.

Lastly, the need for consistent methodology can lead to discrepancies. Different approaches to valuation may yield varying results, and reconciling these differences requires careful consideration. Ultimately, navigating these obstacles is imperative for maintaining integrity and reliability in the valuation landscape.