Exploring the Financial Landscape of Amazon and Its Impact on the Global Economy

The digital marketplace has transformed the way we shop, offering vast opportunities for consumers and businesses alike. In this realm, one name stands out, symbolizing innovation, convenience, and global reach. If you’ve ever browsed through a virtual store or made a purchase from the comfort of your couch, you’ve likely experienced the power of this phenomenon firsthand. It’s not just a shopping platform; it’s a new way of doing business and connecting with millions of potential customers.

In this article, we’ll delve into the various aspects of this commerce behemoth, examining its impact on the economy and how it reshapes our shopping behaviors. From its extensive product offerings to its sophisticated logistics system, we’ll uncover the secrets that drive its success and what they mean for both merchants and consumers. The landscape of buying and selling is evolving, and understanding this giant’s role can help you navigate the future of retail.

Moreover, we will look into the challenges and controversies surrounding this online titan. Issues like competition, market influence, and consumer rights play a critical role in the narrative. It’s fascinating to explore how such a dominant force not only changes the game for buyers but also redefines the rules for sellers. Join us as we unpack this intricate web of commerce and see what lies beneath the surface.

Exploring Amazon’s Financial Services

The technology giant has ventured beyond its core offerings, creating a suite of services that cater to a variety of monetary needs. These innovative solutions are designed to streamline transactions, making both shopping and business operations smoother for everyone involved.

One standout feature in this ecosystem is the ability to easily manage payments and transactions. Users can tap into tools that facilitate quick checkouts, while merchants benefit from enhanced processing solutions that simplify their financial workflows. This seamless integration of e-commerce and payment solutions makes it effortless for customers to engage and transact.

Moreover, there are options for managing investments that appeal to both novice and seasoned investors alike. With educational resources and user-friendly interfaces, individuals can explore their options and make informed decisions regarding their capital. The experience is tailored to empower users and enhance their understanding of various strategies.

Additionally, the enterprise has launched initiatives aimed at small businesses, offering support in managing cash flow and providing access to funding. This not only fosters growth but also contributes to the vibrancy of the marketplace, enabling entrepreneurs to realize their ambitions.

As the landscape evolves, the tech leader continues to innovate, introducing new offerings to meet the changing demands of users. This commitment to enhancing user experience through robust services speaks volumes about its visionary approach to the digital economy.

Stock Performance and Market Impact

When we talk about how a certain company behaves in the stock market, we’re really diving into its performance over time and how it influences broader market trends. It’s fascinating to see the patterns that emerge, reflecting not only the company’s health but also how investors react to news, announcements, and industry developments. This section will explore those dynamics, shedding light on the factors that contribute to stock fluctuations and investor sentiment.

The value of shares can fluctuate significantly based on a variety of elements, including earnings reports, product launches, and even changes in management. Such movements don’t occur in a vacuum; they reverberate throughout the market. When one major player makes waves, it can set off a chain reaction, impacting competitors and related industries. Understanding this ripple effect is crucial for anyone who’s invested or interested in the market dynamics.

Additionally, external factors like economic indicators, policy changes, and global events play a key role in shaping stock trajectories. Investors closely monitor these influences, adjusting their strategies accordingly. It’s a balancing act–while some may react with panic or excitement to market stimuli, others take a more measured approach, assessing long-term potential. This variance in responses adds to the market’s complexity, making it an ever-evolving landscape.

Ultimately, examining stock performance isn’t just about numbers; it’s about the stories they tell and the trends they reveal. Keeping an eye on these elements can provide valuable insights into where a company might be headed and the potential impact on the wider market environment. Engaging with this material gives investors a better chance to navigate the highs and lows with confidence.

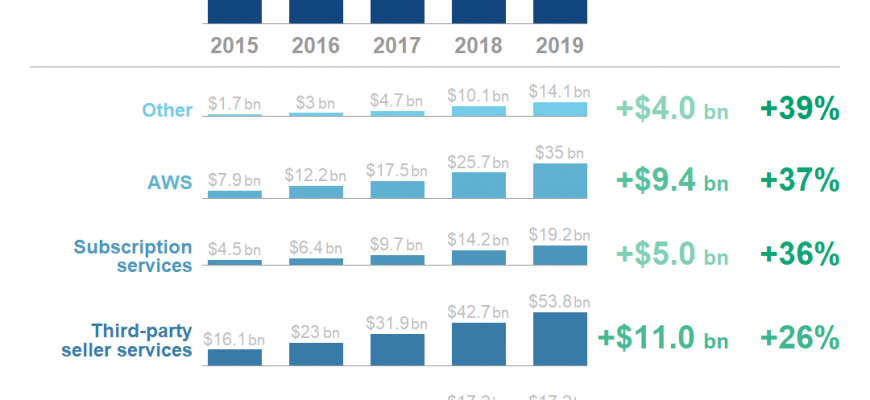

Revenue Streams from Diverse Business Segments

In today’s ever-evolving market landscape, a multitude of revenue sources plays a crucial role in sustaining and growing a company’s bottom line. By tapping into various sectors, businesses can create a more resilient financial structure, minimizing risks associated with dependency on a single income avenue. This versatility allows organizations to cater to different audiences while fostering innovation and adaptability in their strategies.

For instance, companies can explore opportunities in retail, cloud computing, streaming services, and even logistics. Each segment not only contributes financially but also enhances brand loyalty and customer engagement. By diversifying their offerings, organizations can effectively capture a broader market share, optimizing both short-term gains and long-term stability.

Moreover, venturing into multiple areas enables firms to leverage complementary strengths. For example, an organization with a strong e-commerce presence might utilize its distribution network to launch subscription services or digital marketplaces. This interconnectedness of different segments amplifies revenue potential, creating a synergistic effect that propels overall growth.

Ultimately, engaging in diverse business endeavors equips companies with the tools they need to navigate fluctuations in consumer demand and market conditions. By maintaining a continued focus on innovation and diversification, organizations can ensure they remain competitive and relevant in a rapidly changing environment.